TL;DR

- KlarnaUSD is Klarna’s new dollar-backed stablecoin, designed to move money across borders faster than traditional banking rails.

- Built on the Tempo blockchain, it enables near-instant, low-cost settlement for merchant payments and BNPL flows.

- Klarna’s scale and banking license give it a credible path to bring stablecoin-based settlement into everyday commerce.

Global commerce moves roughly $23.5 trillion across borders every year, yet the payments infrastructure remains costly and inefficient. The complex web of correspondent banks, card networks, acquirers, FX brokers, and compliance layers extracts an estimated $120 billion in fees annually from these transactions. But often they deliver slow settlement times and opaque pricing. The new KlarnaUSD stablecoin aims to disrupt this costly ecosystem. Klarna will provide a dollar-backed digital asset that settles transactions faster and cheaper than legacy payment networks.

Klarna’s push into stablecoins is not a superficial move. It is a strategic attempt to shift substantial payment volume away from traditional rails toward programmable, low-latency blockchain-based infrastructure. Success could reshape how merchants, consumers, and global e-commerce platforms transfer funds on a massive scale.

KlarnaUSD: A Simple Concept With Significant Implications

Klarna’s stablecoin is designed for real-world use cases, such as retail checkout, merchant settlement, remittances, and supplier payments. The fully dollar-backed token is issued via Stripe’s stablecoin infrastructure built for regulated institutions. It runs on Tempo, a blockchain developed by Stripe and Paradigm that prioritizes high throughput, rapid finality, and extremely low fees, all tailored for payment settlements rather than speculation. KlarnaUSD is currently live on testnet, allowing early integrations and testing, with a mainnet launch planned for 2026.

Klarna enters this market with a unique profile:

- It processes over $110 billion in annual gross merchandise volume (GMV).

- It serves 114 million customers globally.

- It operates as a licensed European bank, funding a majority of its credit book through deposits.

This blend of scale, regulation, and deeply integrated distribution positions the KlarnaUSD stablecoin as a mass-market settlement instrument beyond typical crypto projects.

Why Cross-Border Payments Are the Focus

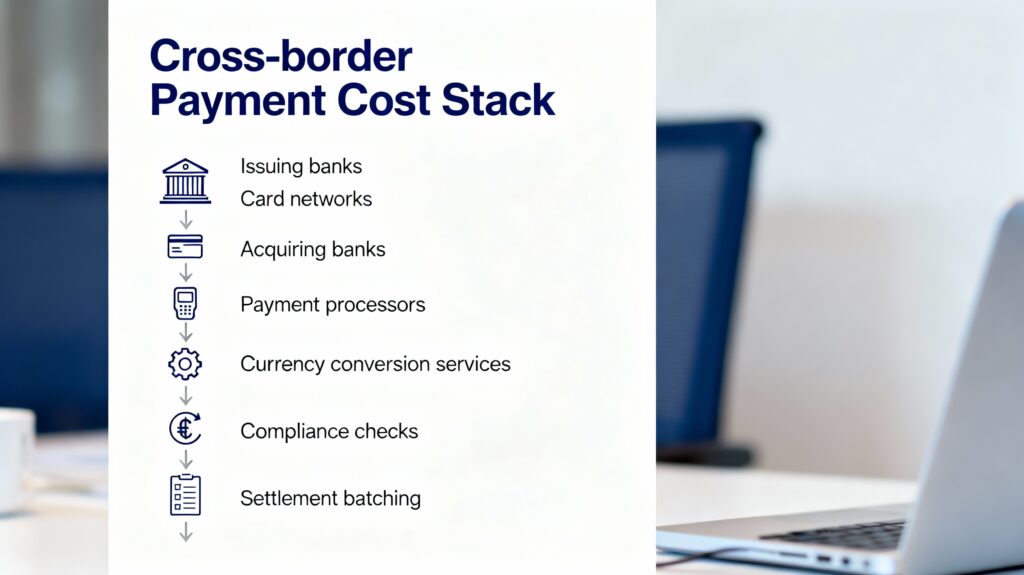

Cross-border payments, and cross-border commerce more broadly, suffer from fragmentation, delays, and layered fees as transactions pass through multiple intermediaries:

Each participant levies fees and adds latency. This cost structure burdens merchants operating with thin margins or serving sensitive, price-conscious regions.

Stablecoins like KlarnaUSD can reduce this burden by eliminating redundant intermediary hops and substantially lowering FX markups in many corridors. Additionally, programmable settlement collapses payment cycles from days to near-instant flows. It reduces working capital needs and improves liquidity which are key pain points for cross-border commerce.

Riding a Growing Stablecoin Wave

Stablecoins already process tens of trillions in annual volume, with estimates ranging from $18 trillion to upwards of $28 trillion depending on measurement methodology. Corporate stablecoin adoption is fastest in Latin America, Asia-Pacific, and MENA regions, where stablecoins overtly outperform traditional bank transfers on speed and cost.

KlarnaUSD launches into this vibrant market, building on a rapidly expanding curve of stablecoin adoption reshaping global payment behavior.

Tempo Blockchain: Focused on Payments

Unlike blockchains optimized for trading or DeFi, Tempo prioritizes payment needs. It offers seconds-level finality, transaction fees in fractions of a cent, and integrates directly with Stripe’s merchant ecosystem. This allows merchants to accept stablecoin payments and settle instantly without managing wallets, keys, or exposure to decentralized finance complexities.

Tempo’s design contrasts sharply with card networks, which focus on authorization and consumer protections. However, they cannot offer true real-time, frictionless global settlement. Klarna aims to present merchants with a credible, cost-effective alternative to the prevailing costly interchange, FX, and acquirer fee stack dominating global retail commerce.

Klarna’s Broader Business Transformation

Klarna’s stablecoin initiative aligns tightly with its existing Buy Now, Pay Later (BNPL) business. Klarna funds roughly 95% of its credit book through customer deposits, but its U.S. operations are limited by dependencies on partner institutions holding dollars. A dollar-backed stablecoin enables:

- Instant merchant settlement

- Faster BNPL credit disbursements

- Enhanced liquidity management across regions

- Lower FX exposure and costs in cross-border transactions

Ultimately, Klarna anticipates BNPL could settle through real-time stablecoin flows, shrinking the lag between purchase, merchant payout, and internal reconciliation. That would represent a clear advantage over BNPL competitors still tied to slower legacy rails.

Adoption Outlook: Impact If KlarnaUSD Scales

- Merchant adoption via Stripe’s extensive distribution allows merchants to improve economics without altering their front-end user experience.

- Consumer benefits include faster refunds, faster cross-border checkouts, and fewer hidden FX fees, all while abstracting blockchain complexities behind Klarna’s app.

- BNPL infrastructure efficiency gains from quicker settlement cycles, freeing capital and enabling operational agility.

Regulatory and Competitive Landscape

The U.S. GENIUS Act, adopted in 2025, lays a comprehensive regulatory framework for stablecoins, mandating permitted issuers to hold 1:1 USD reserves with strict disclosure and liquidity requirements. The EU’s MiCA regulation imposes transaction volume caps and criteria on non-euro stablecoins, applying to dollar-backed e-money tokens used as currency substitutes.

Klarna’s status as a licensed, regulated European bank situates it uniquely among stablecoin issuers, distinct from unregulated crypto startups. Competitors like PayPal USD , Société Générale’s EURCV, and Circle’s USDC are extending the stablecoin settlement category, signaling increased institutional adoption.

>>> Read more: Western Union USDPT Stablecoin Launch

A New Phase in the Payments Race

The launch of KlarnaUSD reflects a broader trend where major incumbents with real customers and financial infrastructure shift toward blockchain rails for payments. Klarna’s effort is not about speculative assets but redirecting meaningful global payment flows away from expensive intermediaries toward near-instant digital settlement.

Whether Klarna can scale its stablecoin will depend on regulation, merchant incentives, and Tempo’s performance at scale. But the direction is clear: the payments ecosystem is evolving to operate more like the internet—fast, cheap, and borderless, eliminating unnecessary bottlenecks.

If Klarna succeeds, it won’t merely save costs; it will alter the fundamental logic of how money moves across borders worldwide.