The rehabilitation trustee for the defunct Mt. Gox exchange has pushed the long-anticipated creditor repayment deadline back by another year, to October 31, 2026. The repayment delay keeps an estimated $4 billion in Bitcoin locked inside the Mt. Gox estate for at least twelve more months. While it temporarily eases market fears of a sudden supply shock, it further prolongs the wait for creditors who have already endured almost a decade of uncertainty.

A Decade-Long Winding Road

Once the world’s largest crypto exchange, Mt. Gox collapsed in 2014 after losing 850,000 BTC to hacks and mismanagement. The Tokyo District Court placed the firm into rehabilitation, and years of claims processing followed. A settlement framework approved in 2021 set the stage for gradual repayments, with October 2025 as the original deadline. That schedule has now shifted again. The trustee cited procedural bottlenecks that make it impossible to complete distributions on time.

>>> Read more: $9.6 Billion Mt. Gox Payout Shakes Bitcoin

Why the Mt. Gox Trustee Asked for Another Year

In a court-approved statement, the rehabilitation trustee said the extension was necessary “to make the repayments to the extent reasonably practicable.” Behind that legal phrasing lie two main challenges. First, a significant number of creditors still have not completed required verification steps. That includes KYC checks, bank-account linking, and identity validation on partner exchanges. Second, several partner institutions continue to report processing or compliance issues that slow transfers. Rather than closing the window prematurely, the trustee sought more time to ensure that every verified claimant receives the correct allocation. In essence, the Mt. Gox repayment delay reflects administrative accuracy rather than any new financial dispute.

How Much Has Been Repaid So Far

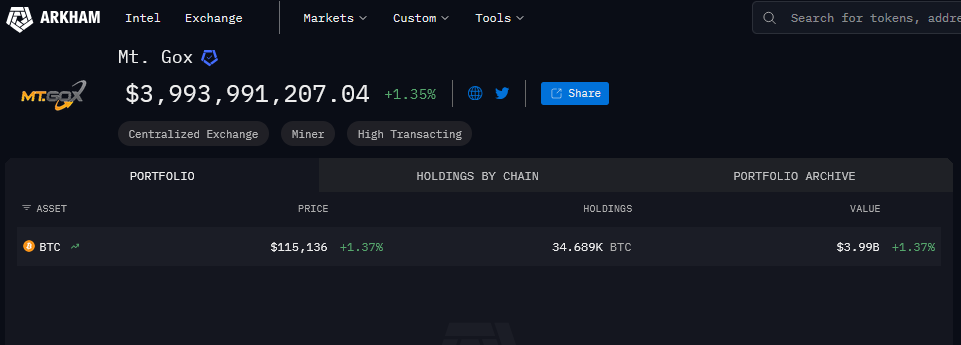

On-chain data and trustee disclosures show that Mt. Gox held 141,686 BTC in total for distribution. As of late October 2025, approximately 106,997 BTC (≈ 75.5%) have already been transferred to end recipients. About 34,689 BTC are still in trustee-controlled wallets. The Base, Early Lump-Sum, and Intermediate Repayment tranches are “largely completed” for creditors who met all procedural conditions. Remaining assets include unallocated Bitcoin Cash (BCH) and Japanese yen cash balances awaiting confirmation. The trustee has not published a unified fiat + crypto total, but blockchain trackers confirm that a majority of BTC disbursements are complete.

Market Impact: Relief Now, Uncertainty Later

For traders, the extension offers a near-term reprieve. The delayed release of billions in Bitcoin means that tens of thousands of coins remain off exchanges, preventing abrupt liquidity shocks that could depress prices. Analysts had warned that repayments scheduled for late 2025 might trigger a surge in sell orders as long-waiting creditors cashed out. By shifting the timeline to 2026, the trustee effectively defers that risk. Though this allows markets to absorb the supply gradually once transfers resume, it simply moves the risk forward in time. Some creditors are long-term believers who are likely to hold. However, others, especially funds that bought claims at discounts, are expected to sell once assets arrive. That blend of holders and sellers means eventual volatility is probable, just not imminent.

The Creditors’ Perspective

For former Mt. Gox users, the news lands with mixed emotions. On one hand, the majority of compliant claimants have finally received partial payouts in BTC, BCH, or fiat. On the other hand, many small creditors feel the rehabilitation has become an endless paperwork loop. Thousands remain stuck in verification limbo due to repetitive KYC requests and exchange-specific technical issues. Each claim must still pass through multiple compliance layers before any transfer is released, and even minor data discrepancies can freeze a case for months. The trustee has warned against unofficial communication channels after several phishing campaigns targeted creditors seeking updates. All status changes are now posted exclusively on the official MtGox.com site and through direct trustee notices.

Why the Delay Matters Beyond Creditors

The Mt. Gox repayment delay doesn’t just impact former customers—it shapes Bitcoin’s supply dynamics. Mt. Gox’s remaining 34,000 BTC equal roughly 0.16% of the circulating supply, a non-trivial amount in thin liquidity conditions. Keeping that stock dormant effectively supports short-term price stability. However, the longer the holdings stay frozen, the more the market begins to price in their eventual return. Traders monitor trustee wallets closely; any large outgoing transaction instantly appears in blockchain analytics dashboards, often sparking temporary price dips. Thus, while the delay offers breathing room, it also extends a period of heightened attention across global crypto markets.

What Happens Next

The trustee has pledged to continue repayments “as soon as practicable” and will issue periodic updates through 2025 and 2026. Remaining payments are expected to occur in staggered batches as each creditor clears final checks. Observers anticipate at least one more progress report in Q2 2026, followed by a completion notice near the new October deadline, if timelines hold. In the meantime, analysts expect Mt. Gox-linked wallets to remain static, signalling that no large market inflows are imminent. Until that changes, both creditors and traders remain in a holding pattern defined by delayed closure and cautious optimism.

Conclusion

More than eleven years after its collapse, Mt. Gox continues to cast a long shadow over Bitcoin’s history. The current extension embodies a paradox: it protects the market from short-term disruption while testing the patience of those still waiting for restitution. If the rehabilitation plan stays on course, 2026 should finally mark the end of this drawn-out saga. A resolution creditors have been chasing since before crypto’s first bull run.

Readers’ frequently asked questions

How do I check my Mt. Gox claim status?

Use only the official Mt. Gox Rehabilitation Claim System and the trustee’s verified emails. Log in with your issued credentials to see approval status and any pending steps. Ignore messages on social media or third-party sites asking for wallet keys or seed phrases.

Will my repayment arrive in BTC, BCH, or cash?

That depends on your linked accounts and the option you selected. Repayments can be delivered in Bitcoin (BTC), Bitcoin Cash (BCH), or Japanese yen (JPY). Crypto transfers are routed via trustee-approved exchanges; cash payments are processed to registered bank accounts.

What if I missed KYC or procedural deadlines?

Your repayment is paused, not forfeited. Complete the required KYC and account details through the official portal; once verified, processing resumes in the next eligible batch. Always rely on the trustee’s notices for exact instructions and timing.

What Is In It For You? Action items you might want to consider

Monitor on-chain movements of Mt. Gox wallets

Large outgoing transactions often appear before official repayment updates. Tracking these movements can provide early insight into when repayments might resume and how much Bitcoin could enter the market.

Prepare for potential short-term volatility in 2026

The eventual release of Mt. Gox Bitcoin may trigger temporary price swings. Traders should plan hedging strategies or adjust portfolio exposure ahead of the revised repayment window.

Stay subscribed to official trustee communications

Use only MtGox.com and verified email addresses for repayment updates. Avoid unofficial Telegram or Discord groups that may circulate false timelines or phishing links.