TL;DR

- Standard Chartered cut its 2025 Bitcoin forecast from 200,000 dollars to 100,000 dollars and pushed its long-term milestones to 2030 after reassessing demand conditions.

- Corporate treasury buying remained active through 2024 and 2025 but is now treated as a mature cohort rather than a new source of incremental demand.

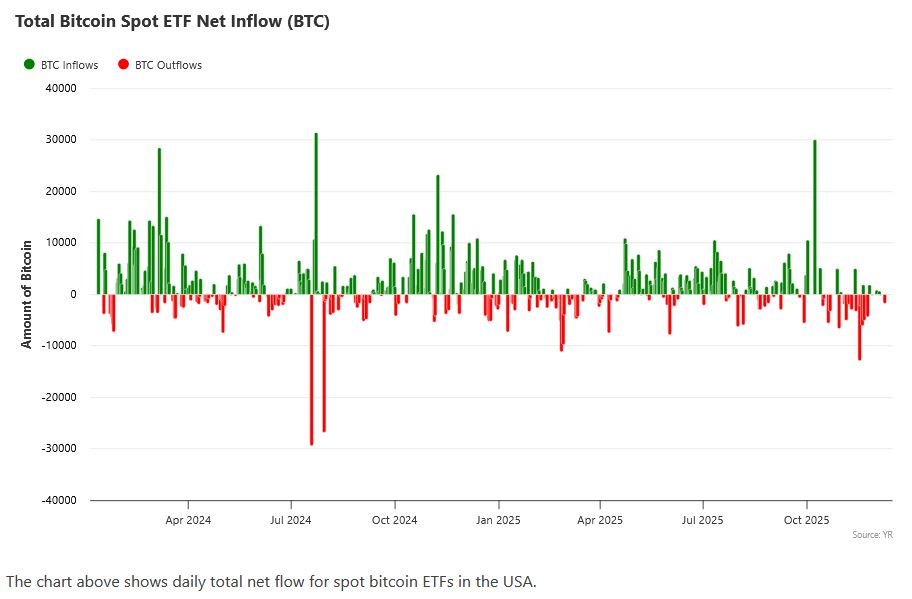

- ETF inflows slowed to about 50,000 BTC this quarter, which led the bank to base its model on steadier ETF driven adoption and stronger macro influences.

Standard Chartered has not been shy about making bold Bitcoin predictions. The bank raised eyebrows in mid 2025 when it set a 200,000 dollar year end target, a view it repeated as Bitcoin rallied to record highs in October. That call has now been withdrawn. The latest Standard Chartered Bitcoin forecast cuts the 2025 projection to 100,000 dollars and delays the bank’s long term milestones.

The revision lands after one of the most volatile trading years in Bitcoin’s history. Prices surged to new highs, then fell more than thirty percent in the weeks that followed. ETF inflows weakened, corporate treasuries slowed their buying pace, and the macro backdrop grew more unstable. Standard Chartered still believes Bitcoin is headed for six figures and beyond, but the assumptions behind that journey have changed.

The New Forecast: A Longer Road To The Same Destination

In its updated outlook, the bank now expects Bitcoin to close 2025 at 100,000 dollars instead of 200,000 dollars. The multi year roadmap has shifted as well. The new path runs through 150,000 dollars for 2026, 225,000 dollars for 2027, 300,000 dollars for 2028, and 400,000 dollars for 2029. The 500,000 dollar long term target remains in place, but the timeline moves from 2028 to 2030.

Analysts frame the recent pullback as painful but within the normal range of corrections observed since spot ETFs launched. They insist that the long term outlook is intact. What changed is the composition of demand. The bank’s earlier model relied on two forces that worked together across 2024 and 2025. One of those forces is now considered mature.

The Standard Chartered Bitcoin price prediction remains bullish, but the updated Bitcoin price targets 2025 to 2030 reflect a cycle where demand is steadier and less explosive than analysts assumed in mid 2025.

Why Standard Chartered Slashed Its Bitcoin Forecast

The downgrade becomes easier to understand once the bank’s earlier model is unpacked. When Standard Chartered made its 200,000 dollar call, it was counting on two powerful engines. The first was the growing cohort of digital asset treasury companies that held large Bitcoin positions on their balance sheets. The second was the surge of capital that entered US spot Bitcoin ETFs after their launch in 2024.

Both engines were active throughout 2024 and deep into 2025. Corporate treasuries accumulated significant amounts of Bitcoin, and ETF inflows brought large new buyers into the market. The issue now is not that these forces disappeared. It is that one of them no longer adds incremental pressure.

Standard Chartered’s analysts now assume that corporate treasuries will not be a major source of new net demand from here. With that assumption removed, the Bitcoin forecast downgrade reasons center on the idea that the market has shifted into a new phase. The bank now counts only one reliable structural driver of demand.

Corporate Bitcoin Treasuries: From Growth Engine To Mature Cohort

Corporate Bitcoin buying was one of the defining stories of 2024 and 2025. Several companies followed a MicroStrategy style strategy and increased their holdings throughout the year. Some continue to add small amounts. The new view is not that this activity ends completely, but that the cohort is no longer expanding at a pace that justifies including treasury growth as a major demand leg in forward models.

Standard Chartered treats the corporate Bitcoin buying wave as mostly complete in its impact. Treasuries now sit on very large holdings. The marginal effect of each new purchase is smaller than it was when the trend was new and the base was low. For modelling purposes, the bank assumes an end of corporate Bitcoin treasury demand as a structural engine, even if some companies continue to accumulate.

This shifts the Bitcoin demand drivers 2025 in a meaningful way. The next stage of institutional adoption relies less on balance sheet strategies and more on broader market participation through ETFs.

ETF Inflows: From Surge To Stabilisation

This leaves ETF flows as the key structural support for Standard Chartered’s new model. During the strongest periods of the ETF cycle, US spot products saw quarterly inflows of more than 200,000 BTC. At their strongest, spot ETF inflows topped 200,000 BTC in a quarter, and corporate treasuries were actively accumulating at the same time. Even then, total demand did not reach the extreme levels many investors assumed, which helps explain why Standard Chartered now sees that phase as a one off surge rather than a baseline.

Here in late 2025, conditions look different. The bank highlights that net spot Bitcoin ETF inflows are roughly 50,000 BTC this quarter, which is the weakest pace since the products listed. The falling Bitcoin ETF inflows show that the early rush into ETFs has cooled and that future adoption will follow a more gradual pattern.

Standard Chartered still expects ETFs to play a leading role. It assumes that average flows of around 200,000 BTC per quarter are possible over time, but not on a continuous or explosive basis. This supports an ETF driven Bitcoin market, but not the type of vertical rise that earlier models implied. Flows will depend on allocations, rebalancing cycles, and broader investor sentiment.

In this environment, institutional Bitcoin adoption is still underway. It is simply less dramatic and more tied to portfolio construction than traders hoped in the middle of the year.

Bitcoin Is Now A Macro Asset, Not Just A Halving Story

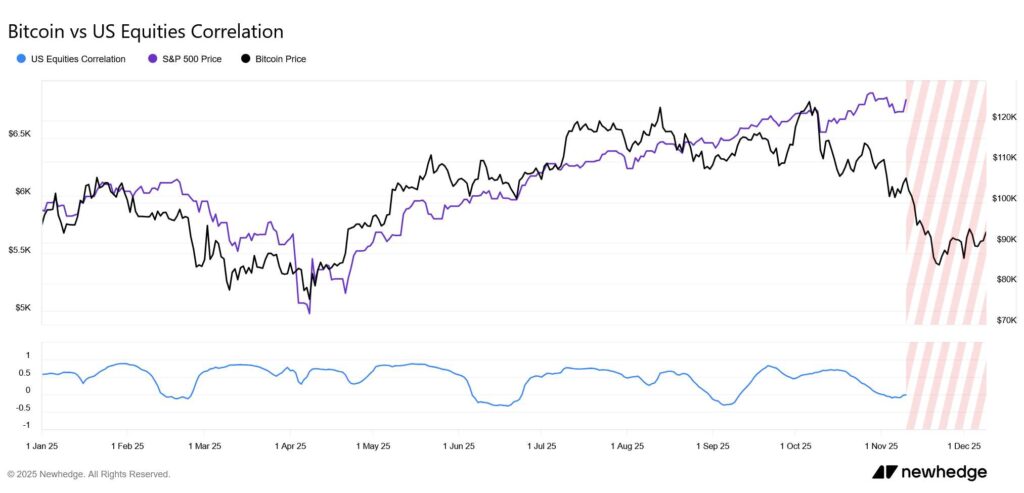

The downgrade also reflects a structural shift in how Bitcoin behaves in the ETF era. Standard Chartered argues that Bitcoin has become more sensitive to macro conditions. Across 2025, Bitcoin showed higher correlation with major equity indices, AI driven tech stocks, and shifts in Federal Reserve expectations. These Bitcoin macro drivers now overshadow the role of the halving cycle in day to day pricing.

Correlation data supports this view. Reuters notes that Bitcoin’s average correlation with the S&P 500 in 2025 has been significantly higher than in 2024. This rising Bitcoin correlation with equities makes the asset more responsive to interest rates, liquidity cycles, and volatility regimes.

For this reason, macro factors affecting Bitcoin price outlook now matter more than supply narratives in Standard Chartered’s model.

What The Downgrade Means For Investors

For institutions, the interpretation is clear. Bitcoin is still in the process of being integrated into mainstream portfolios, but the timeline is longer than early ETF enthusiasm suggested. Most allocations will flow through ETFs and other regulated channels. Committee approvals will align with risk conditions.

For retail investors, the message is simpler. Watch ETF flows and macro indicators rather than relying solely on halving based expectations. The Bitcoin demand outlook now depends on how quickly institutional money rotates back into risk assets when conditions ease. The revised Bitcoin price forecast 2025 is a baseline for a slower cycle, not a bearish reversal. The updated Bitcoin price targets 2025 to 2030 still show long term upside.

>>> Read more: Bitcoin ETF Outflows Trigger BTC Drop Toward $80K

Conclusion: A Bullish View With A Different Engine

Standard Chartered has not abandoned its long term view. The bank still sees Bitcoin reaching 500,000 dollars, but the timeline reflects a changed market. Corporate treasuries expanded aggressively in 2024 and 2025 and now form a mature cohort rather than a growing one. ETF inflows remain the key driver, but they no longer resemble a launch phase surge.

The Standard Chartered Bitcoin forecast now reflects a market shaped by ETF flows, macro forces, and a broader institutional integration period that takes time. The destination remains. The journey is slower and depends on whether ETF demand and global conditions can sustain the next leg higher.