Uniswap Labs emerged unscathed as the US Securities and Exchange Commission (SEC) officially dropped its investigation into the decentralized exchange protocol. The decision sent Uniswap’s native token, UNI, soaring by 5%, reflecting renewed investor confidence. This regulatory retreat is not isolated—similar investigations into major crypto players like Coinbase and Robinhood Crypto have also been shelved. Is the SEC’s softened stance a win for innovation, or a temporary lull in regulatory scrutiny?

SEC Closes Uniswap Probe Without Enforcement Action

On February 25, 2025, Uniswap Labs announced that the SEC concluded its investigation without recommending any enforcement action. The investigation, initiated in April 2024 under then-SEC Chair Gary Gensler, centered around allegations that Uniswap operated as an unregistered broker and exchange and may have issued unregistered securities through its UNI token. Despite extensive scrutiny, the SEC found insufficient grounds to pursue charges.

>>> Read more: SEC Targets Uniswap in Lawsuit Over Regulatory Compliance

Uniswap Labs welcomed the decision, emphasizing its ongoing commitment to regulatory compliance and transparency. In a public statement, the company reiterated its belief in the legality of decentralized protocols and highlighted the importance of clear regulatory guidelines for the industry.

Market Reacts: UNI Token Surges

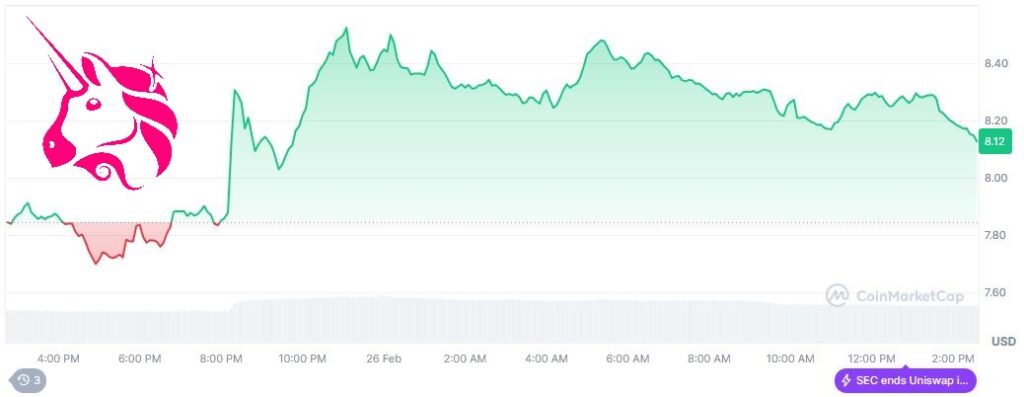

The market responded positively to the news. Following the announcement, Uniswap’s UNI token surged approximately 5%, reflecting a broader sense of relief among investors. Market participants interpreted the SEC’s decision to drop the investigation as a sign of potential regulatory leniency, at least toward established decentralized finance (DeFi) platforms like Uniswap.

“The closure of the investigation removed a significant overhang for Uniswap and the DeFi sector,” noted a crypto market analyst from CoinDesk. “Investors are now reassessing risk premiums attached to tokens with regulatory exposure.”

Trading volumes for UNI also saw a noticeable uptick, indicating renewed confidence and speculation on further gains in light of a perceived regulatory retreat.

Broader Regulatory Context: A Shift in Approach?

The decision to end the Uniswap probe is part of a broader trend. In recent weeks, the SEC has also concluded investigations into other major crypto entities, including Coinbase and Robinhood Crypto, without filing charges. These actions come amid growing pressure on U.S. regulators to provide clearer, innovation-friendly frameworks for digital assets.

Industry insiders speculate that the SEC’s shift may stem from judicial setbacks and mounting political pressure to foster innovation in the blockchain space. However, the regulatory landscape remains fluid. While some see this as a sign of lasting change, others caution that future enforcement actions could still emerge, particularly under different political leadership.

Investor Sentiment and Industry Implications

For investors, the SEC’s retreat has been a catalyst for optimism. The decision buoyed UNI and sent ripples across the broader DeFi market, with several decentralized protocols experiencing price gains. Market participants view this development as a green light for innovation, albeit with a recognition that regulatory uncertainty is far from over.

“This is a short-term win for DeFi,” commented an analyst from CryptoSlate. “But the industry must remain vigilant, as regulatory attitudes can shift quickly.”

The SEC’s decision to drop its investigation into Uniswap marks a pivotal moment for the DeFi sector, bolstering investor confidence and potentially setting a precedent for how regulators approach decentralized platforms. Yet, whether this represents a lasting regulatory shift or merely a pause in enforcement remains to be seen. For now, markets are celebrating, but the industry continues to navigate an evolving regulatory landscape.

Readers’ frequently asked questions

What is Uniswap, and how do people use it?

Uniswap is a decentralized exchange (DEX) that allows users to trade cryptocurrencies directly from their digital wallets without needing an intermediary like a traditional exchange. It operates on the Ethereum blockchain, using smart contracts to automate trades. Users connect their crypto wallets, select the tokens they want to trade, and execute transactions through the platform. Unlike centralized exchanges, Uniswap doesn’t require account creation or identity verification for basic use.

What is the UNI token, and why does its price matter?

The UNI token is Uniswap’s governance token, allowing holders to vote on decisions about the platform’s development and policies. Holding UNI gives users a say in upgrades, fee structures, and how the platform’s treasury is used. The token’s price matters because it reflects market confidence in Uniswap’s future and can influence how much sway token holders have in governance. A higher price can also encourage broader participation in the Uniswap ecosystem.

How does a regulatory investigation like this affect crypto users?

Regulatory investigations into major crypto platforms can impact users in several ways. If a regulator enforces penalties or restrictions, it can limit access to certain services or tokens. Even without charges, an investigation can create uncertainty, which may affect token prices and platform usage. In this case, the SEC dropping the investigation means Uniswap users can continue using the platform without disruptions tied to legal issues.

What Is In It For You? Action Items You Might Want to Consider

Reassess Your UNI Holdings

With the SEC dropping its investigation, UNI’s recent 5% surge could be just the beginning. Consider revisiting your UNI position—whether you’re holding long-term or looking for short-term gains, market sentiment has turned positive. Keep an eye on trading volume and price action for potential entry points or profit-taking opportunities.

Explore DeFi Platforms with Renewed Confidence

Regulatory clarity often sparks market optimism. With Uniswap in the clear, this could be the right time to explore or re-engage with DeFi protocols. Platforms like Uniswap might see increased usage and liquidity, which can translate into better trading conditions and yield opportunities. Stay vigilant but consider diversifying within the DeFi space.

Monitor Regulatory Developments Closely

While this is a win for Uniswap, regulations remain a moving target. Stay informed on future SEC actions, as regulatory sentiment can shift quickly and affect market dynamics. Use this period of stability to review your portfolio’s exposure to DeFi and adjust strategies to manage potential regulatory risks.

[…] not crackdown.” The agency even dismissed several enforcement cases involving Coinbase and Uniswap, began pilot programs for compliant token offerings, and opened consultations for […]