In the wake of a $235 million cyberattack, the Singapore high court granted Indian crypto exchange WazirX a four-month moratorium, providing temporary legal protection as it scrambles to address the crisis. The hack targeted WazirX’s multi-signature wallet in July 2024. It was the second-largest crypto breach this year and left thousands of users in financial uncertainty. The court’s decision allows WazirX time to implement a restructuring plan and disclose its financial records while fending off creditors.

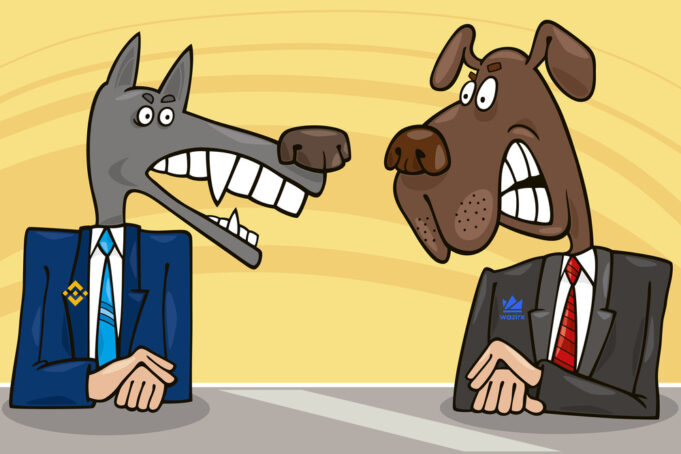

At the heart of the situation is the ongoing dispute between WazirX and Binance, the world’s largest cryptocurrency exchange by trading volume. Binance, previously linked to WazirX through a 2019 acquisition announcement, has forcefully denied any involvement or responsibility for the breach.

Binance’s Response to the Hack

In response to claims that Binance should bear some responsibility, Binance CEO Changpeng Zhao (CZ) has consistently maintained that Binance never actually owned or operated WazirX. Despite earlier suggestions of an acquisition, Binance clarified that the parties never fully completed the deal because WazirX failed to meet certain contractual obligations. “Binance has not owned, controlled, or operated WazirX at any time, including before, during, or after the July 2024 attack,” Binance stated in a public release.

Binance emphasized that its relationship with WazirX was limited to providing wallet infrastructure. They ceased offering the service in early 2023. Zhao criticized WazirX for misleading its users by implying that Binance had operational control. Tensions now escalated as WazirX founder Nischal Shetty suggests Binance’s involvement hindered efforts to compensate users.

WazirX’s Defense and Legal Strategy

WazirX’s management, however, paints a different picture. According to Shetty, Binance’s technical integration played a significant role in managing WazirX’s funds before the hack. He suggested that Binance holds partial responsibility for user losses. He pointed out that Binance controlled the bulk of WazirX’s assets up until 2023. In his view, this complicated WazirX’s ability to compensate users following the cyberattack.

In response to the hack, WazirX sought protection from the Singapore High Court under Section 64 of the Insolvency, Restructuring, and Dissolution Act (IRDA). The court granted WazirX a four-month moratorium. During this period it must reveal its financial details, including wallet addresses, and establish a transparent restructuring plan. This should allow WazirX to develop a recovery proposal with input from its creditors, ensuring any voting is conducted through independent third parties.

The Broader Implications for the Crypto Space

The dispute between Binance and WazirX brings to the fore questions about transparency and accountability within the crypto sector. Binance’s decision to distance itself from WazirX is a critical development. It underscores the challenges of operational clarity in decentralized financial ecosystems. Users and creditors are now caught in the crossfire of this corporate battle, uncertain about the future of their funds.

While WazirX focuses on recovering from the breach, Binance’s firm denials left WazirX with fewer avenues for relief. Currently, trading remains suspended, but INR withdrawals have resumed in phases. However, users can withdraw only up to 66% of their balances. Cryptocurrency withdrawals are still on hold until a court-approved restructuring scheme is finalized. This uncertainty leaves users waiting for further resolution. In the meantime, the hacker has reportedly laundered most of the stolen funds using privacy tools like Tornado Cash.

Looking Forward

The coming months will be pivotal for WazirX as it seeks to regain stability and compensate affected users. The court-mandated restructuring plan offers a glimmer of hope, but much depends on whether WazirX can successfully navigate its financial challenges and the growing legal complexities of its dispute with Binance. For now, users are left waiting, with their trust in the platform — and the broader crypto ecosystem — severely tested.

>>> Read more: BingX Hack Sparks Hot vs. Cold Wallet Debate in Crypto Security

As the crypto industry matures, these types of conflicts will likely shape the regulatory landscape, with increasing calls for transparency in partnerships, ownership structures, and user agreements. For WazirX, the court ruling offers temporary relief, but the path to recovery remains fraught with challenges.

Readers’ frequently asked questions

What is the status of the stolen funds from the WazirX hack, and is there any chance of recovery?

As of now, a significant portion of the stolen $235 million in crypto assets has been laundered through privacy tools, such as Tornado Cash. These platforms are designed to obscure the origin and movement of digital assets, complicating efforts to trace and recover stolen funds. WazirX expressed doubts about whether they will be able to recover all the lost assets. Estimates suggest that only 55-57% of the funds might be potentially recoverable. The legal advisors working with WazirX have pointed out that the stolen assets have been rapidly dispersed. That makes it difficult to regain them through traditional legal channels. Although WazirX has committed to a restructuring plan that could involve compensating users, the extent of that compensation remains uncertain as the platform seeks legal and financial resolutions through the courts.

Why is Binance distancing itself from WazirX, and how does it impact users?

Binance’s public distancing from WazirX stems from an unresolved acquisition dispute. In 2019, Binance announced its intent to acquire WazirX. However, in 2022, Binance’s CEO Changpeng Zhao (CZ) clarified that the acquisition was never completed because WazirX failed to meet certain contractual obligations. Since then, Binance has been firm in stating that it does not own or control WazirX. This counters claims from WazirX’s founder, Nischal Shetty, who suggested that Binance still played a role in handling WazirX’s funds before the hack. Binance’s stance has significant implications for WazirX users. It absolved itself of any responsibility for compensating users affected by the hack. This leaves WazirX solely responsible for managing the aftermath, adding to user uncertainty. Binance’s decision to distance itself further complicates WazirX’s efforts to recover and stabilize. Binance had previously provided technical services, including wallet infrastructure, but these ceased in early 2023.

What will happen during WazirX’s court-mandated restructuring, and what does it mean for users?

WazirX’s four-month moratorium granted by the Singapore High Court should provide the exchange with temporary relief from legal actions and creditor claims, giving it time to develop a recovery plan. During this period, WazirX must take several key steps, including disclosing its wallet addresses and full financial accounts. It will also need to present a transparent plan for how it intends to compensate users and manage its outstanding liabilities. The restructuring plan, which will involve voting by creditors, must be approved by the court before any funds can be disbursed to users. While this court protection gives WazirX some breathing room to organize a fair resolution, it also means users will have to wait before any asset recovery. This process will likely take several months. Trading on the platform remains suspended, which increases uncertainty for users. It is unclear when or how they will regain access to their funds.

What Is In It For You? Action Items You Might Want to Consider

Monitor WazirX’s restructuring developments closely before making any major trading decisions

With the Singapore court granting a four-month moratorium to WazirX, it’s essential to stay informed about any updates related to their restructuring plan. The outcome of this process will directly affect the platform’s recovery efforts, user compensation, and future trading activity. Keep an eye on official communications from WazirX and the Singapore courts to gauge when trading might resume and whether it’s safe to reinvest or withdraw.

Diversify your holdings across multiple exchanges to mitigate risk

The ongoing dispute between WazirX and Binance highlights the uncertainty that can arise from partnerships and acquisitions within the crypto space. To avoid being caught in similar situations, traders should diversify their funds across multiple reputable exchanges. Doing so reduces exposure to risks such as platform shutdowns, hacks, or unresolved ownership issues that could lock up your assets.

Be cautious of exchanges under financial or legal distress

As WazirX goes through a court-ordered restructuring, it’s wise to be cautious about interacting with platforms facing financial instability. Even if an exchange resumes trading, consider withdrawing or limiting your funds until you’re confident that it has resolved its issues. Keep track of how WazirX handles user compensation post-hack. This can provide insight into its reliability and the broader risks associated with such platforms.