World Liberty Financial (WLFI), a decentralized finance (DeFi) platform launched in September 2024, entered the crypto market with significant fanfare. Backed by the endorsement of Donald Trump and his family, the project promised to disrupt traditional financial systems with decentralized borrowing and lending services. However, despite its high-profile associations, WLFI has struggled to gain traction. Its token sale initially targeted $300 million. It had only raised $21 million before Justin Sun, founder of the Tron blockchain, intervened with a $30 million investment. While Sun’s involvement brings fresh capital and expertise, questions remain about whether this will be enough to overcome the platform’s challenges.

What Is World Liberty Financial?

WLFI aims to position itself as a next-generation financial platform leveraging blockchain technology to offer decentralized lending and borrowing services. Through its native WLFI token, the platform intends to create a governance system where token holders can influence decisions and participate in the ecosystem’s growth.

The project’s design emphasizes compliance with financial regulations, particularly in the United States. This compliance-driven approach has led to significant restrictions on the WLFI token. It is non-transferable, meaning investors cannot trade or exchange the token on secondary markets. Further, its availability is limited to accredited U.S. investors and non-U.S. participants. While these measures may appeal to regulators, they have significantly limited the token’s appeal to crypto enthusiasts who prioritize liquidity, freedom of exchange, and speculative potential.

Despite these lofty goals, the platform has struggled to differentiate itself in an increasingly saturated DeFi market. Unlike its competitors, WLFI has not introduced groundbreaking technology or features that would set it apart. Combined with its restrictive tokenomics, this lack of innovation has raised questions about its long-term viability.

The Trump Connection: Boon or Burden?

WLFI’s association with Donald Trump and his family has undoubtedly brought significant attention to the project. The Trump family’s involvement includes promotional backing from Donald Trump himself and active roles for his sons, Eric and Donald Jr.. This association is reflected in WLFI’s branding, marketing, and even its financial structure. According to the project’s “gold paper,” a portion of the proceeds from the token sale is allocated to a Trump-owned company. Profits are kicking in after the $30 million milestone – a target that Sun’s investment has finally met.

However, this close relationship with the Trump brand has been a double-edged sword. While it attracts a politically aligned audience, it also alienates potential investors who may view the project’s governance structure as opaque or overly politicized. The allocation of funds to Trump-owned entities has sparked debates about the project’s motives and whether it prioritizes innovation or financial gain for its backers.

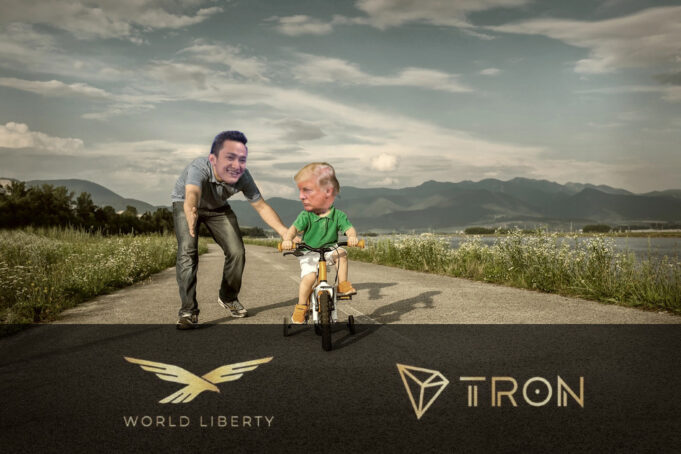

Justin Sun’s $30M Gamble

Justin Sun’s $30 million investment represents a lifeline for WLFI, more than doubling the funds raised to date. As the founder of Tron, Sun is no stranger to the competitive world of blockchain and cryptocurrency. His leadership of Tron has turned it into one of the leading blockchain platforms, renowned for its efficiency and support for decentralized applications. Additionally, Sun has a reputation for taking bold bets in the cryptocurrency space, often leveraging aggressive marketing strategies to achieve results.

By becoming WLFI’s largest investor and taking on an advisory role, Sun is expected to bring not only financial resources but also strategic guidance to the project. His expertise in blockchain technology and marketing could help WLFI overcome its initial hurdles, particularly in building credibility within the crypto community and expanding its user base.

However, critics argue that Sun’s investment does not address some of WLFI’s core issues. The non-transferable nature of its token remains a significant obstacle to adoption, as liquidity is a cornerstone of most successful crypto ecosystems. Furthermore, the project’s regulatory focus, while commendable in principle, limits its appeal in a global market that thrives on decentralized and borderless systems.

Challenges Ahead

Despite its high-profile backing, WLFI faces an uphill battle in establishing itself as a significant player in the DeFi market. The platform must address several pressing issues to remain competitive:

- Token Utility and Liquidity: The WLFI token’s restricted usability and lack of liquidity have deterred many potential investors. Revisiting these constraints without jeopardizing regulatory compliance will be a critical challenge.

- Market Differentiation: WLFI needs to identify and market unique features that set it apart from competitors. Simply offering decentralized lending and borrowing is no longer enough in a space crowded with innovative solutions.

- Reputation and Trust: While Sun’s involvement boosts WLFI’s credibility within the crypto community, the Trump connection may deter others. The project must find a way to balance its political associations with the broader market’s expectations.

- Fund Utilization Transparency: With Sun’s $30 million investment, stakeholders will closely watch how these funds are allocated. Mismanagement or a lack of transparency could further damage the project’s reputation.

The Verdict

The partnership between Justin Sun and World Liberty Financial represents a fascinating intersection of politics, blockchain technology, and high-stakes investment. Sun’s involvement has provided a much-needed boost to the project. However, it remains to be seen whether his expertise and resources will be enough to rescue it from obscurity.

>>> Read more: Trump World Liberty Financial: Crypto Innovation or Political Move?

For now, WLFI remains a case study in the challenges of navigating the intersection of traditional power structures and decentralized technology. While its high-profile endorsements and ambitious goals have captured attention, the platform’s ultimate success will depend on its ability to overcome its structural weaknesses and deliver on its promises. Whether Sun’s $30 million proves to be a masterstroke or a misstep will likely define WLFI’s future – and its place in the ever-evolving DeFi landscape.

Readers’ frequently asked questions

What does “non-transferable token” mean, and why does it matter for investors?

A non-transferable token means that once you acquire the token, you cannot trade, sell, or exchange it with others on secondary markets, unlike most cryptocurrencies. For investors, this limitation is crucial. It removes the possibility of profiting from price fluctuations or liquidity – key reasons many people participate in cryptocurrency markets. This design is intended to comply with regulatory requirements, ensuring that the WLFI token doesn’t fall under stricter securities laws. However, for someone with little trading experience, your ability to benefit from owning the token is limited to its use within the World Liberty Financial ecosystem, such as governance voting or platform participation.

What is an “accredited investor,” and why can only they invest in WLFI tokens in the U.S.?

An accredited investor is an individual or entity that meets specific financial criteria set by U.S. regulations. For example, they must have a net worth of over $1 million (excluding their primary residence) or an annual income exceeding $200,000 for the past two years. This designation exists to protect less experienced or less financially secure individuals from potentially risky investments. World Liberty Financial restricts token sales to accredited investors in the U.S. to comply with these regulations. For readers wondering if they qualify, it’s important to assess your financial situation or consult a financial advisor before attempting to participate in projects like WLFI.

What are the potential risks of investing in a project like World Liberty Financial?

Investing in a project like WLFI comes with unique risks, even beyond the typical volatility associated with cryptocurrencies. First, its compliance-heavy structure limits the token’s appeal to a niche market, which may affect its adoption and overall value. Second, the project’s association with Donald Trump could polarize investors and introduce unpredictable reputational risks. Third, its restricted tokenomics, such as the inability to trade the WLFI token, means that your investment’s value is tied strictly to the success of the platform rather than external market dynamics. Finally, WLFI’s early struggles to meet fundraising goals suggest that it might face challenges in gaining user traction or delivering on its promises, especially in a competitive DeFi landscape.

What Is In It For You? Action Items You Might Want to Consider

Evaluate WLFI’s Tokenomics and Compliance Approach Before Investing

Before considering an investment in WLFI, traders should carefully evaluate its unique tokenomics. The non-transferable nature of the WLFI token, along with restrictions on who can purchase it, sets it apart from most cryptocurrencies. Ask yourself: does the regulatory focus align with your trading goals? If you’re looking for speculative opportunities or liquidity, WLFI’s structure may not fit your strategy. However, if governance and potential long-term alignment with regulatory trends appeal to you, it might warrant deeper exploration.

Monitor Justin Sun’s Involvement for Signals of WLFI’s Potential Growth

Justin Sun’s $30 million investment and advisory role bring credibility and momentum to WLFI, but his track record of involvement in other crypto ventures is worth studying. Traders should watch for announcements or changes stemming from Sun’s influence, such as technological upgrades, partnerships, or marketing efforts. These could signal whether Sun’s involvement is driving real growth or if the project is struggling to overcome its current challenges.

Stay Alert to Regulatory and Market Sentiment Around WLFI

Given WLFI’s strong compliance focus and association with Donald Trump, the project is likely to generate polarized opinions in both regulatory and market contexts. Traders should stay updated on how regulators and the broader crypto community perceive WLFI. Regulatory approvals or high-profile endorsements could boost its appeal, while negative publicity or unclear governance could hurt its prospects. Consider setting alerts for relevant news to ensure you’re acting on the latest developments.

[…] billionaires, and political actors, most notably the Trump family. Investigations allege that Sun’s investments in U.S.-based crypto ventures may have bought him access to U.S. political circles. Liberland acts as a diplomatic cover for […]