Few in today’s market remember LuBian, the once-active Chinese bitcoin mining pool that vanished after Beijing’s 2021 mining ban. During its short life, LuBian added measurable hash power to the Bitcoin network, then disappeared without explanation. Its wallets went silent, its site went dark, and the name faded into forum history.

Everything changed in August 2025. Arkham Intelligence, a leading crypto analytics firm, published a forensic report claiming that LuBian had lost 127,426 BTC in December 2020. If correct, it was the largest bitcoin theft ever identified. Using detailed on-chain analysis, Arkham traced payouts and deposits from historical LuBian addresses to clusters apparently outside the pool’s control. LuBian never commented. The silence left Arkham’s attribution uncontested and turned an old mining pool hack into a modern-day mystery.

A Dormant Wallet Wakes Up

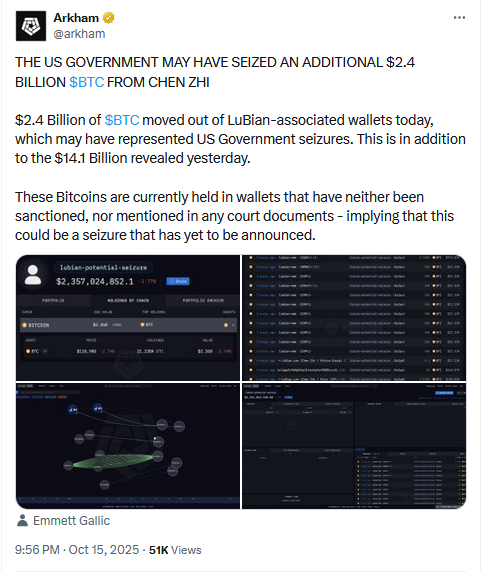

On October 15, 2025, a LuBian-linked wallet suddenly moved 9,757 BTC (about $1.1–$1.3 billion) after nearly three years of inactivity. The coins moved in two waves just hours apart. Several analytics teams confirmed the transfers, matching them to the same address cluster Arkham mapped in August. For on-chain watchers, it was the first visible wallet movement from that group since 2022.

As a result, attention surged. The awakening came less than a day after the U.S. Department of Justice announced a record crypto forfeiture case unrelated to LuBian. That timing sparked rumors. However, no official connection exists between the DOJ action and LuBian’s wallets.

>>> Read more: US Sanctions Burma Militias Over Cyber Scams

Fact vs Inference: What We Know and What We Don’t

Arkham’s report built a factual baseline. Yet many claims circulating online stretch beyond what evidence supports.

| Category | Statement | Status |

|---|---|---|

| Attribution | Arkham mapped 127,426 BTC loss | ✅ Public report confirmed |

| Communications | LuBian made no statement | ✅ Verified silence since 2021 |

| On-chain event | 9,757 BTC moved on Oct 15, 2025 | ✅ On-chain confirmed |

| Enforcement link | DOJ seizure includes LuBian coins | ⚠️ Unverified / speculative |

| Motive | Reason for movement | ⚠️ Unknown / speculative |

| Control | Wallet owner identity | ⚠️ Unknown / speculative |

In short, the coins moved; the motive did not.

Who Controls the Keys? Competing Theories

Analysts and traders suggest several possibilities. First, the move could reflect a law-enforcement transfer following a quiet seizure. Second, it may show an internal reshuffle by former operators protecting private keys. Third, a thief could be testing small spends before liquidation. Finally, there may be third-party access through compromised or resold keys.

Even now, no public filing confirms any scenario. The bitcoin address cluster Arkham identified shows coins splitting into new outputs, yet there are no exchange deposits or mixing patterns so far. Therefore, the market continues to watch.

Market and Investigative Implications

Overall, the LuBian mining pool story exposes weak governance in early mining operations. It also illustrates how wallet tracking and on-chain analysis now help investigators follow multi-billion-dollar trails years later. Moreover, it reminds compliance teams to review older forfeiture case filings and exchange-screening alerts. Even limited movement from a stash this large can shift short-term BTC liquidity and spreads.

>>> Read more: August 2025 Crypto Hacks: $163M Lost

Bottom Line

Two verified anchors now define the case: Arkham Intelligence’s August 2025 report tracing a 2020 theft of 127,426 BTC, and the October 15 awakening of 9,757 BTC from a dormant wallet after years of silence.

Everything between those points (ownership, intent, and outcome) remains under investigation. As a result, LuBian may become a benchmark for how analytic evidence, custody failures, and cross-border enforcement converge at a billion-dollar scale.

Readers’ Frequently Asked Questions

Was LuBian actually hacked in 2020?

Arkham’s August 2025 report attributes a 127,426 BTC loss to theft and maps the addresses involved. However, it remains analytic, not a court finding, and LuBian has issued no statement.

What exactly moved on October 15 2025?

A long-silent LuBian-linked wallet transferred 9,757 BTC in two waves after roughly three years of inactivity, worth about $1.1 – $1.3 billion.

Does this prove the coins were sold or seized?

No. The movement is fact; the motive is not. There is no public document explaining who controls the wallet or why it moved.

What Is In It For You? Action items you might want to consider

Track new outputs from LuBian-linked wallets

Follow on-chain activity for signs of consolidation, mixing, or deposits to exchanges. Any movement could indicate changes in control or liquidation attempts.

Review exchange compliance policies

Exchanges should ensure their wallet-screening systems detect LuBian-linked addresses to avoid accidental acceptance of tainted funds.

Revisit mining-pool governance standards

For mining operators, this case highlights the need to strengthen private-key custody, audit procedures, and internal controls to prevent future losses.