Imagine trading shares of Meta Platforms Inc. (NASDAQ: META) anytime, anywhere, without needing a traditional brokerage account or being curbed by market hours. Injective, a finance-optimized Layer-1 blockchain, has made this possible by launching a tokenized version of Meta stock through its iAssets framework. This development signifies a significant stride towards financial inclusivity. Particularly, investors in underbanked regions benefit from it, challenging the traditional equity market’s gatekeepers.

Injective’s iAssets: Bridging Traditional Finance and DeFi

Injective’s iAssets framework enables tokenizing real-world assets (RWAs), such as stocks, bonds, and ETFs, into programmable tokens on the blockchain. These tokens can be traded 24/7 on Helix, Injective’s decentralized exchange, offering global users unrestricted access to financial markets.

By minting Meta stock as an iAsset, Injective provides network-wide liquidity. It allows traders, lenders, and DeFi platforms to incorporate $META into various financial strategies without the limitations of traditional markets. This approach democratizes access to high-value equities and integrates them into the decentralized finance ecosystem, enhancing their utility.

Empowering Investors Globally

The tokenization of Meta stock is particularly impactful for individual investors in regions with limited access to traditional financial services. By eliminating the need for intermediaries and offering 24/7 trading, Injective empowers users to participate in global markets, fostering financial inclusion and autonomy.

Moreover, integrating tokenized stocks into DeFi applications allows for innovative financial strategies. For example, investors can use $META as collateral in lending protocols or incorporate it into automated trading strategies. This flexibility enhances the financial tools available to individual investors, enabling them to manage and grow their assets more effectively.

>>> Read more: Deutsche Telekom Becomes Validator for Injective Protocol

A Step Towards a Decentralized Financial Future

Injective’s initiative to bring Meta stock on-chain is part of a broader movement to integrate traditional financial assets into the decentralized finance landscape. By doing so, Injective not only increases the accessibility and efficiency of financial markets but also paves the way for a more inclusive and decentralized financial system.

As the demand for real-world asset tokenization grows, Injective’s iAssets framework positions the platform at the forefront of this financial evolution. It offers users unprecedented access to a diverse range of financial instruments and opportunities.

In summary, Injective’s tokenization of Meta stock represents a significant advancement in bridging the gap between traditional finance and decentralized platforms. It promotes financial accessibility and empowerment for investors worldwide.

Readers’ frequently asked questions

Do I need to own any cryptocurrency to buy tokenized Meta stock?

Yes, to buy tokenized Meta stock on Injective’s platform, you’ll first need to own a cryptocurrency supported by the Injective network, typically INJ (Injective’s native token) or a stablecoin like USDT or USDC. You’ll also need a crypto wallet that supports Injective, such as MetaMask connected via a bridge. Once your wallet is funded and connected to the Helix decentralized exchange, you can trade your crypto for the tokenized Meta stock.

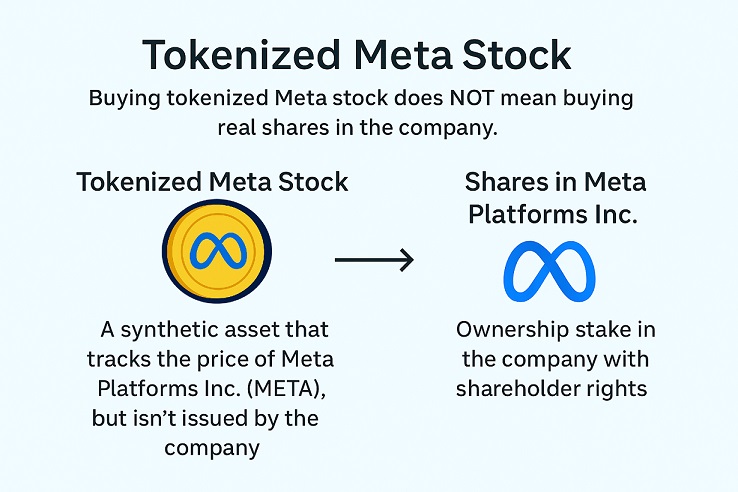

If I buy tokenized Meta stock, do I get the same benefits as owning real shares?

No, when you buy a tokenized version of Meta stock on Injective, you’re gaining exposure to the stock’s price movements. You don’t own the actual shares, hence you don’t receive dividends, voting rights, or other shareholder benefits related to holding real equity through a regulated broker. The token simply mirrors the stock’s market price through a price feed.

Can I convert the tokenized Meta stock back into regular money?

Yes, but the process is indirect. You can sell the tokenized Meta stock back into a cryptocurrency like USDT or INJ on the Helix exchange. Then, using a crypto exchange that supports fiat withdrawals (like Binance or Coinbase), you can convert your crypto into your local currency and withdraw it to a bank account. Keep in mind that fees, KYC requirements, and withdrawal limits may apply depending on the platform you use.

What Is In It For You? Action Items You Might Want to Consider

Explore 24/7 Trading Opportunities on Helix

Take advantage of Injective’s Helix exchange to gain exposure to Meta stock outside of traditional market hours. This can be especially useful for reacting to after-hours news or global events impacting stock prices before markets open.

Diversify with Tokenized Real-World Assets

Don’t limit your DeFi exposure to crypto-native tokens. Consider adding tokenized stocks like Meta, Tesla, or Nvidia to your portfolio to mirror TradFi performance while staying within the blockchain ecosystem.

Use iAssets in DeFi Strategies

Look into DeFi protocols on Injective that allow you to lend, borrow, or leverage tokenized assets. Using $META tokens as collateral or pairing them with stablecoins in liquidity pools could add extra utility and yield to your holdings.