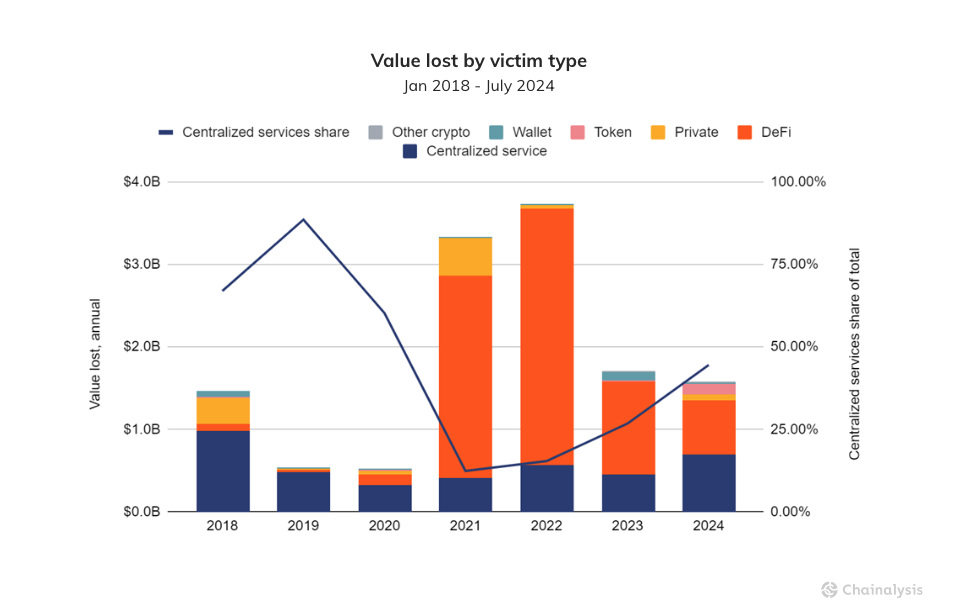

As the crypto landscape continues to evolve, so do the tactics of cybercriminals. In 2024, a stark increase in the scale of crypto-related crimes has emerged. Stolen funds reached an alarming $1.58 billion by mid-year, a significant 84% rise compared to the same period in 2023. This surge has largely been driven by a resurgence in attacks targeting centralized exchanges (CEXs) and record-breaking ransomware payouts, painting a worrying picture for the industry.

Centralized Exchanges in the Crosshairs Again

After several years of heightened focus on decentralized platforms, cybercriminals have returned to centralized exchanges. These platforms offer large liquidity pools and hold substantial reserves. They have become prime targets once more despite enhanced security measures. The 2024 Chainalysis mid-year report notes that hackers are employing increasingly sophisticated methods, such as advanced social engineering and even insider infiltration, to compromise these exchanges. The May 2024 breach of Japanese exchange DMM, resulting in the theft of $305 million in Bitcoin, exemplifies this trend.

One of the key reasons for this shift is that while decentralized finance (DeFi) platforms have been under heavy scrutiny and security tightening, centralized exchanges remain attractive for their concentrated assets. Even as security protocols improve, the potential payoff for cybercriminals remains too tempting to resist. High-profile breaches, often involving North Korea-linked hacking groups like Lazarus, underscore the evolving threat landscape.

Ransomware on the Rise: Record-Breaking Payouts

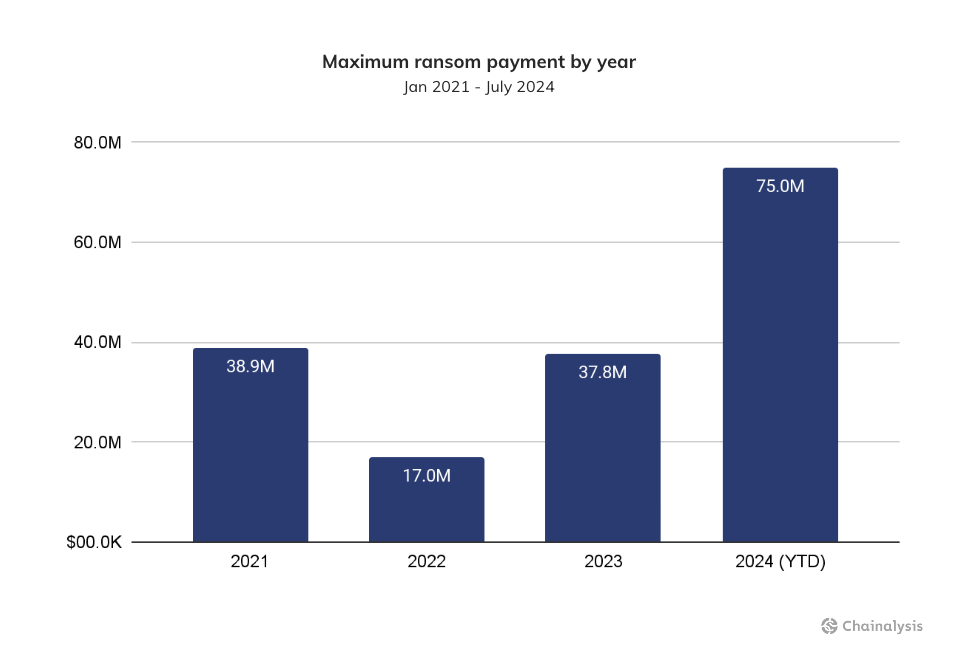

2024 has also seen ransomware attacks escalate to unprecedented levels. Not only has the frequency of attacks grown, but the payouts have also skyrocketed. The largest recorded ransomware payment in history – $75 million to the Dark Angels group – was made this year. It highlights the trend of “big game hunting” where attackers specifically target high-value organizations with the capacity to pay large ransoms.

The rise in ransomware activity reflects a broader shift in strategy among cybercriminals. Instead of numerous small-scale attacks, attackers increasingly focus on smaller but larger targets. This shift has led to a significant increase in the average ransom payment. It spiked from under $200,000 in 2023 to over $1.5 million in mid-2024. These figures point to a new era in ransomware attacks. Criminal groups are more organized and selective in their approach.

The Broader Implications: A Threat to Industry Credibility

While overall illicit cryptocurrency activity has dropped by nearly 20% – thanks to the growing dominance of legitimate transactions driven by positive developments like spot Bitcoin and Ethereum ETFs – the rise in high-value crimes is casting a shadow over the industry’s progress. The fact that stolen funds have surged despite this broader decline suggests that the security landscape is lagging behind the innovation and growth within the sector.

These developments raise critical questions about the crypto industry’s ability to protect its users and maintain trust as it moves toward mainstream adoption. The continuous evolution of criminal tactics, coupled with the immense financial rewards for successful attacks, signals that the threat will only grow more complex. For an industry aiming for global legitimacy, tackling these challenges is essential to ensuring that crypto’s bright future isn’t overshadowed by its dark underbelly.

>>> Read more: Crypto Crime 2023 – Chainalysis Report | CrispyBull

The dual narrative of 2024—on one hand, significant growth in legitimate crypto adoption, and on the other, a resurgence of large-scale crimes—underscores the fragile balance the industry must strike. While advancements in adoption are promising, the escalating scale of theft and extortion reveals vulnerabilities that must be addressed. For the crypto ecosystem to sustain its momentum, ensuring robust defenses against sophisticated cybercrime will be as crucial as the innovations driving the next wave of adoption.

Readers’ frequently asked questions

Why are centralized exchanges (CEXs) suddenly more vulnerable again, despite their improved security measures?

The resurgence in targeting centralized exchanges can be attributed to several factors. While these platforms have indeed implemented more robust security features over the years, the scale and liquidity they hold still make them prime targets. Cybercriminals have adapted by shifting from technical exploits to more sophisticated social engineering techniques. For example, some attackers, particularly those linked to North Korea, are reportedly securing insider positions within crypto firms. This allows them to bypass advanced security layers. Additionally, CEXs hold large amounts of assets in fewer locations compared to decentralized platforms. It makes them harder to crack but all the more attractive. This combination of significant rewards and evolving infiltration strategies is driving the renewed focus on these exchanges.

What measures are being taken to combat the growing ransomware threat in the cryptocurrency industry?

While ransomware attacks are on the rise, governments and industry players are not sitting idle. Law enforcement agencies are increasingly coordinating internationally to target ransomware groups. Consequently, they took down several high-profile ransomware operators like ALPHV/BlackCat and LockBit. Additionally, cybersecurity firms are refining tools to detect and mitigate ransomware attacks. In addition, many companies are investing in more advanced backup systems to minimize the need to pay ransoms. The industry is also pushing for regulatory changes to improve the reporting of ransomware incidents and discourage ransom payments. However, the growing sophistication of these groups, combined with the deep financial resources of their targets, continues to challenge even the best defensive strategies.

How does the rise in crypto-related crime affect mainstream adoption of cryptocurrencies?

The increase in large-scale hacks and ransomware attacks does pose a threat to broader adoption. It can undermine public trust in the security and reliability of crypto platforms. For institutional investors and businesses considering entering the crypto space, the risk of large financial losses due to security breaches is a significant concern. On the other hand, the growth in legitimate transactions, fueled by developments like spot Bitcoin ETFs, suggests that many users and institutions remain optimistic about crypto’s long-term prospects. To maintain this positive trajectory, the industry will need to demonstrate that it can stay ahead of evolving threats, potentially through better regulatory frameworks, stronger security protocols, and greater transparency in how incidents are handled.

What Is In It For You? Action Items You Might Want to Consider

Diversify Your Trading Across Platforms

With centralized exchanges becoming prime targets for sophisticated attacks, consider spreading your assets across multiple platforms, including decentralized exchanges (DEXs) and secure wallets. By diversifying where you hold your assets, you reduce the risk of losing everything in a single breach. Consider using hardware wallets or multi-signature solutions for added security.

Stay Updated on Security Best Practices and Industry News

Given the evolving nature of cyber threats, it’s essential to keep yourself informed. Regularly monitor updates from trusted blockchain analytics firms, like Chainalysis, and stay aware of recent attacks and the methods used. This knowledge can help you better anticipate risks and adopt preventive measures, such as enabling two-factor authentication (2FA) and avoiding platforms with a history of breaches.

Assess Risk Before Participating in High-Yield Opportunities

While high-yield opportunities on centralized platforms can be tempting, these may come with elevated risks, especially in a climate of increased cybercrime. Before committing significant assets to a platform offering attractive returns, evaluate the platform’s security protocols, history, and whether it has implemented recent safeguards. Prioritizing platforms with transparent security practices can be the difference between gaining returns and suffering unexpected losses.

[…] with a surge in fraud and cybercrime. According to data from blockchain analytics firm Chainalysis, crypto-related illicit activities have seen a significant increase, with stolen funds nearly doublin… Although overall criminal activity on blockchain networks has slightly declined, specific forms of […]

[…] >>> Read more: Crypto Cybercriminals Target CEXs Amid 2024 Crime Surge […]

[…] >>> Read more: Crypto Cybercriminals Target CEXs Amid 2024 Crime Surge […]