The recent settlement between Terraform Labs and the U.S. Securities and Exchange Commission (SEC) has ignited speculation about its potential ramifications for Ripple and its ongoing legal struggle. As Ripple contests a formidable $2 billion fine from the SEC, the Terraform Labs case introduces a new precedent that could sway the final outcome.

Unpacking the Ripple-SEC Dispute

Ripple Labs finds itself entrenched in a fierce legal dispute with the SEC, which accuses the company of conducting an unregistered securities offering through its sales of XRP. Ripple vehemently disputes the SEC’s demand for nearly $2 billion in penalties, arguing that such a sanction lacks proportionality and legal grounding.

>>> Read more: Ripple XRP Still In Court – SEC Pursues $2 Billion Fine

Analyzing the Terraform Labs Settlement

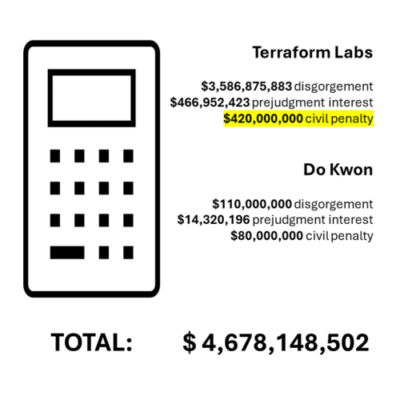

In a recent development, Terraform Labs opted to settle with the SEC for a substantially reduced sum compared to the SEC’s demands from Ripple. Terraform Labs faced similar allegations of unauthorized securities sales. This settlement has sparked debates over its potential implications for Ripple’s penalties.

Ripple’s Legal Defense

Ripple’s legal team asserts that the settlement reached by Terraform Labs underscores the SEC’s inconsistent approach to penalty enforcement. Ripple contends that any fine imposed should align with the Terraform Labs settlement, which did not surpass $500 million. Ripple advocates for a modest $10 million penalty, arguing against the SEC’s purportedly excessive $2 billion claim, which lacks precedent.

Assessing Legal Precedents and Comparisons

The Terraform Labs settlement highlights a stark contrast in penalty outcomes despite allegations mirroring those against Ripple. This disparity bolsters Ripple’s argument that the SEC’s enforcement tactics are erratic and punitive. Ripple’s defense team posits this as evidence of regulatory overreach, urging the court to consider a more judicious penalty.

Potential Industry Impact

The outcome of Ripple’s legal battle holds profound implications for the broader cryptocurrency sector. A favorable ruling for Ripple could establish a benchmark for regulating and penalizing digital assets in the future. Conversely, a verdict favoring the SEC might herald stricter regulatory regimes and heightened penalties across the blockchain industry.

Ripple’s Adaptations and Compliance Efforts

In response to the SEC’s allegations, Ripple has initiated strategic adjustments to its operational protocols. The company has revamped its XRP sales strategies to ensure full compliance with regulatory standards and has taken proactive steps to align with legal requirements. These measures underscore Ripple’s steadfast commitment to upholding the law and mitigating future legal risks.

Looking Forward

As Ripple’s legal battle against the SEC unfolds, the settlement involving Terraform Labs assumes critical significance. Ripple’s plea for a moderated penalty, drawing parallels from the Terraform Labs case, underscores the imperative for consistent regulatory practices. The eventual outcome will not only shape Ripple’s future but also establish vital legal precedents impacting cryptocurrency regulation.

The Ripple-SEC litigation stands as a pivotal juncture for the blockchain industry. With the Terraform Labs settlement potentially serving as a turning point, the verdict in this case could define essential legal benchmarks. The cryptocurrency community eagerly awaits the court’s decision, which promises enduring implications for the governance of digital assets in the United States and beyond.

Readers’ frequently asked questions

How does the Terraform Labs settlement impact Ripple’s case with the SEC?

The Terraform Labs settlement sets a precedent that Ripple is using to argue for a more proportionate penalty. While the SEC demanded nearly $2 billion from Ripple, the settlement with Terraform Labs involved much lower penalties despite similar allegations. Ripple contends that this inconsistency highlights the need for a fairer penalty in its case, aiming for a $10 million fine instead.

What changes has Ripple made in response to the SEC’s allegations?

Ripple has adjusted its business practices to comply with legal standards, including modifying how it sells XRP. The company now ensures its sales are conducted with accredited investors and under proper regulatory frameworks, particularly outside the United States where XRP sales are not treated as securities transactions. These changes demonstrate Ripple’s commitment to adhering to regulatory requirements and reducing future legal risks.

What could be the broader implications of the Ripple vs. SEC case for the cryptocurrency industry?

The outcome of the Ripple vs. SEC case could significantly influence the regulatory landscape for digital assets. A favorable ruling for Ripple might set a precedent for more reasonable and consistent regulatory enforcement in the cryptocurrency industry. Conversely, a ruling in favor of the SEC could lead to stricter regulations and higher penalties for other blockchain companies, potentially impacting innovation and operations within the sector.

What Is In It For You? Action Items You Might Want to Consider

Monitor Legal Developments Closely

Keep an eye on the latest updates in the Ripple vs. SEC case, especially any rulings or statements from the court. Legal outcomes can significantly impact XRP’s market value and the regulatory environment for other cryptocurrencies. Stay informed to make timely trading decisions.

Adjust Portfolio Risk Management

Given the potential implications of the case, consider diversifying your portfolio to mitigate risks associated with XRP. Balance your investments with other cryptocurrencies that have more stable regulatory outlooks, while still maintaining a strategic position in XRP if you believe in its long-term potential.

Leverage Market Sentiment Shifts

Use technical analysis tools to track XRP price movements and identify buying or selling opportunities based on market sentiment influenced by the case’s developments. Sudden legal victories or setbacks can create volatility, presenting short-term trading opportunities for savvy traders.