In January 2024, the U.S. Securities and Exchange Commission (SEC) made a groundbreaking decision to approve spot Bitcoin exchange-traded funds (ETFs). This marked a significant moment in cryptocurrency history, bridging the gap between traditional finance and digital assets. Over the past year, spot Bitcoin ETFs have reshaped the investment landscape, offering accessibility, liquidity, and credibility to a wider audience. This article examines their impact, the market dynamics they have created, and their role in driving Bitcoin toward mainstream adoption.

A Surge in Market Adoption

The introduction of spot Bitcoin ETFs has been a game-changer for investors. ETFs have provided a regulated and simplified avenue for exposure to the leading cryptocurrency without the need to purchase and store Bitcoin itself. This accessibility has spurred unprecedented adoption among retail and institutional investors alike.

BlackRock’s iShares Bitcoin Trust (IBIT) quickly emerged as a dominant player. It amassed over $52 billion in assets under management (AUM) by the end of 2024. This achievement underscores the fund’s popularity and highlights the growing confidence in Bitcoin as a legitimate asset class. Other ETFs, such as Fidelity’s Wise Origin Bitcoin Fund and ARK 21Shares Bitcoin ETF, also carved out significant market shares, with $19 billion and $4.3 billion in AUM respectively.

Bitcoin’s Price Surge

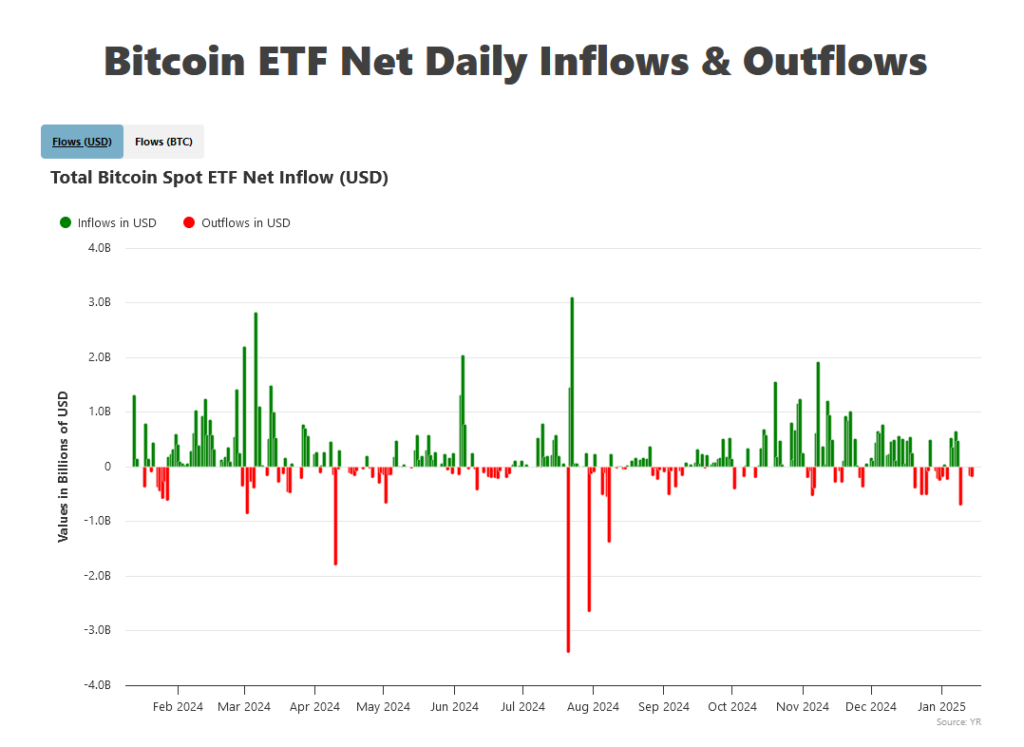

The approval of spot Bitcoin ETFs coincided with a remarkable bull run in Bitcoin’s price. Since January 2024, Bitcoin has more than doubled, surpassing the $100,000 mark by late 2024. Analysts attribute this growth to increased demand driven by ETF inflows and the heightened interest of institutional players. The transparency and regulatory oversight of the ETFs have alleviated many concerns that previously deterred traditional investors from entering the crypto market.

The Competitive ETF Landscape

While BlackRock’s IBIT dominated the market, other ETFs faced challenges in securing significant inflows. Factors such as brand reputation, marketing strategies, and expense ratios were critical in determining market share. Some funds struggled to differentiate themselves, illustrating the high-stakes competition in the ETF market.

The success of these products has not gone unnoticed by competitors and regulators. Discussions have emerged about expanding the ETF model to other cryptocurrencies, including Ethereum and Solana. However, these developments remain subject to regulatory scrutiny, reflecting the cautious approach adopted by the SEC.

Impact on Traditional Finance

Spot Bitcoin ETFs have played a pivotal role in bridging the worlds of cryptocurrency and traditional finance. Their integration into investment portfolios, including those of pension funds and hedge funds, signifies the growing acceptance of Bitcoin as a long-term store of value. This shift has also encouraged financial institutions to explore blockchain-based solutions, further cementing the mainstream relevance of cryptocurrencies.

The Road Ahead

As Bitcoin ETFs celebrate their first anniversary, their impact is undeniable. They have democratized access to Bitcoin, driven its price to new heights, and elevated its status within the broader financial ecosystem. However, challenges remain, including regulatory hurdles for other crypto ETFs and potential market saturation.

Looking ahead, the continued success of Bitcoin ETFs will likely depend on their ability to adapt to market demands and maintain investor confidence. With discussions around multi-crypto ETFs gaining momentum, this year could witness even greater innovation in crypto investment products.

In conclusion, the first year of spot Bitcoin ETFs has been a milestone in cryptocurrency mainstreaming. By offering a secure, accessible, and regulated way to invest in Bitcoin, these ETFs have set the stage for a future where digital assets play an integral role in global finance.

Readers’ frequently asked questions

What exactly is a spot Bitcoin ETF, and how does it differ from other Bitcoin investment options?

A spot Bitcoin ETF is a financial product that allows investors to gain exposure to Bitcoin without buying or storing the cryptocurrency directly. Unlike Bitcoin futures ETFs, which are based on contracts speculating on Bitcoin’s future price, spot Bitcoin ETFs hold actual Bitcoin as their underlying asset. This means the fund tracks the real-time market value of Bitcoin. It is a straightforward way for investors to benefit from price movements without navigating the complexities of crypto wallets or private keys. Spot Bitcoin ETFs are regulated, providing additional security and trust for investors.

Why did Bitcoin’s price rise so significantly after the approval of spot Bitcoin ETFs?

Bitcoin’s price surged following the approval of spot Bitcoin ETFs because these financial products made Bitcoin investment accessible to a broader audience. Retail investors found it easier to participate in the market without the technical challenges of direct ownership. Institutional investors, like pension funds and hedge funds, saw a more credible and regulated pathway to add Bitcoin to their portfolios. The inflows from these new participants created additional demand for Bitcoin, driving up its price. Moreover, the market viewed the SEC’s approval as a signal of legitimacy for Bitcoin as an asset class, further boosting confidence and attracting more investment.

Are there risks associated with investing in spot Bitcoin ETFs, even though they’re regulated?

Spot Bitcoin ETFs provide a safer and more convenient way to invest in Bitcoin than direct ownership, but they are not without risks. Since these ETFs are tied to the price of Bitcoin, investors remain exposed to the cryptocurrency’s volatility. Price swings can lead to significant gains but also substantial losses. Additionally, while ETFs mitigate some risks associated with storing Bitcoin, such as theft or loss of private keys, they introduce new considerations. They apply management fees and investors must rely on the ETF provider’s operational efficiency. Investors should also be aware that regulatory changes or market saturation could impact the performance of these products. As always, it’s essential to research thoroughly and consider your risk tolerance before investing.

What Is In It For You? Action Items You Might Want to Consider

Diversify Your Portfolio with Bitcoin ETFs

Consider incorporating spot Bitcoin ETFs into your investment strategy to gain exposure to Bitcoin without the complexities of direct ownership. These ETFs provide a regulated and secure avenue for trading Bitcoin. They are an excellent option for both novice and experienced traders seeking to diversify their portfolios. Start with a well-established ETF like BlackRock’s iShares Bitcoin Trust to leverage its proven market performance.

Monitor Bitcoin’s Price Trends Post-ETF Inflows

Stay attuned to Bitcoin’s price movements, as ETF inflows can create upward momentum. Use this trend to identify potential entry or exit points for your trades. Tools like technical analysis and market sentiment indicators can help you make informed decisions during periods of heightened ETF activity and market interest.

Explore the Competitive Landscape of Bitcoin ETFs

Not all Bitcoin ETFs are created equal. Analyze factors such as expense ratios, AUM, and fund reputation to choose the ETF that aligns with your financial goals. For example, if you’re looking for cost efficiency, compare expense ratios among available options. For higher liquidity and stability, focus on funds with significant market dominance, like BlackRock or Fidelity’s offerings.

[…] vehicles. By enhancing efficiency and potentially stabilizing the Bitcoin market, this move could make Bitcoin ETFs more attractive to institutional investors. However, it also brings forth challenges that must be carefully managed […]

[…] major shift in this cycle is the growing presence of institutional investors. With spot Bitcoin ETFs approved and launched in major markets, capital inflows from traditional finance have become a defining feature of the […]

[…] most of the year, spot Bitcoin ETFs acted as consistent sources of demand. That dynamic reversed once prices fell through the ETF […]

[…] genius or having a lot of money. If you use the right tools and follow a cautious plan, you can explore crypto and at your own […]