Imagine paying a 5% commission every time you trade Bitcoin – you’d call it a scam. Yet millions of sports bettors do exactly that, betting -110 odds (1.91 decimal). This hidden cost, known as the vig, goes largely unnoticed, while crypto traders haggle over basis points. It’s time to ask: why do sports bettors accept unnecessary friction, and what can they learn from fee-obsessed crypto traders?

The parallel between betting and trading becomes even more relevant in today’s evolving market. Crypto trading is built around speed, transparency, and efficiency, principles that are finally starting to take hold in the world of crypto sports betting and crypto sportsbooks. As bettors become savvier, understanding concepts like arbitrage and +EV is no longer niche; it’s essential.

The Hidden Cost of Sports Betting: Understanding the Vig

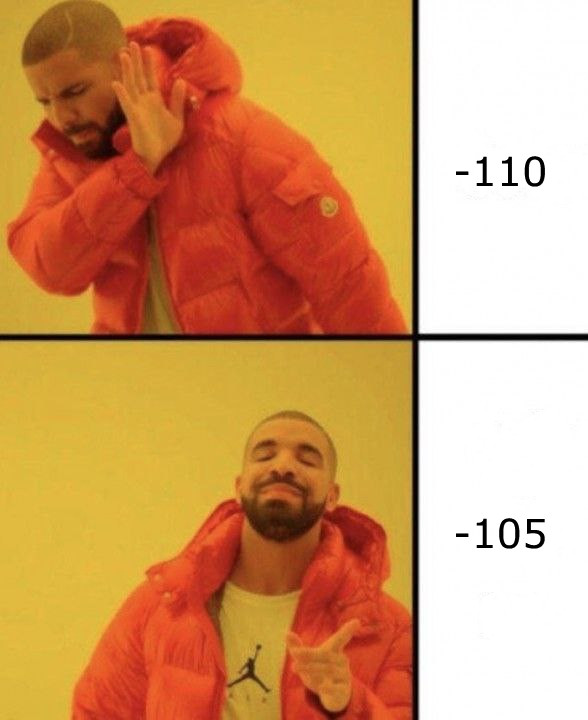

In sports betting, the vig (short for vigorish) is the sportsbook’s commission. Typical point spreads or totals are priced at -110 on both sides, meaning you must wager $110 to win $100 – a built‑in fee of roughly 4.76%.

- Embedded Fee: The vig is hidden in the odds, so few bettors see it as a separate cost.

- Breakeven Impact: To break even at -110 you need a 52.38% win rate. At -105 (“reduced juice”), that drops to 51.22%, giving savvy bettors a real edge.

Parlays and props compound the issue, since the vig applies on every leg, which pushes the effective house edge to 12%+. These bets are what standard sportsbooks market, not sharp books.

Traders Know Better: The Obsession with Low Fees in Crypto

Crypto traders live and die by minimizing costs. On major centralized exchanges like Binance or Kraken, fees range from 0.1% down to 0.01%. On DEXes like Uniswap, liquidity‑provider fees hover between 0.05% and 0.3%, and aggregators or Layer‑2 solutions can shave fees even lower.

Every basis point matters to a trader. Slippage, fee tiers, and gas costs can erode margins quickly, especially for those employing high-frequency or arbitrage strategies. Traders track these costs obsessively because their profits depend on precision.

Strategies like arbitrage and market making collapse under high friction. That’s why paying 4.76% per transaction, like you would at standard sportsbooks, is completely unthinkable in the world of crypto trading. It’s no wonder serious bettors are now turning to crypto sports betting platforms that operate more like efficient exchanges.

Paying 4.76% per transaction in sports betting? Unthinkable in crypto.

Why Bettors Pay What Traders Wouldn’t

- Invisible Fee: Sportsbooks don’t label the vig as a fee. They embed it in odds and normalize it across sportsbooks. Unlike crypto traders who see fees line-by-line in their transaction history, bettors rarely see a breakdown.

- Mindsets differ: Bettors often wager for entertainment, social bonding, or the thrill. They’re emotionally invested and far less price sensitive. Traders are ruthlessly profit-driven. They’re in it to extract value, and every fee is a drag on performance.

- Lack of Alternatives: Many bettors stick with a single sportsbook, unaware of better pricing elsewhere, and out of convenience.

The Rise of Reduced Juice Sportsbooks

The good news? A new wave of sportsbooks is bringing the low-fee mindset to sports betting. Reduced juice sportsbooks – offering odds like -105 instead of -110 – are gaining traction among bettors who understand the long-term value of cutting the vig.

Bet105 is one such platform. Relaunched in 2024, Bet105 positions itself as a crypto sportsbook that offers -105 reduced juice lines as its standard. It’s crypto-only, supports major coins like BTC, ETH, USDT, and USDC, and has fast, fee-free withdrawals. Modeled after low-margin pioneers like Pinnacle, Bet105 aims to give bettors fairer odds and better long-term value.

Other low‑juice pioneers include Pinnacle (often –105/–106), DraftKings -110/-110 and limit sharp/educated players, and Stake (seamless crypto integration). But books like bet105 stand out by combining industry‑leading odds with a crypto‑first platform designed for sharp and EV‑driven players.

What Bettors Can Learn from Crypto Traders

- Line‑Shop Religiously: Use odds‑comparison tools just like traders use DEX aggregators.

- Switch to Reduced Juice Books: Moving from –110 to –105 can double your expected return.

- Track Your Edge: Log your bets, calculate real cost, and measure your win rate.

- Ditch High‑Vig Markets: Parlays and props carry the worst vig—opt for straight value bets.

Conclusion – Stop Accepting the 5% Scam

In crypto trading, paying 5% per transaction is financial suicide. In sports betting, it’s considered “normal.” But it doesn’t have to be. Traders optimize for every basis point, bettors should too. Whether you’re in it for fun or profits, cutting your vig is the single biggest move you can make to improve your bottom line.

Readers’ frequently asked questions

What is the vig in sports betting?

The vig is the commission sportsbooks charge. At -110 odds, it equates to a 4.76% fee hidden in the price.

Why do sportsbooks use –110 odds?

To ensure a profit on 50/50 events: pricing both sides at -110 gives the book a mathematical edge.

What is reduced juice betting?

Reduced juice means betting at lower odds (e.g., -105 instead of -110), which reduces the sportsbook’s edge and improves your breakeven rate.

What are the best low‑vig sportsbooks?

Pinnacle, bet105, Cloudbet, and Stake are known for offering -105 or better odds on many markets.

How do crypto exchange fees compare?

Major exchanges charge 0.1%–0.01% per trade, with some pairs even trading fee‑free. Compared to -110 odds, crypto trading fees are dramatically lower.

Why are traders more fee‑conscious than bettors?

Traders are profit‑maximizers—every fee hits their ROI. Bettors often chase excitement and don’t see the hidden cost baked into odds.

What is EV betting?

EV betting refers to Expected Value betting, a strategy where bettors place wagers only when the potential return outweighs the risk. Professional bettors commonly use it as a long-term profit-oriented approach.

What is arbitrage betting?

Arbitrage betting is a risk-free betting strategy that exploits pricing discrepancies across multiple sportsbooks. Bettors place bets on all outcomes of an event at odds that guarantee a profit regardless of the result. It’s one of the most popular tactics among sharp players using crypto sportsbooks.