Nasdaq-listed VivoPower is shaking up corporate crypto strategy by allocating $121 million toward an XRP-focused treasury. Such an unprecedented move could redefine digital asset management in the boardroom. The company’s bold pivot toward Ripple’s digital token signals an emerging trend of crypto integration into traditional finance, even as XRP’s price shows little immediate reaction.

A Strategic Shift: Inside the VivoPower XRP Treasury Plan

VivoPower has unveiled a digital asset treasury strategy centered entirely on XRP, backed by a $121 million private placement deal. The funding is expected to be used to acquire and hold XRP as a core treasury asset. This marks the first time a publicly listed company has initiated a treasury model focused exclusively on Ripple’s token.

The investment is supported by a Saudi royal family member, lending the initiative a layer of geopolitical weight. VivoPower has framed the move as part of a broader long-term XRP investment strategy. The goal is to future-proof its financial reserves through asset diversification and alignment with blockchain-based infrastructure.

So far, Bitcoin has been the go-to treasury asset for most corporate adopters. But this move signals the possible emergence of XRP as a contender for institutional portfolios. If successful, the strategy could catalyze wider XRP corporate adoption, particularly among companies seeking alternatives to dollar-denominated reserves.

>>> Read more: GameStop Bitcoin Purchase: 4,710 BTC Bet Shakes Up Wall Street

Muted Market Reaction Despite the $121 Million XRP Fund

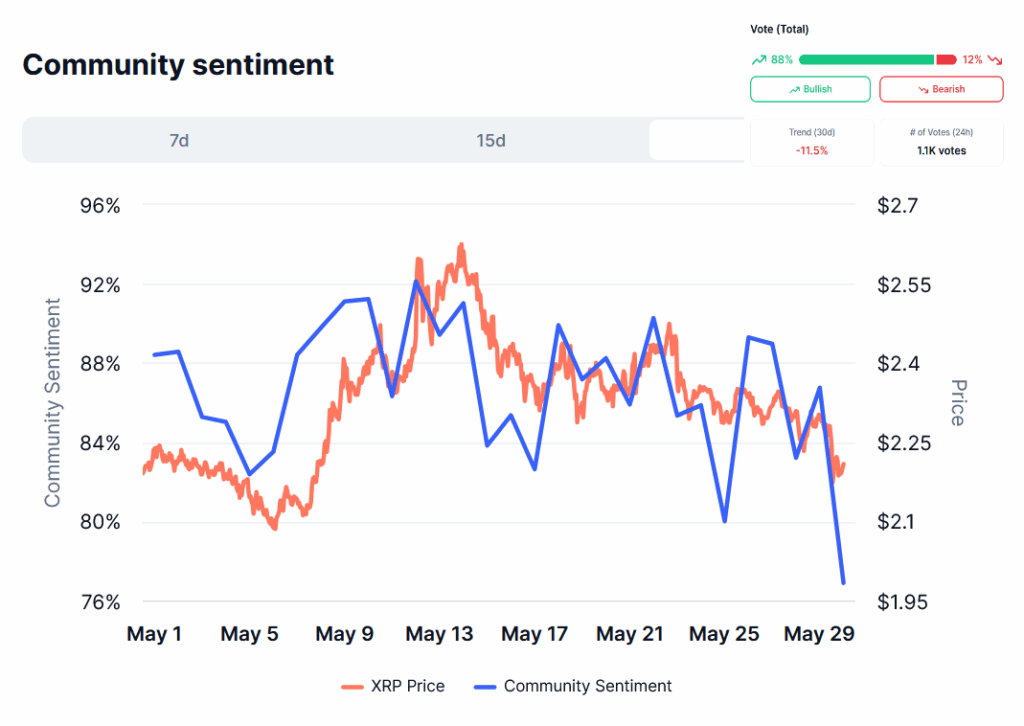

Despite the scale of the announcement, the XRP market response has been underwhelming. The token’s price has remained largely flat, suggesting a disconnect between institutional developments and immediate investor sentiment.

This tepid XRP price reaction reflects a broader dynamic in the crypto space. Strategic asset accumulation is increasingly diverging from short-term market speculation. The $121 million XRP fund is substantial. Still, it represents a relatively small share of XRP’s total liquidity and trading volume.

The regulatory backdrop may also be a factor. XRP continues to face legal and crypto policy challenges in certain jurisdictions, which could be dampening the enthusiasm of speculative traders despite the long-term strategic value implied by the treasury move.

Institutional Capital and Strategic Timing

The timing of the announcement coincides with the increasing involvement of Middle Eastern capital in the digital asset space. The Saudi prince’s backing of the project suggests a broader geopolitical calculus, one in which XRP could serve as a tool for cross-border finance, asset sovereignty, or monetary diversification.

By aligning with XRP at this moment, VivoPower is not only investing in a token. It is making a strategic play at the intersection of financial innovation and international positioning. The move stands as a case study in how corporate and sovereign interests may increasingly converge around blockchain-based assets.

Conclusion: A Calculated Bet on XRP’s Future

VivoPower’s $121 million XRP treasury marks a bold and calculated shift in corporate finance. The market has yet to reflect the significance of this move. However, the growing confidence in Ripple’s infrastructure and token utility seems undeniable.

>>> Read more: Circle’s $6.7B IPO Revival: A Second Chance for the USDC Issuer

As the first public company to commit this scale of funding to an XRP crypto treasury model, VivoPower is positioning itself at the frontier of XRP corporate adoption. If successful, this XRP investment strategy could set a new standard for digital asset reserves, one that merges traditional finance with the promise of blockchain innovation.

Readers’ frequently asked questions

Why would a company choose XRP over Bitcoin or stablecoins for its treasury?

XRP offers fast transaction speeds, low fees, and integration with Ripple’s cross-border payment infrastructure. For companies prioritizing utility over store-of-value status, XRP may offer operational advantages, though it comes with higher regulatory and reputational risks.

What risks does a company face when holding XRP in its treasury?

Risks include regulatory uncertainty, price volatility, and limited liquidity compared to more widely adopted assets like Bitcoin. Companies must also consider accounting complexities and potential scrutiny from shareholders and regulators.

How does an XRP treasury model compare to using stablecoins or Bitcoin for reserves?

Stablecoins offer lower volatility and ease of settlement, while Bitcoin is widely accepted as a digital store of value. XRP sits between the two: it’s faster and cheaper for transactions but carries more regulatory baggage. Choosing XRP reflects a strategic bet on Ripple’s ecosystem and future market integration.

What Is In It For You? Action Items You Might Want to Consider

Track institutional moves involving alternative tokens

Bitcoin isn’t the only crypto catching the attention of corporations. Keep an eye on XRP and similar assets making their way into treasury models.

Monitor XRP’s legal and regulatory developments

The success of VivoPower’s strategy hinges partly on XRP’s regulatory clarity. Stay informed on court rulings and SEC positions that could influence adoption.

Evaluate long-term investment strategies beyond short-term price movement

The muted market reaction doesn’t necessarily invalidate XRP’s potential. Use this as a case study for balancing price speculation with fundamental adoption signals.

[…] >>> Read more: VivoPower XRP Treasury: A New Corporate Strategy […]