TL;DR

- Visa is piloting stablecoin payouts with BVNK via Visa Direct, targeting enterprise and cross-border disbursements.

- The program focuses on backend settlement and treasury flows, not consumer payments or card transactions.

- The rollout remains limited in scope, testing infrastructure inside Visa’s $1.7 trillion payments network.

Visa has partnered with BVNK to pilot stablecoin payouts through Visa Direct. The initiative expands the use of blockchain-based settlement inside Visa’s global payments network. The focus is on enterprise disbursements and treasury flows, positioning stablecoins as a backend settlement tool rather than a consumer-facing payment method. While the move adds to Visa’s growing stablecoin activity, the company is framing it as a controlled infrastructure experiment rather than a broad rollout of crypto payments.

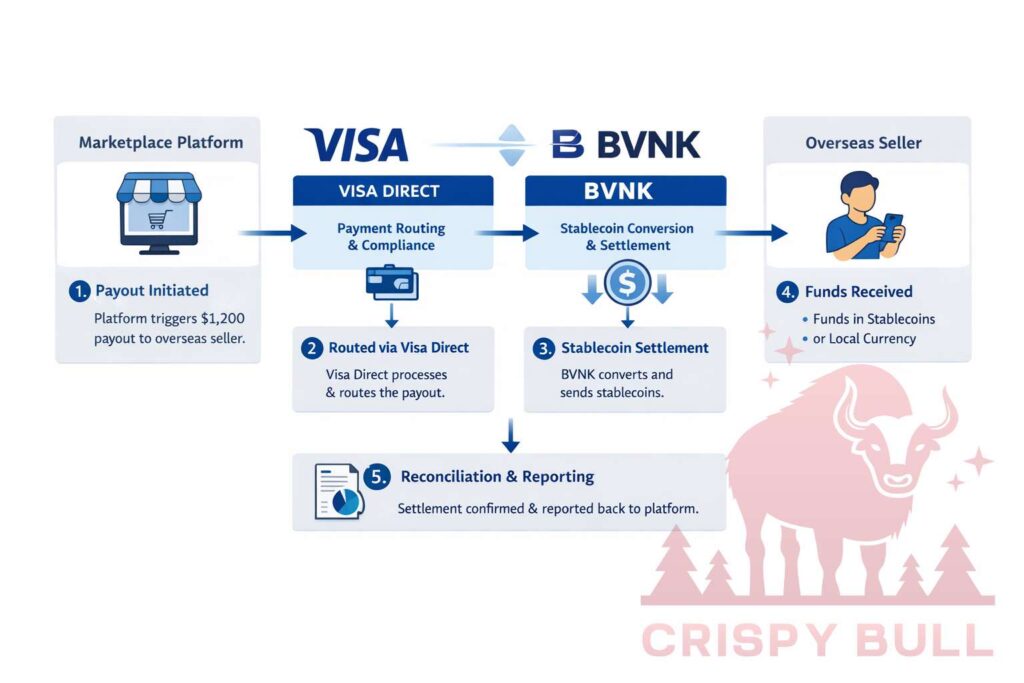

The Visa BVNK partnership enables selected clients to send payouts using stablecoins through Visa’s existing Visa Direct rails. BVNK will provide the underlying stablecoin infrastructure. Visa does not issue stablecoins, hold customer funds, or operate wallets under the arrangement. Instead, it acts as a coordinator. This allows regulated stablecoin flows to plug into its payout network, if permitted by local rules.

What the Visa BVNK partnership actually enables

At a technical level, the Visa–BVNK collaboration allows enterprise clients to route payouts through Visa Direct. Those transfers are settled using Visa Direct stablecoin payouts supported by BVNK. The structure targets use cases such as platform disbursements, cross-border treasury transfers, and corporate settlement flows. In these cases, speed and operational efficiency take precedence over consumer-facing features.

The structure keeps stablecoins firmly in the background. End users may never interact with digital assets directly, while enterprises gain access to faster settlement options that sit alongside traditional fiat rails. This approach reflects Visa’s broader strategy of integrating new settlement technologies without altering how its core payments products function.

Why payouts, not payments, come first

Visa’s focus on payouts rather than retail payments is deliberate. Enterprise disbursements present fewer consumer protection challenges, involve fewer counterparties, and are easier to scope within existing compliance frameworks. For Visa, stablecoin payout infrastructure offers a way to test efficiency gains without exposing cardholders or merchants to new forms of risk.

By starting with payouts, Visa can evaluate whether stablecoins meaningfully reduce friction in areas such as cross-border settlement and treasury management. The emphasis remains on operational plumbing, not on replacing cards or point-of-sale transactions.

A pilot inside a $1.7 trillion network

Despite the scale of Visa’s global payments network, the initiative represents a narrow stablecoin pilot. It is limited in scope and designed to test infrastructure rather than drive volume.

This framing matters. While some coverage has pointed to Visa’s $1.7 trillion annual volume as evidence of impending scale, the company is not positioning the program as a network-wide shift. Instead, it is being used to validate technical and regulatory assumptions before any expansion is considered.

How this fits Visa’s broader stablecoin strategy

The BVNK partnership builds on earlier experiments rather than marking a new direction. In previous initiatives, Visa tested USDC-based settlement between regulated banks in the United States. Those efforts explored whether stablecoins could improve interbank clearing efficiency.

Taken together, these initiatives suggest a layered approach to Visa’s blockchain settlement strategy. Visa is experimenting with stablecoins across different parts of the money movement stack, from bank settlement to enterprise payouts, while avoiding dependence on any single issuer or use case.

>>> Read more: Visa Launches USDC Settlement for U.S. Banks

Regulatory posture and risk containment

Regulation remains a central constraint. Stablecoin rules vary widely across jurisdictions, and Visa has consistently structured its initiatives to remain compliant with local requirements. By keeping pilots small and modular, Visa limits regulatory exposure while gathering data on how stablecoin settlement performs in practice.

The partnership with BVNK reflects this posture. BVNK operates regulated infrastructure in multiple markets, allowing Visa to adapt stablecoin usage to different legal environments without standardizing on a single regulatory model.

What this does, and does not, signal

The move signals growing institutional comfort with stablecoin adoption, particularly for enterprise and cross-border use cases. It also reinforces the view that stablecoins are increasingly treated as infrastructure rather than speculative assets.

At the same time, the initiative does not signal a shift toward consumer stablecoin payments, endorsement of a specific stablecoin issuer, or an immediate increase in transaction volumes. Visa’s core card and account-based payment model remains unchanged.

>>> Read more: Mastercard Zerohash Acquisition Sparks Stablecoin Race

Infrastructure before ideology

Taken together, the BVNK partnership underscores Visa’s cautious approach to blockchain integration. Stablecoins are being tested where they offer clear operational benefits, but always within tightly defined boundaries. For Visa, the priority is future-proofing settlement rails, not reshaping how consumers pay.

In that sense, the pilot reflects incremental normalization rather than disruption. Stablecoins are entering the payments stack quietly, as infrastructure first and ideology last.