A recent report by 404 Media’s investigative journalist Joseph Cox revealed that he was able to create a verified account on OKX, one of the largest cryptocurrency exchanges in the world, by using a variety of false identification, passports, and other legal documentation. This raises serious questions about the security and integrity of the crypto market. What are the potential regulatory impacts of identity fraud on crypto platforms?

OKX’s Verification Policy and Procedures

OKX, a cryptocurrency exchange, requires users to complete the identity verification process to meet the Know Your Customer (KYC) requirements. This is done to ensure the safety of their accounts and assets. During the verification process, users must provide their personal information like name, nationality, date of birth, and address. Additionally, they must upload a photo or video of a government-issued ID and a selfie. OKX claims that it uses advanced technology and third-party service providers to verify the authenticity and validity of the documents and the identity of the users.

Cox found a way to bypass the verification process by using synthetic identities. Underground vendors create these identities by combining real and fake information, such as names, photos, and documents. He obtained these synthetic identities from illicit sellers, peddling them on internet forums and Telegram for as low as $150. He then used these identities to register and verify accounts on various crypto platforms, including OKX, Binance US, Kraken, and Coinbase Pro.

According to Cox’s experiment, OKX’s verification policy and procedures are insufficient in preventing identity fraud. The exchange becomes vulnerable to money laundering, terrorist financing, tax evasion, and other illicit activities facilitated through the use of fake or stolen identities.

Similar Cases of Identity Fraud on Crypto Platforms

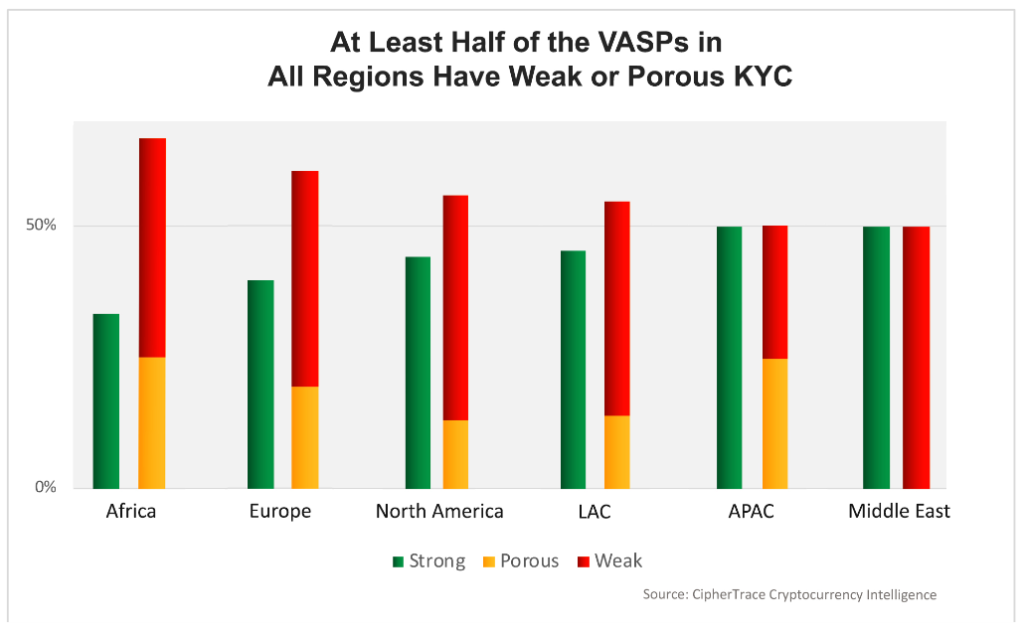

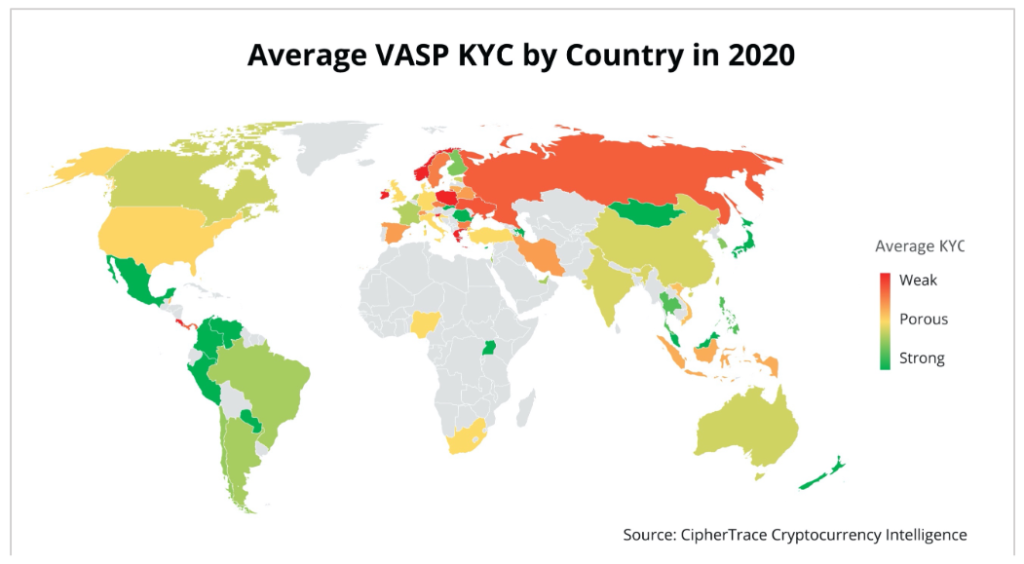

OKX is not the only crypto platform exposed to identity fraud. CipherTrace, a blockchain analytics firm, conducted a study in 2020. It revealed that 56% of crypto exchanges have either weak KYC processes or no KYC measures in place at all. Additionally, a report from CoinDesk, a prominent media outlet for crypto news, showed a thriving black market for “verified” accounts on major exchanges such as Coinbase Pro and Binance US. Fraudsters create these accounts using other people’s identities or fabricated names.

Identity fraud cases in the crypto industry are a major concern. They erode the trust and confidence of users, investors, and regulators. Additionally, they leave platforms and their customers vulnerable to legal and financial liability and reputational damage in the event of fraud, theft, or hacking incidents.

Regulatory Impacts of Identity Fraud on Crypto Platforms

Identity fraud on crypto platforms is becoming more common, raising concerns among regulators. They worry about the harm this could cause to consumers and the financial system. To address this trend, regulators worldwide are working to establish rules and standards to govern crypto assets and their providers. The primary objective is to enhance transparency, accountability, and consumer protection.

Global Standards and Regional Regulations

In 2019, the Financial Action Task Force (FATF), an intergovernmental organization tasked with establishing worldwide standards to combat money laundering and terrorist financing, issued new guidance. These regulations require cryptocurrency platforms or virtual asset service providers (VASPs) to comply with the same KYC (Know Your Customer) and AML (Anti-Money Laundering) obligations as traditional financial institutions. This means that VASPs have to verify the identity of their customers and the origin of their funds. They are obliged to report any suspicious transactions to the authorities.

In 2018, the European Union introduced the Fifth Anti-Money Laundering Directive (AMLD5). It expanded the coverage of the existing AML regulations to include crypto platforms and custodian wallet providers. The directive mandates these entities to register with their national authorities. They must perform due diligence on their customers and collaborate with law enforcement agencies.

In 2019, the Financial Crimes Enforcement Network (FinCEN), a bureau of the Treasury Department in the United States, issued guidance to clarify that cryptocurrency platforms are bound to the same regulatory framework as money transmitters for enforcing Anti-Money Laundering (AML) laws. This implies that these platforms must register with FinCEN and implement AML programs. They must file currency transaction reports and suspicious activity reports to comply with the law.

Challenges and Opportunities for the Crypto Industry

Authorities implemented regulatory measures to create a secure and legal environment for crypto innovation while safeguarding the public interest and financial stability. Nevertheless, these measures can be a significant challenge and expense for crypto platforms, particularly those operating across various jurisdictions. Additionally, they may not be adequate to prevent or identify identity fraud. Some fraudsters may use advanced techniques or exploit regulatory loopholes or inconsistencies.

To ensure the security and compliance of crypto platforms, they must adopt more robust and effective verification methods and technologies such as biometric authentication, artificial intelligence, and blockchain analysis. Additionally, regulators must collaborate with one another, the industry, and civil society. They should develop and enforce harmonized and proportionate rules and standards for the crypto sector.

Read more: Crypto Crime 2023 – Chainalysis Report

[…] Read more: How Easy Is It to Trade Crypto with a Fake ID? […]

[…] >>> Read more: How Easy Is It to Trade Crypto with a Fake ID? […]

[…] >>> Read more: How Easy Is It to Trade Crypto with a Fake ID? […]

[…] >>> Read more: How Easy Is It to Trade Crypto with a Fake ID? […]