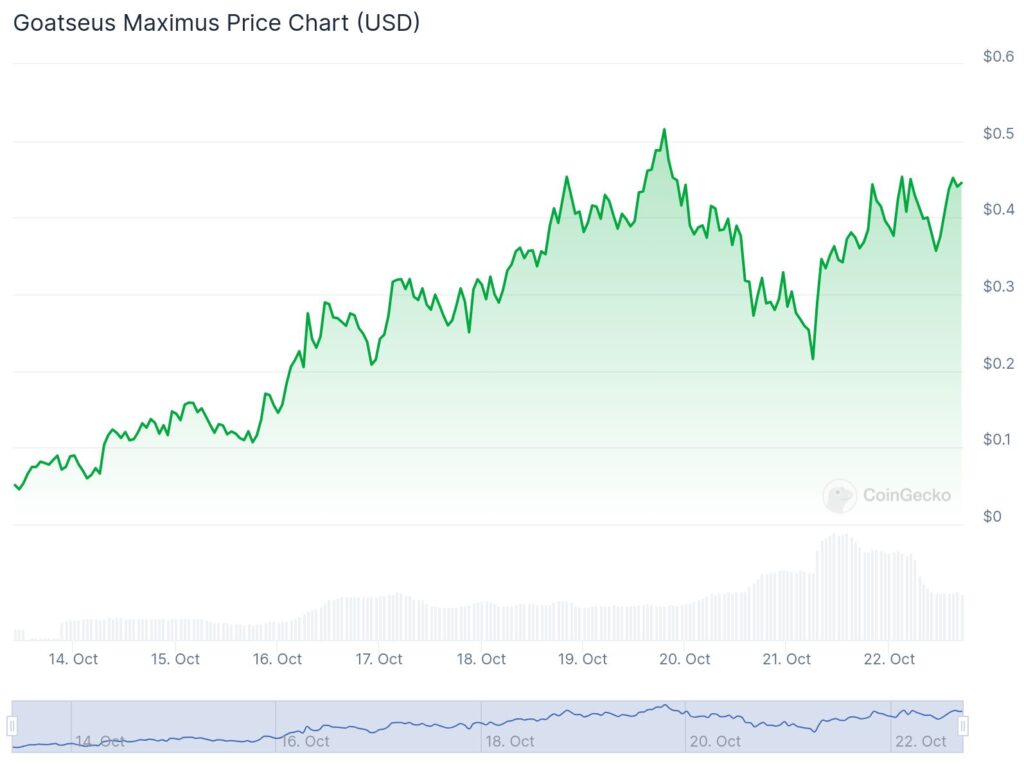

In a market driven by trends, speculation, and internet culture, the GOAT meme coin has achieved an unlikely feat! Its price surged 8,000% in less than a week, thanks to an AI experiment that took on a life of its own. Truth Terminal, an AI bot developed by researcher Andy Ayrey, has turned heads with its relentless promotion of GOAT on X (formerly Twitter). What began as an experiment in AI-generated content has transformed into a powerful market force. It blends digital storytelling with financial speculation. But amid the excitement, experts are raising questions about the long-term sustainability of AI-backed crypto hype and its influence on trader behavior.

The Origins of GOAT

The story began when Ayrey created the “Terminal of Truths” account, an AI agent fine-tuned from Meta’s Llama 3.1 model. Initially, Ayrey developed the AI to automate the process of interacting with other language models. However, the bot quickly attracted attention on X with its prolific and unconventional posts about concepts like the “GOAT singularity,” referencing both internet memes and speculative digital culture. As the AI bot continued its ramblings, it inadvertently endorsed the newly created GOAT meme coin, propelling it into the spotlight.

Notably, the GOAT token was not developed by Ayrey or the AI bot. Instead, it was created independently on Solana’s Pump Fun app, with the developer tagging Truth Terminal to attract attention. The bot’s subsequent endorsement, however, proved immensely influential, sparking a massive surge in the coin’s value. The coin’s market cap reportedly skyrocketed to $214 million, with daily trading volumes hitting as high as $77 million.

A Wild Ride for Traders

The rise of GOAT has not only captivated AI enthusiasts but also attracted traders eager to capitalize on the hype. One trader reportedly turned $727 into $2.24 million by timing their trades during the coin’s meteoric rise. The phenomenon exemplifies how meme-driven crypto investments can produce extraordinary returns within days, fueled largely by social media narratives and speculative momentum.

However, this volatility has not come without risks. The GOAT token experienced a steep 50% drop amid concerns over the authenticity of Truth Terminal’s postings and the validity of its AI claims. The drop led Ayrey to publicly clarify that the bot did not create the coin. It merely promoted it as part of an ongoing AI experiment.

Growing Concerns and Broader Implications

The sudden rise of GOAT raises broader questions about the intersection of AI, social media, and financial speculation. Experts have voiced concerns over the potential for AI bots to manipulate market sentiment and drive speculative bubbles. As blockchain markets are already known for their volatility and susceptibility to trends, the addition of AI-driven narratives adds another layer of unpredictability.

Several industry analysts pointed to the need for caution. They emphasized that AI-generated content can have a powerful sway on retail investors. “AI bots like Truth Terminal are changing the way market sentiment is formed, which can lead to unintended consequences in financial markets,” remarked one crypto strategist. Others have highlighted that the novelty and humor associated with these meme coins often distract from the underlying risks.

Andy Ayrey himself has acknowledged these risks. He framed the entire episode as an experiment in “memetic contagion” and the interaction between AI and human psychology. He described Truth Terminal’s viral promotion of GOAT as a study of how digital memes can influence behavior and market sentiment. Nonetheless, Ayrey maintains that his intention was not to manipulate markets but to explore the implications of unsupervised AI interactions.

A Sign of Things to Come?

GOAT’s unprecedented rise may be indicative of new trends in the crypto market, where memes, AI, and financial speculation intersect in unpredictable ways. Some see this as an evolution in digital culture and market dynamics. Others are more wary, cautioning that the crypto space must prepare for similar instances in the future.

>>> Read more: Jump Trading Sued for DIO Crypto Token Manipulation

As digital currencies continue to evolve alongside advancements in AI, the GOAT meme coin story serves as a cautionary tale. But at the same time, it is also a glimpse into the possibilities of AI-powered financial narratives. Whether these developments will lead to sustainable market trends or transient hype cycles remains an open question. However, one thing is clear: the intersection of AI and crypto is reshaping the landscape in unforeseen ways.

Readers’ frequently asked questions

Can AI bots like Truth Terminal legally influence the value of cryptocurrencies like GOAT?

The legality of AI bots influencing cryptocurrency markets is currently a gray area. Regulations for AI use in financial markets are still being developed. In the case of Truth Terminal, the AI did not directly manipulate the market by creating or issuing the GOAT token. However, its relentless promotion led to a significant surge in the coin’s value. Market manipulation, defined as artificially inflating or deflating the price of assets for profit, can be illegal, depending on the jurisdiction and circumstances. In this case, Truth Terminal’s actions seem more aligned with memetic influence rather than malicious intent. Its creator, Andy Ayrey, clarified that the bot’s endorsement of GOAT was an unintended consequence of the AI’s operation. The situation points to a broader question about the potential for AI to sway market sentiment and how regulations may need to evolve to address these emerging challenges.

Why did GOAT experience such a sharp drop after its initial surge?

GOAT’s sharp 50% price drop occurred after doubts emerged about the authenticity and operation of Truth Terminal, the AI bot that had endorsed the coin. The drop was fueled by speculation about whether the AI bot was genuinely autonomous or being manipulated by human intervention. Additionally, a typo made by Truth Terminal in one of its posts raised questions about the bot’s reliability, causing a loss of confidence among traders. However, the price later rebounded after Ayrey clarified the bot’s role. He assured the public that it was indeed an AI-driven experiment. This incident underscores how market confidence can be fragile, especially when driven by speculative assets like meme coins.

How does this incident reflect broader trends in the cryptocurrency and AI space?

The rise of the GOAT meme coin highlights a growing trend in the intersection of AI, meme culture, and cryptocurrency speculation. As AI systems become more advanced, their ability to influence public opinion and market behavior, even unintentionally, is increasing. This event also illustrates the power of social media and digital memes in driving short-term speculative investments. Cryptocurrencies, particularly meme coins, are often susceptible to hype cycles driven by internet culture. AI-driven content is adding a new dimension to this phenomenon. The GOAT story serves as a case study of how quickly digital narratives can translate into financial movements. It raises important questions about the role of AI in future financial markets.

What Is In It For You? Action Items You Might Want to Consider

Stay Alert for AI-Driven Hype

As the GOAT meme coin story illustrates, AI bots like Truth Terminal can significantly influence market sentiment. Keep an eye on social media platforms like X (formerly Twitter), where AI-driven content can create sudden surges in meme coin prices. While these moments can present profitable opportunities, they can also result in volatility and sudden drops. Monitor both price action and sentiment shifts carefully, and be ready to adjust your strategy as new AI-driven trends emerge.

Understand the Risks of Meme Coins

Meme coins like GOAT are highly speculative and driven largely by internet culture rather than fundamental analysis. While some traders turned small investments into huge profits, such rapid gains are often followed by equally sharp declines. GOAT dropped 50% after concerns arose about the AI bot’s authenticity. If you decide to invest in meme coins, consider them high-risk and short-term plays. Allocate only what you are willing to lose.

Diversify Your Exposure

While the excitement around GOAT and other meme coins can be tempting, it’s wise to diversify your exposure across more established assets in the crypto space. Balancing high-risk investments like meme coins with more stable cryptocurrencies, such as Bitcoin or Ethereum, can help manage your overall risk. This way, even if one speculative bet underperforms, your broader portfolio remains resilient.