TL;DR

- MrBeast bank rumors stem from an October 2025 USPTO trademark that lists banking, lending, and crypto services, not an actual license.

- The filing outlines a MrBeast financial app concept; real banking or crypto app operations would still need partners and regulatory approval.

- The move spotlights the broader rise of influencer banking and creator fintech where online fame meets financial compliance challenges.

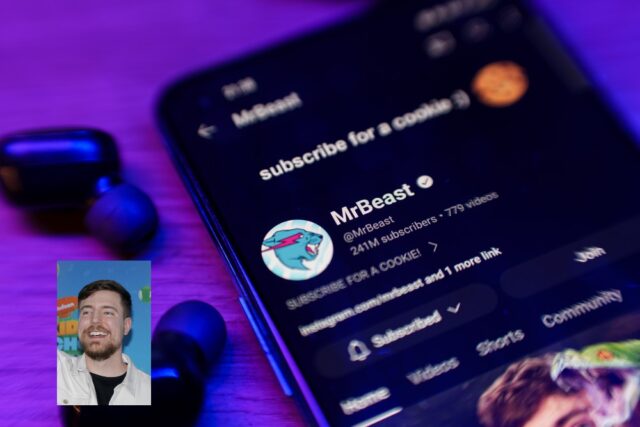

On October 13, 2025, Beast Holdings LLC, the parent company of Jimmy Donaldson’s online empire, filed a USPTO trademark for “MrBeast Financial.” The application describes a mobile platform for banking, lending, investing, payments, and crypto exchange functions. The move immediately triggered speculation that the world’s most-watched YouTuber is building a MrBeast bank.

Yet a trademark, even one this ambitious, is only a legal placeholder. Turning it into a functioning financial platform requires real partners, real licenses, and months of regulatory sign-off.

What the Filing Actually Covers

The trademark lists a broad menu of services: credit and debit cards, micro-loans, investment tools, and even crypto-wallet and DEX-style capabilities. In other words, a proposed MrBeast financial app that blends a digital bank with an exchange. News outlets from Newsweek to Business Insider verified the description directly from the filing, confirming that the document sketches a fintech super-app on paper.

But paper is where most intent-to-use filings stay unless the company can navigate a maze of U.S. financial regulation. So what is MrBeast Financial exactly? At this stage, it’s a concept brand. A name reservation signaling that the creator wants a seat at the fintech table.

A Trademark Is Not a Launch

Filing a trademark does not authorize anyone to operate a MrBeast bank app or issue accounts. Under U.S. law, a trademark applicant must later submit “proof of use” before it’s enforceable, but a trademark never substitutes for a banking charter or money-transmitter license. For context, even startups like Chime and Revolut spent years working through partner banks before offering FDIC-insured services. MrBeast’s filing marks intent, not approval.

Inside the Pitch Deck Clues

Earlier in 2025, Business Insider reported that Donaldson’s team circulated a pitch deck under the working name MrBeast Finance. That presentation outlined credit cards, personal loans, insurance, and a crypto on-ramp, to be delivered through white-label fintech partners, firms already holding the necessary licenses. Such a model lets creators launch branded finance products while offloading regulatory burdens to back-end providers. It’s a proven playbook in creator-led commerce: the brand owns the audience; the partner owns the compliance.

The Regulatory Reality Check

Transforming a trademark into a real-world bank or MrBeast crypto app involves four heavy-lift steps:

- Banking Partnerships – MrBeast Financial would need a bank of record to handle deposits and card issuance under FDIC oversight.

- Crypto Licensing – Operating any exchange or wallet requires money-transmitter licenses in many U.S. states or a BitLicense in New York.

- Compliance and KYC/AML – Every customer must be verified against OFAC and anti-fraud lists; outsourcing these checks still incurs significant costs.

- Custody and DEX Risk – Providing a decentralized-exchange feature could raise securities and commodities law issues depending on design and assets offered; MSB registration alone is insufficient to address all legal risks.

Each layer introduces its own regulators and liabilities. Filing a trademark is the easiest step in that ladder.

Audience and Consumer Protection Concerns

Skeptical voices have raised questions about how a MrBeast crypto bank app might target a youthful audience already prone to high-risk financial behavior. U.S. rules enforced by the FTC and CFPB treat influencer promotions of credit or investment products as advertisements subject to truth-in-lending, disclosure, and UDAAP standards. If a MrBeast-branded micro-loan or debit card ever launches, regulators will closely examine whether minors are being enticed into debt.

This conversation sits within the broader rise of influencer banking, where online personalities blur entertainment and financial advice. Transparency, adult-supervised marketing, will matter as much as technical compliance.

What to Watch Next

- USPTO Docket Updates – acceptance, office actions, or withdrawal of the application.

- Corporate Moves – formation of a fintech subsidiary or new domain registrations.

- Partnership Reveals – any alignment with licensed banks or custodians.

- Beta Launch or Waitlist – an actual app or registration page would signal the project’s seriousness.

>>> Read more: Tether-Backed Rumble Brings Bitcoin Tipping to Creators

Closing Takeaway

The filing for MrBeast Financial services highlights how top creators are expanding into fintech, lured by recurring revenue and brand loyalty. Yet trademarks don’t move money. Before fans can open accounts in a MrBeast bank, Donaldson’s team must pass the same regulatory gauntlet as every other startup. Influencers may disrupt finance, but finance still answers to regulators. As the lines between content and capital blur, creator fintech ventures like this will test how much trust an online persona can carry into the real economy.

[…] >>> Read more: MrBeast Bank Trademark Explained — Not a Real Bank Yet […]