In a groundbreaking development with far-reaching consequences for the digital asset landscape, the U.S. Securities and Exchange Commission (SEC) has given the green light to a series of approved spot Bitcoin exchange-traded funds (ETFs). This decision is a pivotal moment that signals a significant shift in the relationship between traditional finance and the dynamic realm of cryptocurrency investments.

Deciphering Spot Bitcoin ETFs

Spot Bitcoin ETFs stand out as investment products that directly hold physical Bitcoin, as opposed to dealing with futures contracts linked to the cryptocurrency. This distinction is crucial, eliminating the complexities of navigating futures markets and derivatives contracts for investors. Spot ETFs offer a straightforward path to exposure to Bitcoin’s price movements.

Major Players Secure Approval

Among the dozen companies receiving approval for their spot Bitcoin ETFs are financial powerhouses like BlackRock, Fidelity, and Invesco. Their participation not only adds credibility to the cryptocurrency market but also indicates a broader acceptance of digital assets within the mainstream financial sector.

Enhanced Accessibility for Investors

The approval of spot Bitcoin ETFs is a significant win for both institutional and retail investors, providing a more accessible entry point into the cryptocurrency market. These ETFs effectively remove the traditional barriers associated with purchasing and storing Bitcoin directly, such as managing private keys and navigating crypto exchanges.

Fee Wars and Liquidity Dynamics

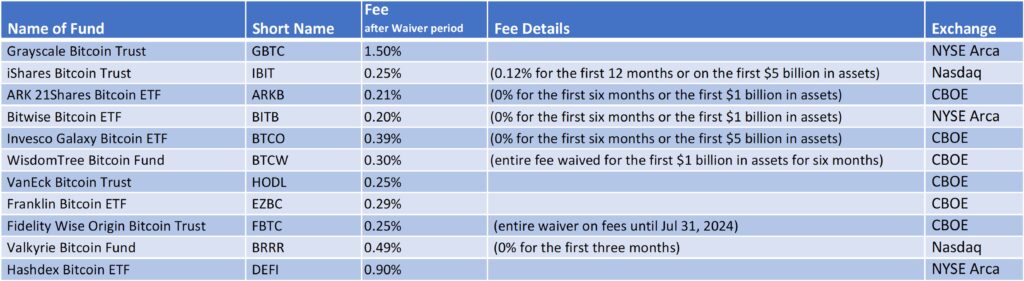

As the approved ETFs prepare to hit the market, fierce competition for investor attention is expected. Fee structures have already become a battleground, with major issuers like BlackRock and Ark/21Shares announcing fee reductions to attract investors. Additionally, liquidity will play a crucial role, especially for short-term speculators looking to capitalize on price movements.

Regulatory Evolution and SEC’s Caution

The SEC’s green light for spot Bitcoin ETFs marks a notable departure from historical skepticism. The decision follows a 2023 court ruling that deemed the SEC’s rejection of a similar proposal by Grayscale arbitrary. SEC Chair Gary Gensler, while cautious, acknowledged the court’s decision and framed the approval as the “most sustainable path forward.”

Anticipating the Future

With spot Bitcoin ETFs set to begin trading, industry experts foresee significant capital inflows. Standard Chartered analysts project potential inflows ranging from $50 billion to $100 billion in 2024 alone. This development also sets the stage for increased innovation in the crypto space, with expectations of other investment products gaining traction.

The SEC’s approval of spot Bitcoin ETFs is a historic moment, marking the convergence of traditional finance and the digital asset ecosystem. As investors explore these new investment avenues, the focus shifts to how these ETFs will shape the future of crypto investments and potentially pave the way for more innovative products.

In summary, the long-awaited approval of spot Bitcoin ETFs not only enhances accessibility but also reflects a maturing regulatory landscape for cryptocurrencies. As market participants navigate this evolving landscape, the impact of these ETFs on the broader financial arena becomes a topic of keen interest.

Read more: Bitcoin’s Fate: Bull Run On or Off?

[…] approval of spot Bitcoin ETFs is a game-changer, heralding an era where investors can gain exposure to […]

[…] Read more: Spot Bitcoin ETFs Approved […]

[…] United States recently introduced Bitcoin ETFs, but Hong Kong has gone a step further by introducing Ethereum ETFs. This move has positioned Hong […]

[…] a new wave of institutional investors, boosting market liquidity and driving up the price of Ether. The approval of spot Bitcoin ETFs earlier this year demonstrated the potential impact, as these products attracted significant […]

[…] Read more: Spot Bitcoin ETFs Approved […]

[…] renewed interest in the crypto market, driven by positive regulatory developments such as the approval of spot Bitcoin exchange-traded funds (ETFs) by the SEC. These favorable conditions could enhance Kraken’s valuation and attract significant […]

[…] resurgence in spot trading has been the introduction of new financial products, specifically the spot Bitcoin and Ether exchange-traded funds (ETFs). These ETFs, launched earlier in the year, have provided […]

[…] The approval of spot Bitcoin ETFs coincided with a remarkable bull run in Bitcoin’s price. Since January 2024, Bitcoin has more than doubled, surpassing the $100,000 mark by late 2024. Analysts attribute this growth to increased demand driven by ETF inflows and the heightened interest of institutional players. The transparency and regulatory oversight of the ETFs have alleviated many concerns that previously deterred traditional investors from entering the crypto market. […]

[…] avenues to gain exposure to digital assets without the intricacies of direct ownership. Since their approval in January 2024, Bitcoin ETFs have amassed over $106 billion in assets under management, attracting net inflows of […]

[…] crypto adoption trend. Firms like Fidelity, BlackRock, and Franklin Templeton have launched spot Bitcoin ETFs. Also, traditional banks are increasingly integrating crypto services into their offerings. The […]

[…] The downgrade becomes easier to understand once the bank’s earlier model is unpacked. When Standard Chartered made its 200,000 dollar call, it was counting on two powerful engines. The first was the growing cohort of digital asset treasury companies that held large Bitcoin positions on their balance sheets. The second was the surge of capital that entered US spot Bitcoin ETFs after their launch in 2024. […]