Bitcoin has achieved what many believed was a distant possibility – surpassing the $100,000 mark. This historic milestone, marked by an intraday high of $103,656, solidifies Bitcoin’s position as the dominant player in the cryptocurrency world. While the achievement is a testament to the resilience and growing adoption of Bitcoin, it also casts a shadow over the broader crypto market, with altcoins experiencing mixed fortunes.

Institutional adoption, regulatory optimism, and political developments have fueled the rise to $100,000. Bitcoin spot Exchange-Traded Funds (ETFs), such as the one launched by BlackRock, have driven massive inflows from institutional investors, positioning Bitcoin as a credible asset class. The market also responded positively to the election of Donald Trump, whose administration is expected to implement crypto-friendly policies, including the appointment of cryptocurrency advocate Paul Atkins to lead the Securities and Exchange Commission (SEC).

Bitcoin’s Growing Dominance

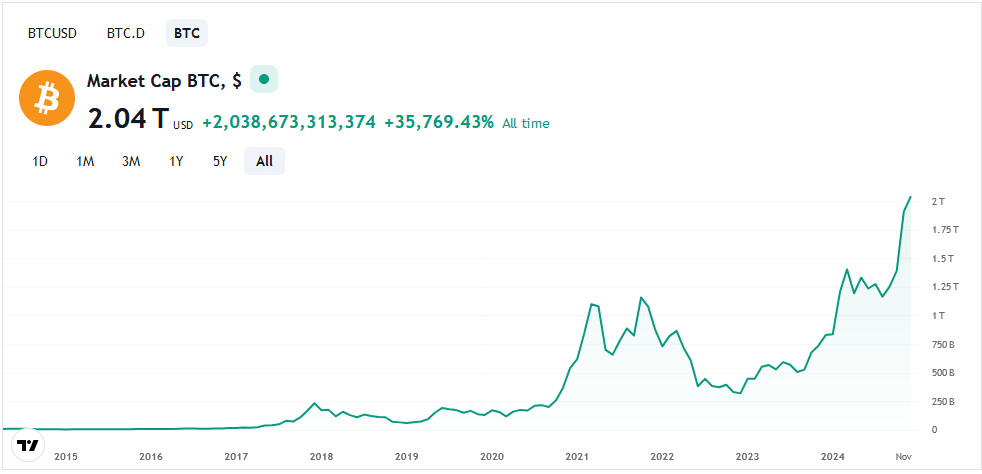

With a market capitalization exceeding $2 trillion, Bitcoin’s share of the crypto market is now at its highest in years. Its dominance is reshaping the investment landscape, as institutional players increasingly allocate funds to the leading cryptocurrency, often at the expense of smaller projects. Analysts suggest this trend could widen the gap between Bitcoin and altcoins, making it harder for emerging projects to attract attention and funding.

“Bitcoin has become synonymous with the crypto market for many institutional investors,” remarked a prominent market analyst. “While this benefits Bitcoin, it presents challenges for altcoins struggling to differentiate themselves.”

Winners and Losers in the Altcoin Space

Bitcoin’s ascent has not been uniformly positive for the crypto ecosystem. Some altcoins, such as Dogecoin, have ridden the wave of bullish sentiment, registering gains of up to 140%. However, other digital assets have failed to keep pace, reflecting a fragmented market response. Ethereum, often seen as Bitcoin’s closest competitor, has shown steady but less dramatic growth, while smaller altcoins have faced declines or stagnation.

The disparity in performance raises questions about the sustainability of the “altcoin season” narrative. Many investors are consolidating their portfolios around Bitcoin, prioritizing stability and long-term growth over speculative opportunities in lesser-known tokens.

Challenges for Altcoins

The altcoin market faces additional hurdles beyond investor behavior. Regulatory scrutiny remains a significant obstacle, particularly for projects operating in decentralized finance (DeFi) and other emerging sectors. Meanwhile, Bitcoin continues to benefit from its established reputation and relatively clear regulatory status.

Moreover, the environmental critique of cryptocurrencies disproportionately affects smaller projects, many of which lack the resources to adopt greener technologies. Bitcoin’s energy consumption remains a concern, but its market dominance gives it the leverage to address these issues without losing investor confidence.

What’s Next for the Crypto Market?

Bitcoin’s milestone raises important questions about the future of the cryptocurrency market. Will Bitcoin’s dominance stifle innovation, or will it serve as a gateway for broader crypto adoption? The answer may lie in how altcoins adapt to the shifting landscape. Projects that offer unique value propositions, such as scalability solutions or utility-driven applications, are more likely to survive and thrive.

As Bitcoin continues its upward trajectory, the broader market faces a pivotal moment. For altcoins, the challenge will be to prove their relevance in a market increasingly captivated by Bitcoin’s success. Whether this dynamic will result in a more balanced ecosystem or solidify Bitcoin’s supremacy remains to be seen.

Bitcoin’s journey past $100,000 is not just a milestone – it’s a turning point for the entire crypto landscape. For better or worse, the ripple effects of this achievement will shape the market for years to come.

>>> Read more: Bull or Bubble? Experts Divided as XRP Reaches New Heights

Readers’ frequently asked questions

What is a Bitcoin ETF, and why is it significant for Bitcoin’s price?

A Bitcoin Exchange-Traded Fund (ETF) is a financial product that allows investors to gain exposure to Bitcoin without directly purchasing or holding the cryptocurrency. Instead, the ETF tracks Bitcoin’s price, and investors can buy and sell shares of the ETF on traditional stock exchanges. This is significant because ETFs make Bitcoin more accessible to institutional investors and individuals who might otherwise be hesitant to navigate cryptocurrency exchanges. The approval and success of Bitcoin ETFs, like the one launched by BlackRock, demonstrate growing regulatory acceptance and institutional interest, both of which contribute to Bitcoin’s price surge by increasing demand.

Why does Bitcoin’s dominance impact the broader cryptocurrency market?

Bitcoin’s dominance refers to the proportion of the total cryptocurrency market capitalization that Bitcoin represents. When Bitcoin gains a significant portion of market share, it often draws most of the investor interest and funds, leaving less for altcoins. This can lead to reduced liquidity and slower growth for other cryptocurrencies, especially smaller or newer projects. However, Bitcoin’s prominence can also bring legitimacy and attention to the crypto space overall, indirectly benefiting altcoins in the long term by encouraging broader adoption and innovation within the industry.

Are there risks associated with investing in Bitcoin now that it has reached $100,000?

While Bitcoin’s achievement of $100,000 is a historic milestone, investing at such a high price point carries risks. Market sentiment could shift, leading to price corrections, especially if institutional momentum slows or if regulatory challenges arise. Additionally, Bitcoin’s historical volatility means that significant price fluctuations, both upward and downward, are possible. New investors should also consider the possibility of over-concentration in Bitcoin, as diversification across different asset classes can help mitigate risk. Seeking professional financial advice before investing in cryptocurrencies is always recommended, particularly for those new to the market.

What Is In It For You? Action Items You Might Want to Consider

Diversify Your Portfolio Beyond Bitcoin

While Bitcoin’s rise to $100,000 showcases its dominance, the market reaction among altcoins has been uneven. Use this as an opportunity to assess your portfolio. Consider investing in altcoins with strong fundamentals or unique use cases, such as those focusing on scalability, DeFi, or energy efficiency. A balanced portfolio can help mitigate risks associated with Bitcoin’s volatility while exposing you to the growth potential of emerging projects.

Monitor Regulatory and Political Developments

Favorable political shifts and regulatory optimism have influenced Bitcoin’s surge. Stay informed about upcoming regulatory announcements, particularly regarding Bitcoin ETFs and crypto-friendly policies. These can significantly affect market sentiment and pricing. Platforms like government updates or crypto-focused news outlets can help you stay ahead of the curve and make informed trading decisions.

Capitalize on Market Sentiment but Be Cautious of Overleveraging

Bitcoin’s $100,000 milestone may attract new retail and institutional investors, potentially driving further price momentum. Use this optimism to time your trades, but avoid overleveraging. Bitcoin’s historic volatility means sharp corrections are possible. Set realistic profit targets and stop-loss orders to protect your capital while participating in the current bullish trend.

[…] >>> Read more: Bitcoin’s $100K Milestone: Impact on Crypto and Altcoins […]