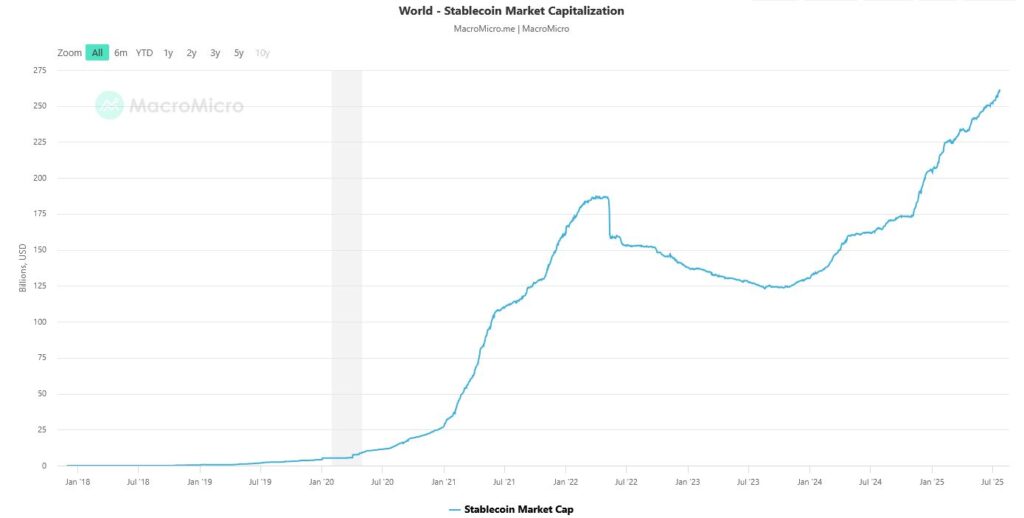

Stablecoins have officially crossed a new threshold, with a combined market capitalization now exceeding $250 billion. This surge in value reflects the expanding role of stablecoins in modern finance. But this number, while impressive, only tells part of the story.

The real disruption is happening beneath the surface, where stablecoin transaction volume now rivals, and in some cases exceeds, the flow processed by traditional payment networks like Visa, Mastercard, and PayPal.

This isn’t just a crypto milestone. It’s a redrawing of the global financial map. Yet despite popular assumptions, the volume that’s shifting onto on-chain rails isn’t coming entirely from credit card companies.

So who’s really losing as stablecoins scale into trillions of dollars in monthly flows?

Stablecoin Market Cap: A Signal, Not the Whole Story

The oft-quoted $250 billion figure refers to the total stablecoin market cap. That’s the aggregate value of tokens like USDT, USDC, and DAI currently in circulation. It represents the size of the “float,” or the total amount of dollar-pegged liquidity available in tokenized form.

Market cap growth is meaningful. It signals institutional trust, broad adoption in fintech and crypto infrastructure, and increasing demand for dollar-denominated digital assets. However, a large market cap doesn’t directly tell us how much economic activity is occurring.

To measure impact, we have to look at stablecoin transaction volume, and that number is far more revealing.

Transaction Volume Tells the Real Story

In 2024, stablecoins processed over $27.6 trillion in total value transfer. As of mid-2025, they’re already pacing ahead of that. Weekly flows now top $500 billion. More than 1 billion on-chain transactions have been recorded in the first half of the year alone.

For context:

- Visa processes roughly $1.1 trillion per month.

- Mastercard is close behind.

- PayPal handles only about $18 billion per month.

This means that on-chain settlement activity in stablecoins now matches or exceeds the volumes of some of the world’s largest payment networks. And yet, these flows are not happening at the point-of-sale.

>>> Read more: Binance Mastercard Alliance Resurrected

So Who’s Really Losing Ground?

Contrary to what some headlines suggest, Visa and Mastercard are not the primary victims of rising stablecoin adoption, at least not yet. Their stronghold remains in consumer-facing retail payments: POS terminals, e-commerce checkouts, subscription platforms, and card-linked apps. So far, these flows remain stable.

Instead, the volume that’s shifting on-chain is displacing incumbents in settlement and liquidity infrastructure. Here’s who’s feeling the squeeze:

1. SWIFT & Correspondent Banking Systems

Traditional interbank messaging networks like SWIFT are losing relevance in cross-border payments and corporate treasury transfers. Stablecoins settle in minutes, not days. They eliminate the need to route through multiple banks or jurisdictions. For businesses needing real-time USD liquidity, USDC and USDT are now viable SWIFT alternatives.

2. Money Transfer Operators

Remittance giants like Western Union and MoneyGram have lost volume to mobile-first apps and wallets offering stablecoin remittances. These services are often faster and cheaper. They don’t require a bank account or a physical outlet. Hence, stablecoins are filling gaps left by legacy providers in regions like Latin America, sub-Saharan Africa, and Southeast Asia.

3. ACH and Interbank Settlement Systems

Within domestic markets, especially in the U.S. and Europe, automated clearing houses and batch-based settlement systems are being undercut by stablecoins. Fintechs are increasingly using on-chain settlement rails for B2B transactions, treasury rebalancing, and liquidity pooling. These were tasks previously handled by slow, bank-operated infrastructure.

4. OTC Desks and FX Intermediaries

In capital-constrained economies or inflationary environments, users and businesses are opting for stablecoins over local currency or bank wires. This is reducing demand for high-margin forex services. It also diminishes the role of OTC brokers and foreign exchange desks in facilitating USD access.

Visa and Mastercard: Not Immune, But Still Defended

That’s not to say Visa and Mastercard are untouched. Some digital-native merchant flows, particularly in crypto e-commerce and borderless online platforms, are shifting to stablecoin settlement.

But their core advantage remains intact: brand trust, fraud protection, and consumer rewards. These features still dominate in mainstream retail.

What’s changing, however, is the layer beneath the card swipe. If fintechs, wallets, and platforms increasingly choose to settle balances in stablecoins, traditional networks may no longer control the rails even if they maintain the interface.

>>> Read more: Visa & Coinbase Enable Real-Time Crypto Purchases

A New Financial Infrastructure Is Taking Shape

Stablecoins are particularly attractive in cross-border payments, where they offer speed and efficiency compared to legacy systems.

This shift suggests that stablecoins are becoming foundational to next-generation payment infrastructure, not just speculative tools.

While traditional payment networks still serve the bulk of consumer commerce, their grip on backend settlement is loosening.

The rise of stablecoin transaction volume marks the emergence of an internet-native value layer. From Stripe to Circle, from JPM Coin to PayPal’s own stablecoin, institutions are realizing that programmable money is not a futuristic concept; it’s operational now.

Conclusion: The Settlement War Has Begun

The $250 billion in market cap is a headline number, but the real power lies in the trillions of dollars already flowing through stablecoin rails each month. This isn’t a retail revolt. It’s a structural reconfiguration of the backend systems that underpin global finance.

Visa and Mastercard may still dominate the checkout experience. But the question is: how long will they control the settlement stack beneath it?

Because the shift is already underway, and the transaction volume is voting with its feet.

Readers’ frequently asked questions

How do I actually send money using stablecoins?

To send money, you’ll need a crypto wallet that supports stablecoins like USDT or USDC. Simply enter the recipient’s wallet address and transfer the amount. Transactions usually confirm within seconds and cost a fraction of traditional wire or remittance fees.

Can stablecoins be reversed or refunded if I make a mistake?

No. Stablecoin transfers are irreversible once confirmed on the blockchain. If you send to the wrong wallet address, the funds cannot be recovered unless the recipient returns them voluntarily.

Do stablecoin transfers show up in my bank account?

Stablecoin transactions are recorded on public blockchains but do not appear in your bank account. They are separate from traditional banking infrastructure unless you use an exchange or service that connects both.

What can you do now? Action items to consider

Audit your current cross-border payment workflows

If your business regularly sends money across borders, evaluate how stablecoins (like USDC or USDT) could reduce costs and settlement time compared to SWIFT or traditional banks.

Explore stablecoin settlement APIs or wallets

Fintech teams and payment platforms should test integrations with blockchain-based settlement providers (e.g., Circle, Fireblocks, or Stripe’s USDC pilot) to future-proof infrastructure and speed up treasury operations.

Review regulatory and tax implications

Whether you’re a startup, freelancer, or enterprise, understand how using stablecoins affects your compliance posture. Review reporting rules for digital assets in your jurisdiction and consult a crypto-literate accountant or legal advisor.

[…] >>> Read more: Stablecoin Transaction Volume Challenges Payment Giants […]

[…] The golden mean is a middle-ground rule for stablecoins that requires reserve transparency, independent audits, and holds issuers accountable. This would increase confidence without restricting innovation. In fact, legislation may potentially authorize stablecoins, encouraging widespread adoption—especially because their transaction volumes already exceed traditional networks such Visa and Mastercard. […]

[…] >>> Read more: Stablecoin Transaction Volume Challenges Payment Giants […]

[…] >>> Read more: Stablecoin Transaction Volume Challenges Payment Giants […]