The U.S. Senate has taken a significant step toward comprehensive stablecoin regulation, advancing the GENIUS Act through a key procedural vote on May 19. The cloture vote marked a critical milestone in what could become the country’s first unified framework for overseeing the booming stablecoin market in the U.S., currently estimated at over $250 billion.

The bipartisan bill, formally titled the Guarding Against Emerging Non-Issuer Unauthorized Stablecoins Act, seeks to regulate stablecoin issuers, outline operational standards, and assign oversight responsibilities between state and federal authorities. The legislation has gained support from both Republican and Democratic lawmakers. Its final passage, though, remains uncertain due to mounting political resistance.

What the GENIUS Act Proposes

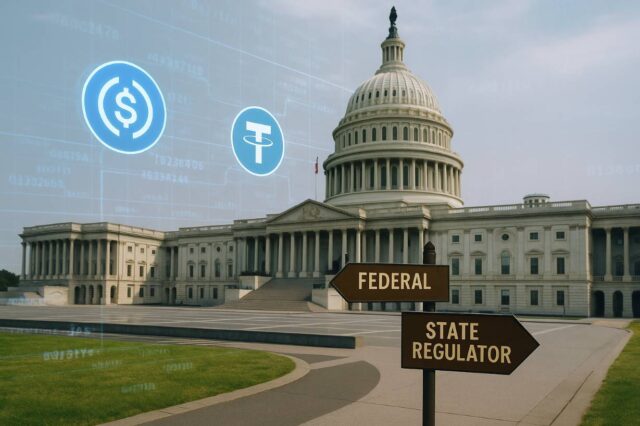

At the heart of the GENIUS Act is a dual-licensing framework. The bill allows nonbank stablecoin issuers to be licensed either at the state level or by a new federal regime supervised by the Federal Reserve. This approach attempts to strike a balance between enabling financial innovation and ensuring systemic safeguards.

Under the bill, the Federal Reserve would have enhanced authority over nonbank issuers, particularly those deemed systemically important. At the same time, state regulators would maintain the right to license and oversee smaller or regionally based entities. This compromise has sparked debate among lawmakers and industry stakeholders. Many are concerned about the balance of power in state vs. federal crypto regulation.

While proponents view the Act as a pragmatic step forward, critics warn of potential ramifications. Some fear it could centralize too much control at the federal level. Others believe it allows regulatory fragmentation if state licensing dominates.

Senate Divided Despite Procedural Win

The cloture vote on the stablecoin legislation passed with bipartisan support. The crypto bill will now proceed to a full debate in the Senate. Still, some Senate Democrats have reversed earlier support. Several lawmakers have expressed unease with provisions that limit the Federal Reserve’s stablecoin authority. They also see gaps in consumer protection.

This shift in position threatens the bill’s momentum. Opposition centers on fears that the Fed’s role in digital asset supervision could be weakened if states are allowed too much autonomy. Nonetheless, backers of the bill argue that the GENIUS Act provides a much-needed regulatory baseline without stifling innovation.

Industry Response and Implications

The crypto industry has responded with cautious optimism. Many stakeholders see the GENIUS Act as the most viable attempt yet to address crypto regulation in 2025. The framework would clarify the regulators’ roles and responsibilities and offer more predictable conditions for stablecoin issuers and investors alike.

However, unresolved jurisdictional issues remain. The bill’s complex structure could also delay effective implementation. Some fear it could open doors for regulatory arbitrage if states adopt diverging licensing standards, undermining the goal of unified digital currency oversight.

What’s Next for the GENIUS Act?

The next stage is a full Senate vote, which could be scheduled in the coming weeks. The outcome will hinge on whether Democratic concerns can be addressed without alienating Republican supporters. Both chambers of Congress are under increasing pressure to act on digital asset legislation ahead of the 2025 election cycle.

>>> Read more: BITCOIN Act Approved, GENIUS Act Hits a Wall

If enacted, the GENIUS Act could serve as a legislative template for future regulation of other crypto assets beyond stablecoins. For now, however, the bill’s future remains uncertain.

The coming days will determine whether the U.S. finally embraces a coherent policy for overseeing the expanding stablecoin market, or whether partisan rifts will derail the country’s most ambitious attempt yet at U.S. stablecoin legislation.

Readers’ frequently asked questions

What is a stablecoin?

A stablecoin is a type of cryptocurrency designed to maintain a stable value. It is usually backed 1:1 by a reserve asset like the U.S. dollar. Traders and investors often use stablecoins to move money in and out of crypto markets without relying on traditional banks.

What does the GENIUS Act try to do?

The GENIUS Act is a proposed U.S. law that would create rules for stablecoin issuers. It allows companies to apply for either a state or federal license, depending on their size and structure. The goal is to make stablecoins safer to use while giving regulators more oversight.

How could this affect my use of stablecoins?

If the law passes, it could change which stablecoins are allowed in the U.S. and how they are backed or managed. Some stablecoins may be required to follow stricter rules. This could affect their availability on exchanges or how quickly you can transfer funds.

What Is In It For You? Action Items You Might Want to Consider

Prepare for Volatility Around Legislative Milestones

As the GENIUS Act progresses toward a final Senate vote, watch for market volatility or sentiment shifts in crypto assets linked to U.S. regulatory headlines. Consider short-term positioning accordingly.

Review Your Stablecoin Exposure

If you’re trading with stablecoins heavily tied to U.S. markets, monitor developments around the GENIUS Act. Regulatory shifts could affect issuers’ ability to operate or the liquidity of certain tokens.

Monitor Fed vs. State Oversight Impact

The regulatory structure proposed in the bill may create differences between state-licensed and federally regulated stablecoin issuers. Stay updated on which licenses your preferred platforms and tokens operate under.

[…] >>> Read more: GENIUS Act Advances in the Senate […]