In the rapidly evolving realm of cryptocurrencies, the significance of the Crypto-Asset Reporting Framework (CARF) 2027 cannot be overstated. Crafted by the Organisation for Economic Co-operation and Development (OECD), this framework responds to the explosive growth of the crypto-asset market, addressing the need for heightened global tax transparency. As digital assets gain traction, so do concerns about stability, security, and potential tax evasion. CARF 2027 aims to tackle these issues head-on, introducing a standardized approach to reporting and offering a beacon of clarity and transparency in the crypto market.

Background

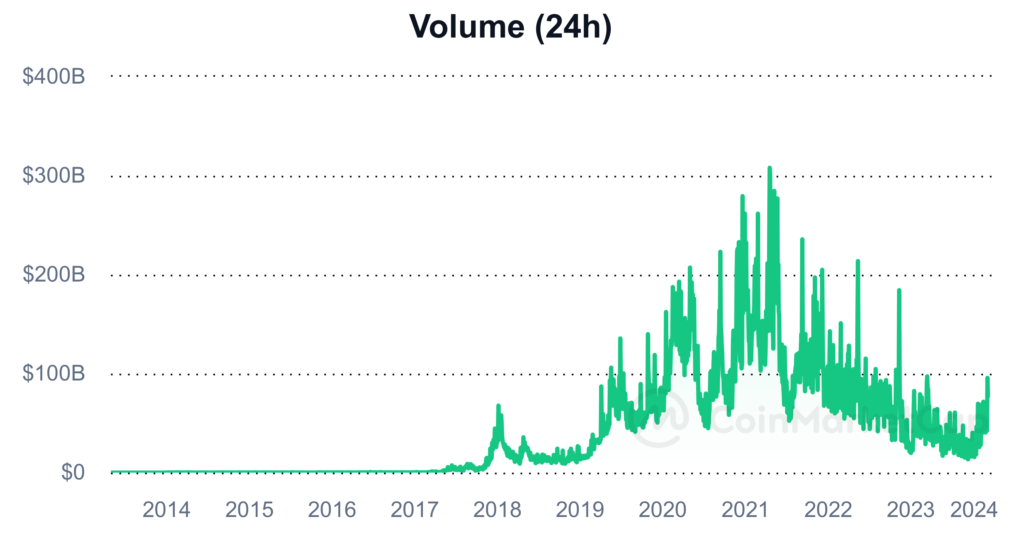

The cryptocurrency market has experienced exponential growth, boasting a total market cap exceeding $1.7 trillion with daily trades surpassing $90 billion. However, the absence of robust regulations in the crypto sphere has given rise to apprehensions regarding transparency, security, and tax evasion. It is against this backdrop that the OECD developed the Crypto-Asset Reporting Framework (CARF) 2027, a comprehensive reporting framework tailored to provide tax-relevant information on crypto-asset transactions. This framework obliges intermediaries and service providers to report aggregated information, categorized by the type of crypto-asset and the nature of the transaction.

What is CARF 2027

At its core, CARF 2027 is a reporting framework designed to furnish standardized information on transactions involving crypto-assets. Developed in response to the burgeoning crypto-asset market, CARF aims to thwart tax evasion and bolster transparency. One of its noteworthy features is its adaptability, allowing it to conform to diverse regulatory frameworks and jurisdictions. Furthermore, CARF is scalable, ensuring it can accommodate the anticipated growth of the crypto market over time.

Implications for Crypto Investors

For crypto investors, the implications of CARF 2027 are substantial. The framework mandates intermediaries and service providers to report aggregated information, classifying it based on the type of crypto-asset and the nature of the transaction. This implies that investors holding crypto-assets are now required to furnish detailed information to their service providers, who, in turn, will report this information to tax authorities. While CARF aims to enhance tax transparency, it raises valid concerns about privacy, data protection, and potential regulatory burdens for investors.

Potential Benefits of CARF 2027

CARF 2027 brings forth several potential benefits for crypto investors. Firstly, it introduces a standardized reporting approach, fostering transparency and mitigating the risk of tax evasion. This standardized approach has the potential to boost investor confidence in the crypto market, potentially leading to increased adoption of crypto-assets. Secondly, CARF’s design flexibility and adaptability to diverse jurisdictions and regulatory frameworks promote harmonization and coordination between different countries and regions. This, in turn, may help reduce regulatory fragmentation and encourage innovation within the crypto market. Thirdly, the scalability of CARF ensures its continued relevance and effectiveness as the crypto market matures and evolves.

Potential Drawbacks for Crypto Investors

However, alongside its benefits, CARF 2027 introduces certain drawbacks for crypto investors. Firstly, the framework’s requirement for intermediaries and service providers to report on an aggregate basis, divided by the type of crypto-asset and the nature of the transaction, adds a layer of complexity. Investors, especially those with extensive crypto portfolios or engaged in frequent transactions, may face increased compliance costs and administrative burdens. Secondly, the implementation of CARF might attract heightened regulatory scrutiny, potentially contributing to greater market volatility and uncertainty for investors.

In summary, CARF 2027 is a pivotal development in the crypto market landscape, offering the potential to improve tax transparency and inspire greater investor confidence in crypto-assets. However, it simultaneously introduces challenges related to privacy, data protection, and potential regulatory burdens. As the crypto market continues its dynamic evolution, staying informed about the latest regulatory developments is imperative for investors navigating this ever-changing terrain.

Additional Insights

As we delve deeper into the intricacies of CARF 2027, it becomes evident that this framework is not just a response to current challenges but a proactive step towards shaping the future of the crypto market. The emphasis on adaptability and scalability showcases an understanding of the dynamic nature of digital assets. Investors, therefore, find themselves at a crossroads – navigating potential benefits while grappling with concerns that echo the broader discussions around privacy and regulatory scrutiny.

The Regulatory Landscape

The introduction of CARF 2027 reflects a broader trend in the regulatory landscape of cryptocurrencies. Governments and international bodies are increasingly recognizing the need to bring clarity and structure to the burgeoning crypto market. This move towards standardized reporting is a stride towards creating a cohesive global framework that can accommodate the unique challenges posed by digital assets. However, the road to implementation is paved with complexities, requiring a delicate balance between fostering innovation and mitigating risks.

Global Collaboration

The commitment of 48 jurisdictions globally to adopt CARF 2027 signifies a remarkable feat in global collaboration. Economic powerhouses such as the United States, the United Kingdom, Singapore, Australia, Brazil, and others are aligning to address the multifaceted issues in the crypto space. The concerted effort to implement a standardized reporting framework underscores the recognition of cryptocurrencies as a global financial instrument that requires a unified approach.

Future Considerations for Investors

As investors navigate the implications of CARF 2027, it becomes crucial to adopt a forward-looking perspective. While immediate concerns about compliance and reporting requirements loom large, the long-term impact on the adoption and acceptance of crypto-assets cannot be ignored. Striking a balance between regulatory adherence and fostering an environment conducive to innovation will be key. Additionally, investors may find themselves at the forefront of advocating for privacy safeguards within the framework, ensuring that the benefits of transparency do not come at the cost of individual privacy rights.

The Evolution Continues

The unveiling of CARF 2027 marks a chapter in the ongoing evolution of the crypto market. As frameworks and regulations take shape, the industry matures, bringing both challenges and opportunities for participants. Whether one is a seasoned investor or a newcomer to the crypto sphere, staying abreast of these developments is essential. The journey towards a more regulated and transparent crypto market may be intricate, but it undoubtedly plays a pivotal role in shaping the future of finance.

[…] efforts against crypto tax evasion through initiatives like the Crypto Asset Reporting Framework (CARF), the crypto market faces increased scrutiny. Given that ownership of assets is predominantly among […]

[…] Read More: What is CARF 2027 […]

[…] governments worldwide to strengthen regulations for this emerging asset class. Initiatives like the Crypto Asset Reporting Framework (CARF) are gaining popularity, signaling a push for accountability and trustworthiness in the […]