Cryptocurrency market decline started last week with the Bitcoin Cash hard fork. Around 14th and 15th of November, the two major cryptos the Bitcoin and the Ethereum started to decrease in price substantially. Since then the market refuses to recover. Instead, it shows a trend of steady decline leading experts to even darker predictions.

At the time of writing, Ethereum is worth only $134.13 USD, according to CoinMarketCap. It marked a decline with almost 15% for just one day. The coin saw its peak in January when it reached around $1,420 USD on some exchanges. That calculates to the incredible difference of nearly 9,000%.

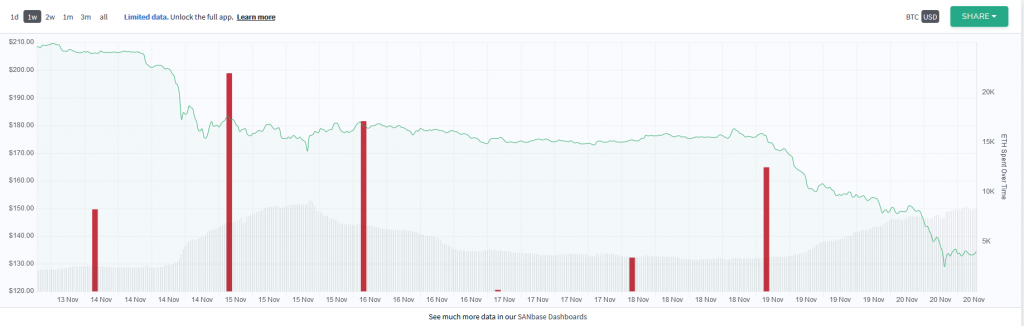

According to the sentiment data by SANbase, 55,000 ETH were moved out of teams’ wallets only for the past week. As seen on the graph, that activity was reported specifically on the 14th and 15th of November, and again on 18th and 19th.

Logically, Ethereum’s market capitalization has shrunk, too. From over $21 billion at the beginning of last week, to just $14 billion today.

The hype around Bitcoin Cash hard fork and the hash war is probably the reason. Miners probably sell their BTC and ETH to sponsor Bitcoin Cash mining. Doing so, they richly supply the market and the price automatically goes down.

Another reason for ETH’s plunge is perhaps the ICO sale on the Ethereum platform. As known, the Ethereum functions a lot like a developing platform, except as only a cryptocurrency. ICO projects, supported by the blockchain, sell Ethereum ERC20 tokens. The ICO market was so vibrant lately, as CrispyBull informed, but the last couple of weeks there is certainly an ICO activation going on.

Ethereum’s price decline seems to be part of the negative financial market in general with stocks’ prices going down and huge corporations registering loses.