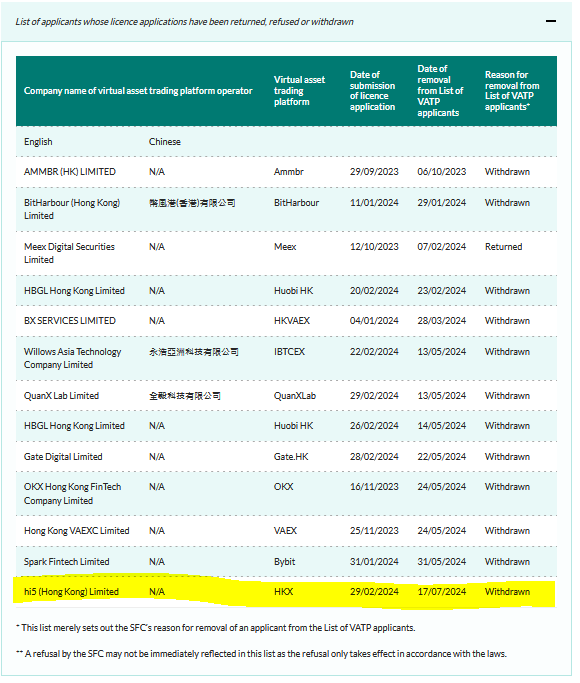

In recent months, the crypto exchange landscape in Hong Kong has witnessed a significant shake-up. Prominent exchanges such as Huobi HK, OKX, and Gate.HK have withdrawn their applications for operational licenses. They cited the stringent regulatory requirements set forth by the Hong Kong Securities and Futures Commission (SFC). Now, HKX joins this growing list, further underscoring the challenges crypto platforms face in complying with the new rules, aimed at enhancing market integrity and anti-money laundering measures.

Immediate Impact of Regulatory Framework

The Hong Kong Securities and Futures Commission (SFC) has imposed rigorous requirements on cryptocurrency exchanges operating within the region. By May 31, 2024, all exchanges must secure an operational license to continue their services. This regulatory push is part of a broader strategy to align Hong Kong’s crypto market with global standards on anti-money laundering (AML) and counter-terrorist financing (CTF).

Huobi HK, OKX, Gate.HK, and now HKX are among the notable exchanges that have recently withdrawn their license applications. These withdrawals highlight the immediate impact of the SFC’s regulatory framework. OKX, for instance, announced it would cease providing centralized virtual asset trading services to Hong Kong residents by the end of May 2024. Similarly, Gate.HK halted its operations, indicating the need for a major overhaul to meet the compliance standards.

Challenges and Pressures

The withdrawal of these applications reflects the substantial challenges crypto exchanges face in adapting to the new regulatory environment. The SFC’s requirements are designed to ensure that exchanges implement robust AML and CTF measures. Those include comprehensive Know Your Customer (KYC) protocols and transaction monitoring systems. These requirements are part of Hong Kong’s broader effort to enhance the integrity of its financial markets.

Exchanges have cited various reasons for their withdrawals, primarily focusing on the extensive changes needed to comply with the new regulations. Gate.HK, for example, mentioned the necessity of a “major overhaul” of its trading platform to align with the SFC’s standards. This overhaul includes implementing enhanced security measures and revising their operational processes to ensure full compliance.

>>> Read more: How Easy Is It to Trade Crypto with a Fake ID?

Regulatory Goals and Future Outlook

The SFC’s stringent regulations aim to bolster investor confidence and ensure that Hong Kong remains a reputable financial hub. By enforcing these rules, the SFC seeks to mitigate risks associated with money laundering and terrorist financing, thereby protecting the broader financial system.

Despite the current challenges, some exchanges are optimistic about the future. Gate.HK has expressed its intention to resume operations after completing the necessary platform upgrades and obtaining the required licenses. This indicates a long-term commitment to adapting to the regulatory environment and continuing to serve the Hong Kong market.

In addition to enforcing compliance, the Hong Kong Monetary Authority (HKMA) is also piloting innovative financial products such as the digital yuan (e-CNY) for cross-border payments. This initiative reflects Hong Kong’s dual focus on regulation and innovation. They are aiming to integrate blockchain technology into their financial system while maintaining stringent oversight.

The recent withdrawals of license applications by major crypto exchanges, including HKX, highlight the significant impact of Hong Kong’s new regulatory framework. While these regulations present immediate challenges, they also aim to enhance market integrity and investor protection. As exchanges like Gate.HK plan to relaunch with upgraded platforms, the future of Hong Kong’s crypto market will depend on its ability to balance regulatory compliance with technological innovation.

Readers’ frequently asked questions

Why are the Hong Kong regulatory requirements so stringent, and what do they entail?

The Hong Kong Securities and Futures Commission (SFC) has implemented stringent regulatory requirements to ensure the integrity of the cryptocurrency market. They aim to combat money laundering and terrorist financing. These regulations required crypto exchanges to obtain operational licenses by May 31, 2024. They also had to comply with comprehensive anti-money laundering (AML) and counter-terrorist financing (CTF) measures. The requirements include robust Know Your Customer (KYC) protocols, thorough transaction monitoring systems, and the implementation of enhanced security measures to protect against illicit activities and ensure market stability.

What is the impact of these regulatory changes on the crypto exchanges and their users?

The regulatory changes have led several prominent crypto exchanges, including Huobi HK, OKX, and Gate.HK, to withdraw their license applications, citing the need for significant overhauls to comply with the new rules. Some exchanges ceased providing their services to Hong Kong residents. For example, OKX stopped providing centralized virtual asset trading services by the end of May 2024. Users of these exchanges are affected as they may need to find alternative platforms that comply with Hong Kong’s regulations. However, these measures are intended to enhance investor protection and market integrity, ultimately benefiting users in the long run.

How are the exchanges planning to adapt to the new regulatory environment in Hong Kong?

Exchanges like Gate.HK are planning major overhauls of their trading platforms to meet the SFC’s compliance standards. This includes upgrading their security measures, revising operational processes, and implementing comprehensive AML and CTF measures. Some exchanges have expressed optimism about resuming operations after completing these necessary upgrades and obtaining the required licenses. For instance, Gate.HK has indicated its intention to relaunch its services once it has adapted to the new regulatory framework. It reflects a long-term commitment to the Hong Kong market.

What Is In It For You? Action Items You Might Want to Consider

Evaluate Exchange Compliance and Adaptability

Before continuing or starting to trade on a Hong Kong-based exchange, research whether the platform is compliant with the new regulatory requirements set by the Hong Kong Securities and Futures Commission (SFC). Exchanges like Gate.HK are undergoing major overhauls to meet these standards. Opt for exchanges actively working on compliance and have clear plans for obtaining the necessary licenses. This will ensure that your trading activities are aligned with regulatory expectations and reduce the risk of interruptions.

Diversify Your Trading Platforms

Given the recent withdrawals of operational license applications by major exchanges such as Huobi HK, OKX, and HKX, consider diversifying your trading activities across multiple platforms. This strategy will help mitigate the risks associated with potential service disruptions or operational halts due to regulatory non-compliance. Look for crypto exchanges with strong regulatory records and those that have expressed commitment to meeting Hong Kong’s compliance standards.

Stay Informed About Regulatory Developments

Keep yourself updated on the latest regulatory changes and announcements from the Hong Kong Securities and Futures Commission (SFC) and the Hong Kong Monetary Authority (HKMA). Regulatory environments can evolve rapidly, and being well-informed will allow you to make proactive decisions regarding your trading activities. Subscribe to reliable news sources, join relevant forums, and consider following updates from the exchanges you use to ensure you are aware of any changes that could affect your trading strategy.

[…] >>> Read more: Tough Rules Lead to Hong Kong Crypto Exchange Withdrawals […]