The U.S. Securities and Exchange Commission (SEC) officially dropping its prolonged lawsuit against Ripple Labs underscores an established trend of crypto-friendly regulation under President Donald Trump’s administration. Since Trump’s inauguration in January 2025, the SEC has consistently signaled a softer regulatory approach towards cryptocurrencies. It dismissed several high-profile legal battles against major crypto firms, including Coinbase, Binance, Robinhood, and now Ripple.

Ripple’s Landmark Victory

Ripple’s legal victory marks the culmination of a four-year battle that began in December 2020 when the SEC accused Ripple Labs of conducting a $1.3 billion unregistered securities offering through XRP tokens. Although Ripple secured a significant court ruling in July 2023 stating that XRP’s retail sales did not constitute securities transactions, institutional sales were found to violate securities laws. The SEC’s recent withdrawal signifies a complete closure to this lengthy legal saga. And, it’s a strong signal to other cryptocurrency entities facing similar regulatory challenges.

XRP Futures Launch

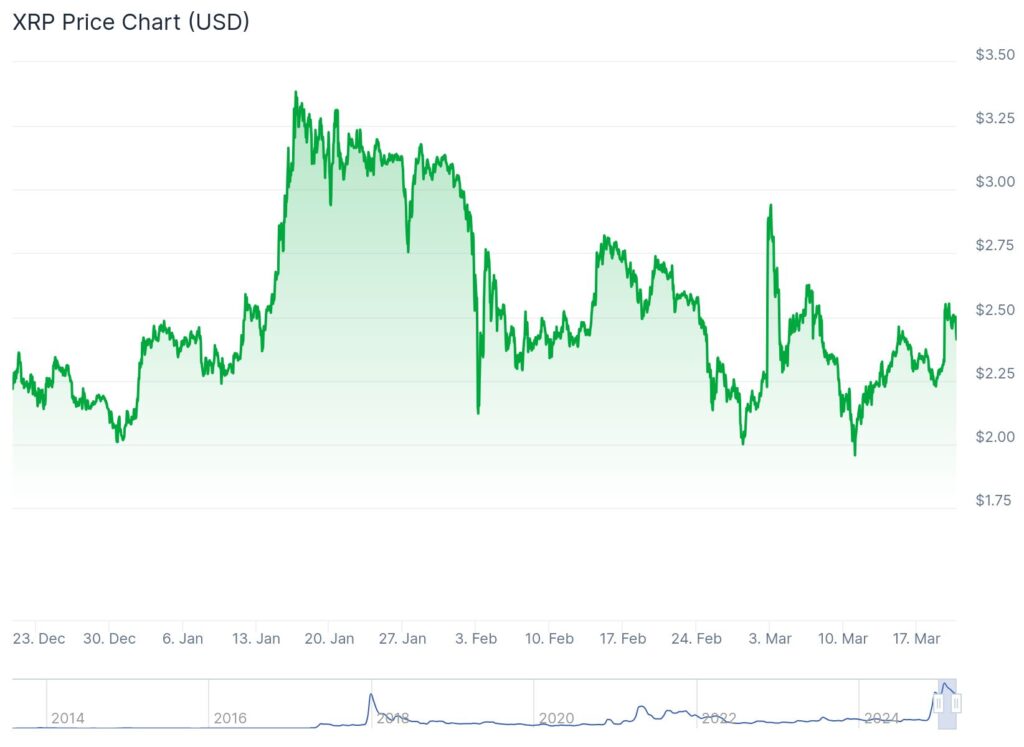

Following the news, XRP’s market value surged by over 10%, briefly surpassing $2.50. This regulatory clarity seems to have restored investor confidence. Capitalizing on this momentum, Chicago-based Bitnomial launched the first Commodity Futures Trading Commission (CFTC)-regulated XRP futures contracts in the U.S. These physically-settled futures, officially trading from March 20, offer traders actual XRP upon contract maturity, marking an essential integration of digital assets into regulated traditional finance.

The launch of XRP futures is expected to enhance market liquidity significantly. It will provide institutional investors and hedge funds with legitimate avenues for exposure to XRP, potentially contributing to broader acceptance and price stabilization in cryptocurrency markets.

Why Institutional Investors May Be Attracted to XRP

Institutional investors may now find XRP particularly attractive due to renewed regulatory clarity and its clearly defined legal status within the U.S. financial market. Unlike Bitcoin, which primarily derives its appeal from scarcity and status as “digital gold,” XRP’s attractiveness stems from its practical utility. As a bridge currency, it enables rapid, cost-efficient cross-border transactions. With SEC-related uncertainty removed, XRP stands uniquely positioned to facilitate financial institutions’ increasing interest in blockchain-based settlement solutions. It offers potentially faster transaction speeds and lower costs than traditional systems like SWIFT. Additionally, regulated XRP futures provide institutions with secure and compliant avenues to engage with XRP, further enhancing its investment appeal.

Implications for XRP and the Crypto Market

Market analysts anticipate XRP could play a more significant role in crypto markets moving forward, potentially attracting substantial institutional investment and paving the way for mainstream financial integration. Optimistic forecasts have suggested XRP’s price could rise significantly, with some predictions reaching as high as $15. The emergence of regulated futures contracts could further stimulate demand, boosting investor confidence, and encouraging greater institutional adoption.

However, XRP’s future also faces potential challenges. Despite the current optimistic climate, skeptics highlight ongoing concerns about XRP’s real-world utility, given that practical applications beyond speculative investment remain limited. Further regulatory clarity will be critical in sustaining XRP’s market position. Uncertainty persists surrounding international regulatory environments and potential market volatility could pose risks to future growth.

A New Era of Regulatory Clarity

As XRP begins trading via regulated futures, the broader cryptocurrency sector is now watching closely, evaluating how this increased clarity and institutional support could shape digital asset markets in the years ahead. The Trump administration’s crypto-friendly policy is seen as fostering innovation, potentially placing the U.S. in a leading position within the global digital economy.

>>> Read more: The Race to Lock in Bitcoin Reserve Policy

The coming months will prove critical, not only for XRP but for the entire crypto industry. XRP’s trajectory, boosted by newfound regulatory clarity, will serve as an essential benchmark for other cryptocurrencies navigating the complex interplay of innovation, regulation, and market adoption.

Readers’ frequently asked questions

What exactly are futures contracts, and why would investors use XRP futures specifically?

Futures contracts are agreements allowing investors to buy or sell an asset at a predetermined price on a specific date in the future. Investors use futures to hedge against price fluctuations or speculate on market movements without directly owning the underlying asset. In the case of XRP futures, institutional investors might use these contracts to safely participate in the cryptocurrency market through a regulated exchange, reducing the risks associated with directly holding digital currencies.

Now that the SEC case has been resolved, can individuals safely invest in XRP without legal concerns?

The SEC’s decision to drop the lawsuit has significantly clarified XRP’s legal status in the United States, making it safer for investors. However, individual investors should still exercise caution. Cryptocurrency markets remain volatile, and legal clarity in the U.S. doesn’t automatically resolve regulatory uncertainties internationally. Investors should stay informed about ongoing developments globally and carefully assess their risk tolerance before investing.

Why is XRP considered useful for cross-border payments, and how does it differ from traditional methods like SWIFT?

XRP facilitates cross-border payments by providing banks and financial institutions a faster, cheaper way to settle international transactions. Unlike traditional systems such as SWIFT, which can take days and incur higher fees, XRP transactions typically complete in seconds and at a fraction of the cost. XRP acts as a bridge currency that allows direct exchanges between different fiat currencies. It can simplify global transactions and reduce reliance on correspondent banking systems.

What Is In It For You? Action Items You Might Want to Consider

Consider Exploring XRP Futures

With regulated XRP futures now available via Bitnomial, you might want to explore this opportunity as a safer way to gain exposure to XRP. Trading regulated futures contracts can help you hedge your risks while benefiting from potential price appreciation.

Stay Updated on Institutional Moves

Keep a close eye on how institutional investors respond to XRP’s new legal clarity. Increased institutional activity could significantly impact XRP’s price movements, presenting valuable trading opportunities.

Watch for International Regulatory Updates

While the U.S. has clarified XRP’s status, international regulations remain uncertain. Regularly monitor global crypto regulatory news, as international developments could affect market sentiment and XRP’s future price stability.