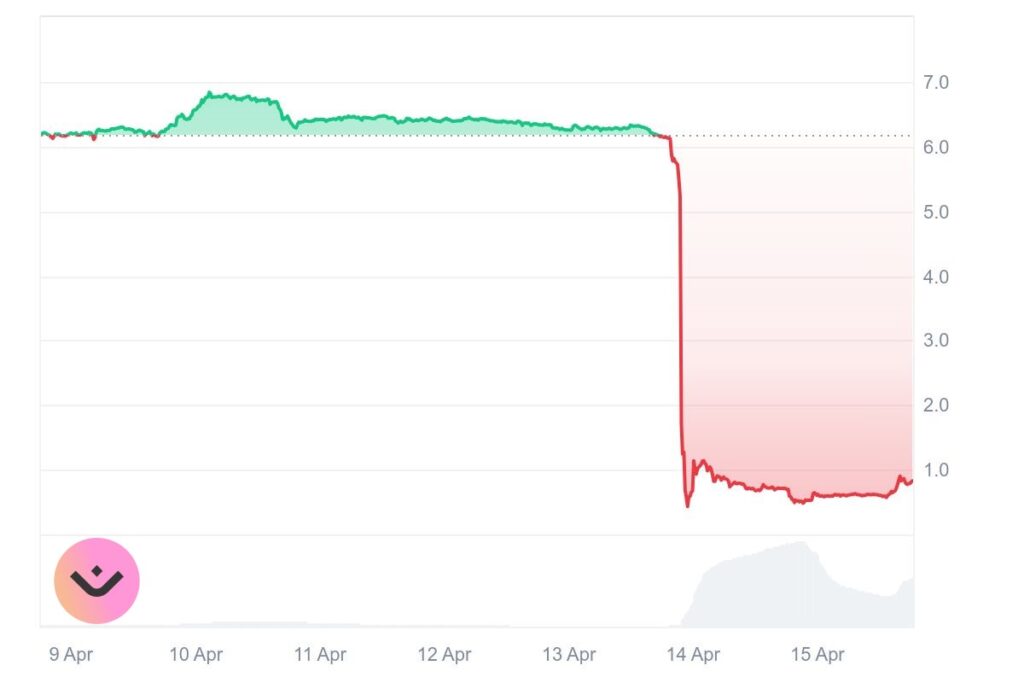

Mantra’s OM token experienced a catastrophic crash on April 13, plummeting more than 90% in value within a single hour and wiping out over $5 billion in market capitalization. The sudden collapse sparked widespread panic across crypto markets, with industry analysts and investors scrambling to understand what went wrong. The project’s leadership points to forced liquidations on centralized exchanges (CEXs) as the root cause. However, emerging on-chain data suggests there may be more to the story.

Mantra Blames Forced Liquidations by CEXs

According to Mantra co-founder John Patrick Mullin, a series of automatic liquidations on exchanges such as Binance and OKX triggered the token’s freefall. These were allegedly initiated during low-liquidity trading hours, leading to a cascade effect as margin positions were force-closed without warning. Mullin criticized CEXs for lacking transparency and acting without adequate safeguards. He argued that these exchanges hold disproportionate power over the fate of crypto assets.

Suspicious On-Chain Activity Sparks Insider Concerns

However, blockchain analysts have uncovered a series of suspicious transactions that suggest possible pre-crash token dumping. Seventeen wallets reportedly transferred over 43 million OM tokens to exchanges in the hours leading up to the price collapse. This volume represents more than 4.5% of OM’s circulating supply at the time. While some of these wallets have been linked to early investors and private round participants, these parties have denied involvement in any coordinated sale.

Tokenomics Adjustments Raise Transparency Issues

Further complicating the narrative, OKX quietly updated OM’s tokenomics during the chaos. The circulating supply jumped from 60 million to over 880 million tokens. The move, made without public explanation, raised concerns about how such backend adjustments may have influenced price discovery or affected leverage ratios on derivative platforms.

Derivatives Surge Amid Retail Losses

In the aftermath, derivatives trading volume for OM surged by over 7,000%, indicating that some traders capitalized on the extreme volatility. Meanwhile, retail investors took to social media to express outrage and despair. Many compared the event to the 2022 Terra (LUNA) collapse.

Regulatory Scrutiny and Erosion of Trust

Mantra, a Dubai-regulated project under VARA (Virtual Assets Regulatory Authority), had positioned itself as a credible DeFi platform with ties to major real estate developers in the UAE. The crash now places its regulatory standing and investor trust under significant pressure.

As the dust settles, the incident highlights the urgent need for greater transparency in token issuance, clearer exchange disclosure practices, and enhanced investor protection mechanisms. Whether this was a systemic failure or a more coordinated act remains under investigation. But one thing is clear: trust in crypto market infrastructure has once again been shaken.

Readers’ frequently asked questions

What is a circulating supply, and why did the change in OM’s supply matter during the crash?

Circulating supply refers to the number of tokens that are actively available for trading on the market. When OKX updated OM’s circulating supply from 60 million to over 880 million during the crash, it signaled that far more tokens might suddenly be tradable than previously thought. This change can affect a token’s price because it impacts how scarce the asset appears to be. If traders think there are suddenly many more tokens available, they may value each one less. That can lead to panic selling or rapid devaluation, especially if the change isn’t explained clearly in real-time.

What are “forced liquidations” on exchanges, and how can they crash a token’s price so quickly?

Forced liquidations happen when a trader uses borrowed funds (leverage) to make a bet on a token’s price and the market moves against them. Exchanges like Binance or OKX automatically close these positions to prevent further losses when the trader’s collateral falls below a certain threshold. If a token’s liquidity is thin, meaning there aren’t enough buy orders to absorb rapid sell-offs, these liquidations can cause a sharp price drop. When many liquidations happen at once, especially in off-hours when fewer trades are taking place, it can trigger a cascade effect where each liquidation causes more, creating a rapid freefall in price.

How can wallet activity be tracked before a crash, and is that information public?

Yes, wallet activity on blockchain networks is public and traceable using blockchain explorers like Etherscan or third-party analytics tools like Arkham or Nansen. These platforms allow users to monitor how much of a token is being moved between wallets and to exchanges. In the case of OM, analysts noticed that certain wallets sent millions of tokens to exchanges shortly before the crash. That kind of movement is often interpreted as a sign that the holders might be preparing to sell, especially if they’ve been inactive for a long time or are linked to early investors.

What Is In It For You? Action Items You Might Want to Consider

Keep an eye on token unlock schedules and circulating supply updates

If a project’s circulating supply can jump from 60 million to 880 million without prior notice, as it did with Mantra’s OM token, you need to know before it happens, not after. Bookmark the project’s tokenomics page (if it has one). You can also use on-chain tools like TokenUnlocks or DeFiLlama to stay ahead of major unlock events that could flood the market.

Track large wallet movements before you trade

Want to spot trouble early? Start watching what the big wallets are doing. If you see multiple dormant or investor-linked wallets moving large amounts of tokens to exchanges right before a price dip, that’s your cue to sit back; or get out. Tools like Arkham, Nansen, or even free explorers can give you a serious edge.

Be cautious when trading tokens with high-leverage exposure

If a token is heavily traded in derivatives markets, its price can collapse fast under pressure, especially during off-peak hours. Before jumping into a trade, check platforms like Coinglass to see if open interest is rising too quickly. High leverage might look like an opportunity, but it’s often the match that lights the fuse.