As Russia ramps up its use of Bitcoin (BTC) and stablecoins such as Tether (USDT) to facilitate oil trade with China and India, Western regulators are scrambling to close the loopholes that allow such transactions to bypass sanctions. Governments and financial watchdogs are now eyeing stricter measures against crypto exchanges, wallet providers, and on-chain tracking firms that facilitate these trades. But with blockchain’s decentralized nature and the rising influence of BRICS nations in alternative financial networks, can sanctions enforcement agencies truly keep up? The answer may redefine the future of financial regulation in the digital age.

How Crypto is Powering Russia’s Oil Trade

According to recent reports, Russian oil exporters increasingly rely on digital assets to process payments from buyers in China and India. Since many Russian banks were cut off from SWIFT – the global financial messaging system – cryptocurrency has provided an alternative way to settle international trade transactions without using Western-controlled banking networks.

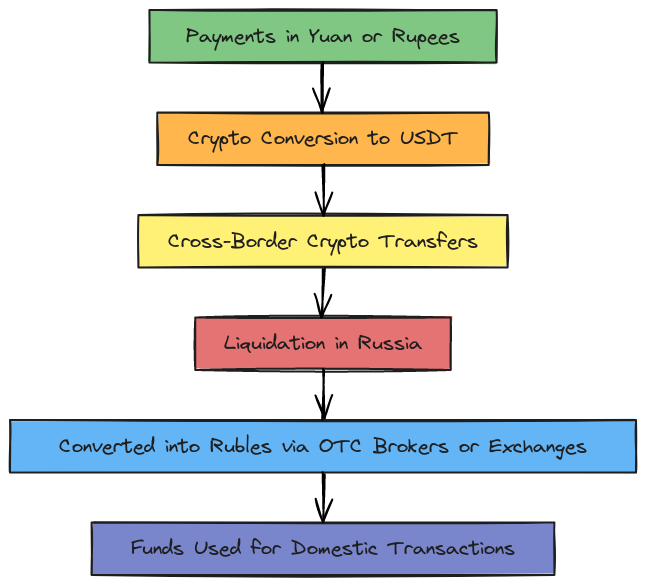

The mechanism behind this operation is relatively straightforward:

Payments in Yuan or Rupees: Chinese and Indian buyers pay for Russian oil in their respective national currencies.

Crypto Conversion: These payments are then converted into cryptocurrencies – mainly stablecoins like USDT, which provide liquidity and stability.

Cross-Border Transfers: The crypto assets are transferred across borders, bypassing financial institutions subject to Western sanctions.

Liquidation in Russia: The received crypto is ultimately converted into Russian rubles through local exchanges or over-the-counter (OTC) brokers.

While crypto transactions currently account for a small portion of Russia’s $192 billion annual oil trade, their use is steadily growing. Insiders suggest that digital assets are being deployed strategically, particularly in dealings where traditional banking channels pose higher risks due to sanctions compliance.

Western Regulators Respond: Sanctioning Exchanges and Crypto Firms

To curb Russia’s reliance on crypto for trade, the U.S. and European Union have started targeting crypto exchanges and financial service providers that facilitate illicit transactions. One of the key enforcement actions has been against Garantex, a Russian-based crypto exchange sanctioned by the U.S. Treasury and the European Union for allegedly processing transactions linked to illicit funds, including those associated with Russian oil sales.

Western regulators also work closely with blockchain analytics firms to monitor large transactions, track wallet addresses linked to Russian entities, and identify suspicious activity. The Office of Foreign Assets Control (OFAC) expanded its blacklist to include digital wallets suspected of involvement in sanctions evasion. At the same time, the European Union pushed for stricter KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations across crypto service providers.

Yet, enforcing such measures remains a challenge. Unlike traditional banks operating within centralized regulatory frameworks, crypto transactions are largely decentralized. Russian oil traders can shift between different exchanges, use privacy-focused assets, or conduct transactions through peer-to-peer (P2P) networks.

The BRICS Factor: A Growing Alternative Financial System

Russia’s increasing reliance on cryptocurrencies also coincides with the BRICS bloc – comprising Brazil, Russia, India, China, and South Africa – pushing for a de-dollarization strategy to diminish the influence of Western sanctions. In 2023, BRICS nations discussed developing a blockchain-based payment system to facilitate trade settlements outside the traditional financial ecosystem dominated by the U.S. dollar.

China, in particular, has been at the forefront of this shift. They are exploring state-backed digital currencies such as the digital yuan (e-CNY) to conduct trade with Russia and other partners. If BRICS nations successfully implement alternative financial mechanisms, it will significantly weaken the West’s ability to enforce sanctions through the banking system.

Is Russia Alone in Using Crypto to Evade Sanctions?

Russia is not the first country to use digital assets to evade economic restrictions. Other sanctioned nations, such as Iran, North Korea, and Venezuela, have long relied on crypto to sustain trade operations.

- Iran has used Bitcoin mining to generate revenue while circumventing U.S. financial restrictions, exchanging mined BTC for imports.

- North Korea has allegedly conducted large-scale cyberattacks to steal cryptocurrencies, using them to finance weapons programs.

- Venezuela attempted to launch its own state-backed digital currency, the Petro, to conduct trade outside the dollar system.

While Russia’s case is unique due to its scale and strategic oil partnerships, it reflects a broader trend of sanctioned states leveraging blockchain technology as a tool of economic resilience.

Can Crypto Crackdowns Work? The Future of Financial Sanctions

As Western regulators tighten the noose around crypto-based transactions, the ultimate question remains: Can enforcement agencies truly stop nations from using decentralized financial networks to evade sanctions? The challenges to enforcement are substantial. Unlike traditional banks, crypto transactions do not rely on a central authority, making it difficult to block them outright. Additionally, sanctioned entities like Russia can bypass exchanges entirely by using direct peer-to-peer (P2P) transfers, further complicating oversight.

Privacy-enhancing technologies add another layer of difficulty. While Russia primarily relies on stablecoins, there is potential for greater use of privacy-focused cryptocurrencies such as Monero or mixing services that obscure transaction trails. At the same time, jurisdictional loopholes remain a key issue. Many crypto exchanges operate in regions with loose regulatory frameworks, making international enforcement efforts fragmented and inconsistent.

Despite these obstacles, governments are adopting a multi-pronged approach to curbing illicit crypto use. Measures include sanctioning non-compliant exchanges, blacklisting wallet addresses linked to evasion schemes, and implementing stricter anti-money laundering (AML) requirements across digital asset platforms. However, as blockchain technology evolves and new financial alliances emerge, traditional methods of sanctions enforcement may prove insufficient. The global financial order is shifting. Hence, regulators may need to rethink their approach to financial restrictions in an increasingly decentralized world.

Conclusion: A Defining Moment for Crypto Regulation

The battle between regulators and crypto-fueled sanction evasion is far from over. Russia’s use of blockchain in oil trade exposes the limits of traditional financial controls. It pushes the West to rethink how it can effectively enforce economic restrictions in a decentralized world.

As digital currencies continue to gain prominence in global trade, the future of financial regulation may depend on whether governments can strike a balance between security and the ethos of decentralization that cryptocurrencies were built upon.

The coming years will determine whether crypto becomes a backdoor for sanctioned nations or a regulated financial tool that upholds economic transparency – a decision that could reshape international finance for decades to come.

Readers’ frequently asked questions

How does Russia convert cryptocurrencies like Bitcoin or USDT into rubles without using Western banks?

Russia uses a network of intermediaries, including crypto exchanges, OTC (over-the-counter) brokers, and peer-to-peer (P2P) trading platforms to convert cryptocurrencies into rubles. When Russian oil exporters receive payments in stablecoins like USDT or Bitcoin from China and India, they can liquidate these digital assets through non-sanctioned exchanges, especially those operating in crypto-friendly jurisdictions. Alternatively, Russian entities can engage directly with local buyers (P2P) who want to acquire USDT or BTC in exchange for rubles. Some of these transactions may happen outside traditional banking systems, making it difficult for Western regulators to track or block them. Additionally, Russia has developed domestic crypto infrastructure, allowing for easier integration of digital assets into its financial system.

Why is the West struggling to enforce sanctions on Russia’s crypto transactions?

Unlike traditional banking, where transactions pass through centralized financial institutions that can be monitored and blocked, cryptocurrencies operate on decentralized networks. This means that Russian oil traders can move funds across borders without needing banks or government-controlled financial intermediaries. Even when regulators sanction crypto exchanges or blacklist specific wallet addresses, Russian actors can use alternative platforms. They can create new wallets, or use mixing services to obscure transaction trails. Furthermore, some crypto exchanges operate in neutral or Russia-aligned jurisdictions, making them less likely to comply with Western enforcement measures. The rise of peer-to-peer trading and privacy-focused cryptocurrencies further complicates efforts to track and regulate illicit transactions.

If cryptocurrencies enable Russia to bypass sanctions, will Bitcoin and stablecoins become dominant in the global oil trade?

While cryptocurrencies are playing an increasing role in Russia’s oil trade, they are not yet dominant in the global energy market. Most oil transactions are still conducted in fiat currencies, particularly the U.S. dollar, Chinese yuan, and Indian rupee. However, if Russia and other BRICS nations continue pushing for de-dollarization and develop blockchain-based settlement systems, digital assets could gain more traction in global trade. The success of this shift depends on factors such as international regulatory responses, the willingness of major economies to adopt crypto for trade settlements, and the stability of digital assets compared to traditional fiat currencies. While crypto offers advantages like speed and reduced reliance on Western-controlled financial infrastructure, traders still view it as a complementary rather than a primary payment method in the global oil market.

What Is In It For You? Action Items You Might Want to Consider

Monitor Crypto Exchange Regulations Closely

With Western regulators cracking down on crypto exchanges that facilitate sanctioned transactions, traders should stay informed about new compliance measures, potential blacklisted platforms, and tightening KYC/AML requirements. If you’re trading on international exchanges, check whether they’re at risk of regulatory action. Sudden sanctions or shutdowns could impact liquidity and access to funds.

Pay Attention to Stablecoin Liquidity and Market Shifts

With Russia increasing its reliance on stablecoins like USDT for oil trade, demand fluctuations could impact liquidity, pricing, and regulatory scrutiny. Watch for any shifts in stablecoin reserves or de-pegging risks. Watch out for major movements of Tether on-chain that might indicate geopolitical market reactions. If regulations tighten, the adoption of alternatives like USDC or regionally backed stablecoins might increase, creating new trading opportunities.

Track BRICS Crypto Developments for Long-Term Trends

Russia’s use of crypto in oil trade signals a broader shift toward de-dollarization, especially among BRICS nations. Traders should keep an eye on developments like state-backed digital currencies (e.g., the digital yuan) and blockchain-based payment networks altering cross-border trade dynamics. If BRICS nations successfully implement a crypto-powered settlement system, it could reshape the global financial landscape and open new trading opportunities in emerging markets.

[…] >>> Read more: Russia’s Crypto Loophole: Can Sanctions Stop Oil Trade? […]

[…] >>> Read more: Russia’s Crypto Loophole: Can Sanctions Stop Oil Trade? […]

[…] >>> Read more: Russia’s Crypto Loophole: Can Sanctions Stop Oil Trade? […]