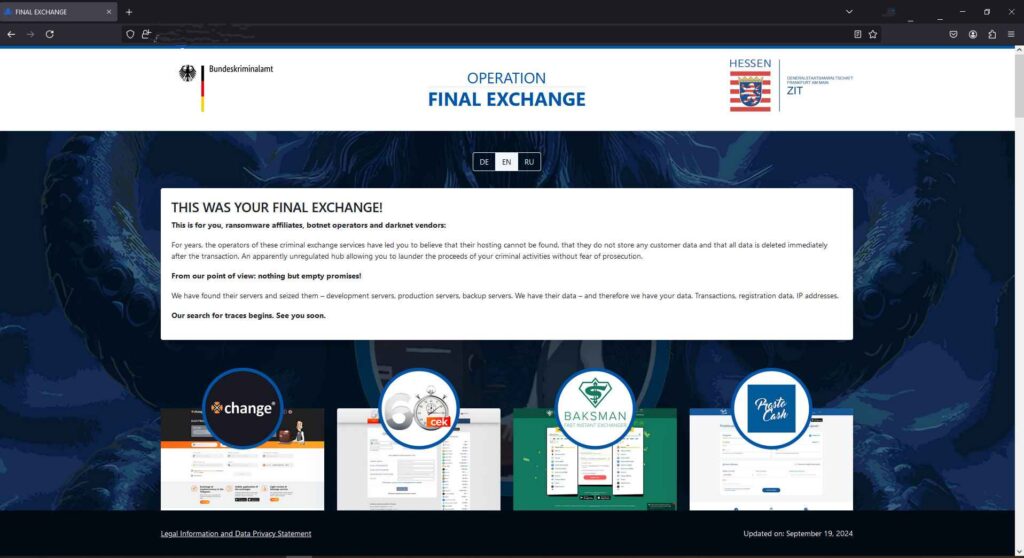

German law enforcement has delivered a major blow to cybercriminals. They seized 47 cryptocurrency exchanges accused of facilitating anonymous transactions for money laundering. The platforms, including Xchange.cash, 60cek.org, and Bankcomat.com, have been taken offline and replaced with government warning pages informing users that their transaction and registration data, including IP addresses, has been seized by authorities. While no arrests have been made yet, the operation, dubbed “Final Exchange,” marks a significant shift in the enforcement of anti-money laundering (AML) laws in the cryptocurrency space.

The crackdown was part of a joint effort between Germany’s Federal Criminal Police Office (BKA), the Frankfurt prosecutor’s office, and the cybercrime agency ZIT (Central Office for Combating Cybercrime). These exchanges allowed users to conduct transactions anonymously, circumventing the Know Your Customer (KYC) regulations that should prevent money laundering and illicit financial activities. By operating in this legal gray zone, these platforms became an integral part of the cybercrime ecosystem. They facilitated the laundering of ransom payments, proceeds from darknet markets, and other criminal gains.

The Illusion of Anonymity

For years, users of these crypto exchanges relied on the platforms’ promises of complete anonymity. However, the recent seizure has exposed the vulnerability of that perceived protection. Upon visiting the websites of the confiscated exchanges, users are now greeted with a stark message: all data, including transactions, has been secured by law enforcement. According to the BKA, the operation recovered production servers as well as backup servers and user databases. Authorities can now trace cybercriminals who believed they were protected by the platforms’ anonymity.

This marks a critical shift in the enforcement landscape of cryptocurrency. Historically, cryptocurrencies such as Bitcoin were often mischaracterized as providing complete anonymity. In fact, the underlying blockchain technology records all transactions on a public ledger. However, the anonymity provided by these specific exchanges allowed cybercriminals to obfuscate their tracks. They could move illicit funds without leaving a traceable identity behind. This is why platforms like Xchange.cash, which processed over 1.3 million transactions for 410,000 users, became a go-to resource for criminal networks.

Impact on Ransomware and Illicit Networks

The operation has far-reaching consequences, particularly for ransomware gangs, who frequently demand payments in cryptocurrency due to its perceived anonymity. Many of the platforms targeted in the crackdown were allegedly used by ransomware operators to launder ransom payments and bring their illicit gains into the legitimate financial system. In this way, exchanges like 60cek.org and Bankcomat.com played a pivotal role in allowing cybercriminals to convert illicit cryptocurrency into fiat money.

The seizure of extensive user data, including registration information, IP addresses, and transaction logs, now poses a direct threat to these networks. With authorities gaining access to this data, many ransomware operators and their accomplices could soon find themselves exposed and vulnerable to prosecution. The BKA has made it clear that their investigations are ongoing. Arrests could follow based on the data they’ve secured.

Erosion of Crypto Anonymity

This operation underscores a broader trend in the crypto space: the erosion of anonymity. As regulatory scrutiny increases and enforcement actions become more sophisticated, the once-perceived invulnerability of cryptocurrencies in illicit activities is being dismantled. Law enforcement agencies globally are collaborating more effectively. They leverage the transparency of blockchain technology to identify and track illicit transactions.

The consequences are profound for users who depend on the anonymity of these platforms. Not only has their data been exposed, but many now face potential legal repercussions. Furthermore, the shutdown of these exchanges sends a powerful message to the broader crypto community: anonymity is no longer a guarantee, especially when it comes to platforms that operate outside the bounds of regulatory oversight.

>>> Read more: Germany Seizes €28 Million Cracking down on Illegal Crypto ATMs

Germany’s seizure of 47 cryptocurrency exchanges represents a significant step in the global crackdown on crypto-fueled cybercrime. By exposing the vulnerabilities in anonymous transaction platforms and securing valuable data, law enforcement has sent a clear message to ransomware operators and other cybercriminals: the days of hiding behind anonymity are numbered. As the investigation continues, the broader implications for user privacy and the future of cryptocurrency in illicit networks will undoubtedly unfold.

This operation is likely to have a chilling effect on similar platforms that have yet to comply with AML and KYC regulations. Authorities are further tightening the regulatory noose around the darker corners of the crypto world.

Readers’ frequently asked questions

How does this crackdown impact the wider cryptocurrency market, especially for legitimate users?

This crackdown on 47 cryptocurrency exchanges mainly targets platforms that allow anonymous transactions. They are illegal in many jurisdictions because they facilitate money laundering and other criminal activities. Legitimate cryptocurrency exchanges that comply with regulations such as Know Your Customer (KYC) and Anti-Money Laundering (AML) policies are unlikely to be directly affected by this operation. However, it could serve as a wake-up call for platforms operating in a regulatory gray area, prompting them to tighten their compliance measures. For legitimate users, the immediate impact is minimal unless they were unknowingly using one of the seized platforms. The broader effect will likely manifest in the form of stricter regulations and oversight in the cryptocurrency space. That could affect the ease of transactions but also improve security and legitimacy in the long run.

Will users of these platforms face legal consequences?

The seizure of 47 exchanges also involved securing user data. They captured transaction records, registration details, and IP addresses, making it possible for law enforcement to track down those involved in illicit activities. While the initial reports indicate no arrests have been made so far, the BKA has indicated that investigations are ongoing. Future arrests could follow based on this recovered data. Users who engaged in illegal activities, such as laundering ransomware payments, are at significant risk of prosecution. Even users who were not directly involved in cybercrime but used these platforms for anonymous transactions may face scrutiny, especially if they violated financial regulations. However, law enforcement agencies will likely prioritize the prosecution of high-profile cybercriminals and platform operators.

What does this mean for the future of anonymous cryptocurrency transactions?

This operation highlights a growing trend: the erosion of anonymity in crypto transactions. While cryptocurrencies like Bitcoin are not inherently anonymous, platforms like those seized in Germany facilitated transactions that allowed users to avoid traditional identification requirements. As regulatory frameworks evolve, both regionally and internationally, we are likely to see a continued crackdown on anonymous exchanges. The future of cryptocurrency is leaning toward more transparency. Most governments now require exchanges to implement stringent KYC and AML protocols. For those who used cryptocurrencies for privacy reasons, this shift could push them toward decentralized or privacy-focused cryptocurrencies like Monero. However, even these might not remain fully immune from regulation. Governments worldwide continue to develop tools and strategies to trace blockchain transactions.

What Is In It For You? Action Items You Might Want to Consider

Review your exchange platform’s compliance status

If you’re using cryptocurrency exchanges that operate in jurisdictions with lax or unclear regulations, now is the time to reassess. Germany’s recent crackdown on 47 crypto exchanges highlights the increasing pressure on platforms to follow strict Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols. To safeguard your assets and ensure legal compliance, consider shifting to regulated exchanges. They prioritize security and adhere to global AML/KYC standards.

Prepare for tighter regulations in crypto trading

As governments globally intensify their scrutiny of anonymous crypto transactions, traders should anticipate more regulations, particularly regarding privacy-focused coins and exchanges. Stay updated on new laws or compliance requirements in your country, especially regarding tax reporting and transaction limits. Being proactive about regulatory changes will help you avoid unexpected disruptions or legal complications that may arise as the landscape evolves.

Evaluate your privacy strategy in light of ongoing enforcement trends

It will become harder to maintain anonymity in the crypto world. Traders who value privacy should consider diversifying into decentralized or privacy-centric cryptocurrencies, such as Monero. However, do so with caution. Even these coins may come under scrutiny in the future. To mitigate risks, implement best practices for security, such as using hardware wallets. Regularly monitor regulatory developments to stay ahead of enforcement trends impacting privacy tokens.