TL;DR

- The full team of Zcash developers employed by Electric Coin Company leave after a governance dispute with the Bootstrap board.

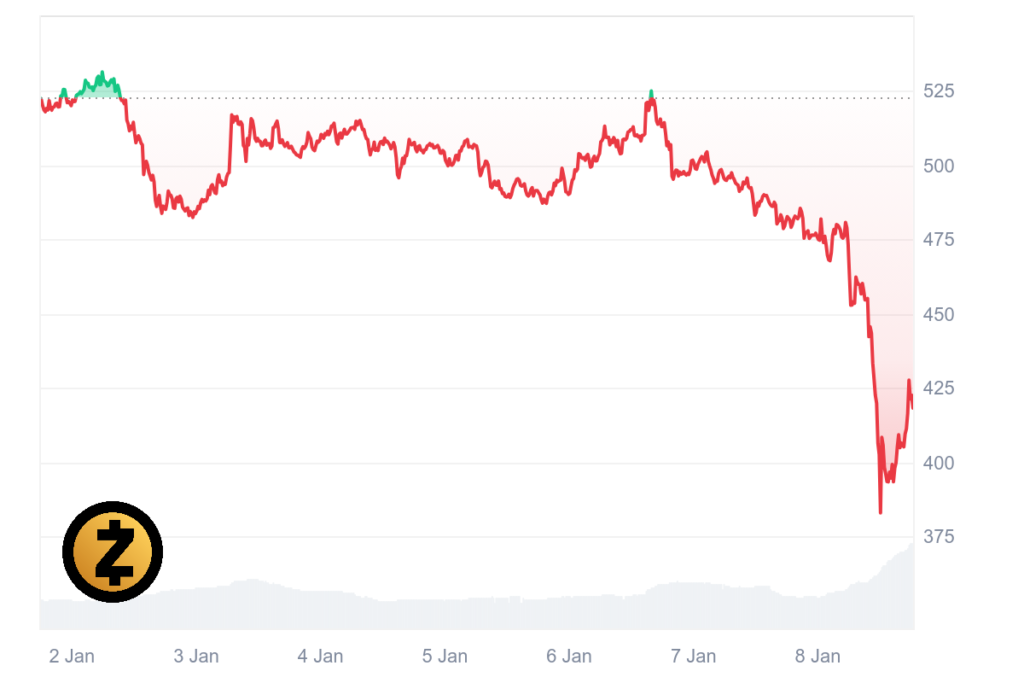

- ZEC fell double digits as markets priced in execution and coordination risk, despite no technical failure or protocol disruption.

- Zcash remains operational and open-source, but unresolved questions around governance, funding, and roadmap ownership now shape investor confidence.

Zcash’s developer exit has shaken confidence in one of crypto’s longest-running privacy projects. ZEC moved sharply lower as investors reacted to sudden governance uncertainty. The entire Zcash development team employed by Electric Coin Company (ECC), a key contributor to Zcash, departed following a dispute with the Bootstrap board. The situation has raised fresh questions about how the project is governed and who controls its future direction.

ZEC fell double digits shortly after the news broke. The ZEC price drop reflected concerns about execution risk rather than any immediate technical failure of the network.

What happened

The dispute unfolded during an internal restructuring process involving ECC and Bootstrap. Bootstrap is the nonprofit entity responsible for oversight of ECC’s operations. According to public statements, Bootstrap moved to assert greater authority over strategy and organizational decisions. The board cited its fiduciary responsibilities as a nonprofit.

ECC leadership and developers pushed back. They argued that the restructuring altered the balance between responsibility and authority. As discussions broke down, the entire Zcash development team opted to leave together. This brought ECC’s role as the project’s primary development shop to an abrupt halt.

This zcash developer exit was not triggered by a security incident, funding shortfall, or code failure. Instead, it stemmed from disagreements over governance and control during Zcash restructuring. At the center of the dispute was how decisions would be made going forward.

Competing narratives

Former ECC chief executive Josh Swihart described the situation as a case of constructive discharge. The term is used when working conditions change so materially that continuing employment becomes untenable. In his framing, ECC retained responsibility for delivering results. At the same time, it lost meaningful autonomy over how it could achieve those results.

From this perspective, the governance dispute at Zcash centered on control. Developers believed the evolving oversight structure prevented them from executing effectively. Expectations, however, remained unchanged.

Bootstrap has offered a different explanation. The board has emphasized that nonprofit governance requirements and legal obligations were driving its actions. According to this view, oversight changes were necessary to protect assets and ensure compliance. The board also pointed to accountability requirements within Zcash’s nonprofit structure.

Neither side has alleged misconduct. The conflict instead reflects a structural tension between a nonprofit board and a developer organization. That organization had been operating with startup-style expectations.

Immediate market reaction

Markets responded swiftly. ZEC’s price dropped due to fears that the sudden loss of a coordinated core team could delay development milestones. Traders also focused on the risk that future upgrades could become harder to coordinate.

The market reaction mirrors past episodes across crypto. In those cases, governance shocks rather than protocol flaws triggered sharp repricing. Even when networks continue to operate normally, investors tend to discount assets when leadership clarity vanishes.

In Zcash’s case, the sell-off appeared driven by risk repricing rather than panic. Trading volumes spiked as the news spread across major venues.

What did not change

Despite the headlines, Zcash itself continues to function. The protocol remains live, and transactions are processing normally. No vulnerabilities have been reported.

Zcash’s codebase is open-source. Development can continue even outside a single corporate structure. Importantly, this was an organizational rupture rather than a technical one. The Electric Coin Company may no longer house the core developers, but the departure did not affect the network itself.

What happens next

The departing developers have indicated plans to form a new entity where they want to continue working on privacy-focused technology. How closely that work will align with Zcash going forward remains an open question.

Several uncertainties remain unresolved. Who maintains the primary Zcash roadmap? How will the network fund future development? What role, if any, will the Bootstrap board play in coordinating contributors? These questions will shape whether confidence can be restored after Zcash developers leave ECC.

>>> Read more: Mango Markets to Destroy $70M in MNGO Tokens

Governance as the real stress test

The zcash developer exit underscores how governance, not cryptography, has become the primary risk variable for mature blockchain projects. Hybrid models that combine nonprofit oversight with centralized development teams can function smoothly. Problems emerge when authority and accountability drift out of alignment.

Whether this episode becomes a temporary disruption or a lasting governance crisis for Zcash will depend on how quickly they clarify roles and rebuild coordination. For now, the market is watching governance rather than code.

Readers’ frequently asked questions

Who is responsible for maintaining Zcash after the developer exit?

Zcash remains an open-source project, meaning any qualified contributors can work on the codebase. However, it is currently unclear which organization or group will take primary responsibility for coordinating development, reviewing upgrades, and maintaining a unified roadmap for Zcash.

Does the developer exit affect the security or operation of the Zcash network?

No. The Zcash network continues to operate normally, with blocks processing and transactions settling as expected. The developer exit did not involve a security breach, protocol flaw, or emergency network action.

Can Zcash still receive upgrades without Electric Coin Company’s development team?

Yes, upgrades are still possible because Zcash’s code is open-source. That said, major protocol changes typically require coordination, funding, and community alignment, which may be more difficult until governance and leadership roles are clearly defined.

What’s in it for you? Action items you might want to consider

Track governance updates before reacting to price moves

Short-term price volatility reflects governance uncertainty rather than protocol failure. Waiting for clarity from Bootstrap and former ECC developers may provide a better signal than reacting to market swings alone.

Differentiate network stability from execution risk

Zcash continues to operate normally, but leadership and coordination questions could affect future development. Evaluating these risks separately can help avoid overestimating immediate technical threats.

Watch for signals from any newly formed developer entity

If the former ECC development team launches a new organization, its funding model, contributor access, and stated relationship with Zcash will be important indicators of long-term project direction.