Bitcoin mining stocks surged after former President Donald Trump pledged to centralize all Bitcoin mining operations within the United States. Companies like CleanSpark and Riot Blockchain experienced notable increases in their stock prices, reflecting investor optimism. However, this move has not been without controversy. Environmentalists and political opponents raise concerns about the sustainability and the logistical challenges of such a comprehensive plan.

Market Reactions

Following the Trump announcement, Bitcoin mining stocks saw immediate positive impacts. CleanSpark, a leading mining and energy technology company, saw its stock price increase by over 15%. Riot Blockchain, another major player in the industry, experienced a similar surge. Investors are bullish on the potential for increased profitability and stability in the U.S. mining sector, spurred by anticipated regulatory support and investment in infrastructure.

The enthusiasm in the market reflects a broader optimism about the U.S.’s ability to leverage its technological and economic advantages to dominate the Bitcoin mining industry. Analysts suggest that Trump’s proposal could lead to significant investment in renewable energy sources and advanced mining technologies. That would position the U.S. as a global leader in this rapidly evolving sector.

Environmental Concerns

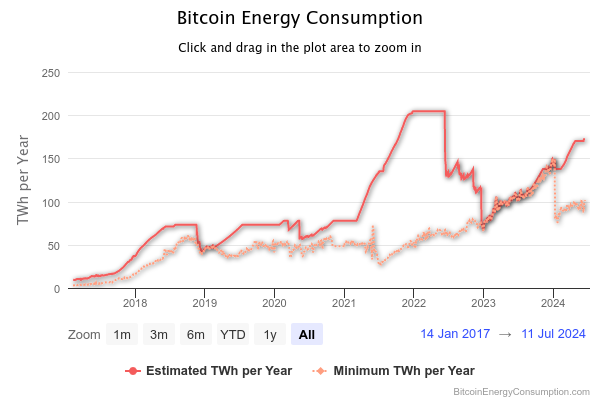

Despite the market optimism, Trump’s pledge has sparked significant controversy, particularly from environmental groups. Bitcoin mining is notorious for its high energy consumption. Critics argue that scaling up operations in the U.S. could exacerbate environmental issues. The Bitcoin network’s energy consumption already rivals that of some small countries, leading to concerns about the sustainability of such an expansion.

Trump and his supporters counter these concerns by emphasizing the potential to use renewable energy sources. They argue that the U.S. could set a global standard for sustainable mining practices, potentially repurposing fossil fuel plants and investing in solar, wind, and hydroelectric power to mitigate the environmental impact.

Political and Logistical Challenges

The political landscape surrounding Trump’s proposal is equally complex. While the plan has garnered support from segments of the tech industry and pro-crypto lawmakers, it faces opposition from those worried about regulatory overreach and the feasibility of rapidly scaling up mining operations. Critics point out the significant logistical challenges of transitioning a substantial portion of global Bitcoin mining to the U.S. That includes the need for vast amounts of energy and the infrastructure to support it.

Moreover, the political ramifications extend beyond environmental concerns. Some see Trump’s proposal as a strategic move to regain influence in the tech sector and appeal to younger, tech-savvy voters. However, it also risks alienating environmentalists and those skeptical of large-scale government interventions in the private sector.

>>> Read more: Is Trump Really the Pro-Crypto Candidate He Claims to Be?

The ambitious Trump plan to centralize Bitcoin mining operations in the United States has sparked mixed reactions of market enthusiasm and significant controversy. While the potential economic benefits and market reactions are promising, the environmental and logistical challenges cannot be overlooked. As the debate continues, the future of Bitcoin mining in the U.S. will likely hinge on finding a balance between economic ambitions and sustainable practices.

Readers’ frequently asked questions

How does Bitcoin mining impact the environment, and what are the proposed solutions to mitigate these impacts?

Bitcoin mining consumes a lot of energy, leading to significant carbon emissions. Proposed solutions include using renewable energy sources, improving energy efficiency in mining hardware, and implementing regulatory incentives to promote sustainable practices.

What are the economic benefits of centralizing Bitcoin mining operations in the United States?

Centralizing Bitcoin mining in the U.S. could create jobs, attract investments in infrastructure and technology, and generate tax revenue. It positions the U.S. as a leader in the global cryptocurrency market

What are the logistical challenges of shifting global Bitcoin mining operations to the United States?

Challenges include meeting high energy demands, developing necessary infrastructure, navigating regulatory hurdles, and managing geopolitical risks. Coordinated efforts are required to address these issues effectively

What Is In It For You? Action Items You Might Want to Consider

Monitor Bitcoin Mining Stocks

Keep a close eye on Bitcoin mining companies like CleanSpark and Riot Blockchain, which have seen stock surges following Trump’s pledge. Consider these stocks for short-term gains, but remain cautious of potential volatility due to ongoing environmental debates

Evaluate Renewable Energy Investments

Given the emphasis on sustainable mining practices, look for investment opportunities in renewable energy companies that might benefit from increased demand due to expanded Bitcoin mining operations in the U.S.

Stay Updated on Regulatory Changes

Regulatory landscapes can significantly impact the profitability and legality of Bitcoin mining. Follow updates from U.S. regulatory bodies to anticipate how new policies might affect the cryptocurrency market and adjust your trading strategies accordingly