The U.S. Internal Revenue Service (IRS) is introducing new cryptocurrency tax reporting requirements in 2025. It marks a significant shift in digital asset regulation. For the first time, the IRS will require centralized exchanges (CEXs), such as Coinbase and Gemini, to report user transactions directly using Form 1099-DA. While the initiative aims to enhance compliance and streamline tax filings, it also raises concerns about the administrative burden on cryptocurrency exchanges and the potential impact on investor privacy. The crypto industry faces a pivotal transition as reporting obligations will expand to decentralized platforms by 2027. What do these changes mean for traders, investors, and the broader crypto ecosystem?

Breaking Down the IRS’s New Cryptocurrency Tax Reporting Rules

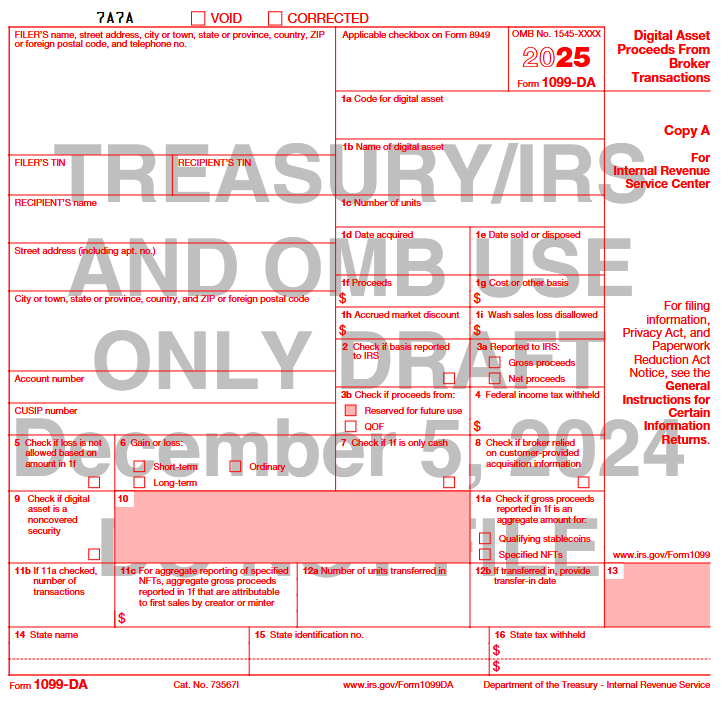

The IRS’s updated regulations, set to take effect in 2025, will require cryptocurrency brokers, including CEXs, to issue Form 1099-DA to both users and the IRS. This form will provide detailed information on annual digital asset transactions. It ensures that taxable events are properly documented. This initiative is part of the broader enforcement strategy outlined in the 2021 Infrastructure Investment and Jobs Act. The act mandates enhanced oversight of digital asset transactions.

The reporting obligations will be phased in:

- 2025: Centralized exchanges must begin reporting basic transaction details.

- 2026: Cost basis information (i.e., original purchase prices) will be included, aiding in the accurate calculation of gains and losses.

- 2027: Decentralized exchanges (DEXs) and non-custodial wallets will be required to report gross proceeds from transactions, marking a major expansion of tax oversight in DeFi.

These measures are intended to close tax loopholes and ensure digital asset investors comply with existing tax laws. The IRS argues that cryptocurrency transactions should be treated similarly to traditional financial instruments to maintain fairness in the tax system.

Implications for Investors and Exchanges

For investors, these new regulations mean increased scrutiny of their crypto transactions. Those who previously underreported or failed to report crypto-related income may face penalties as the IRS gains greater visibility into their activity. While Form 1099-DA is designed to simplify tax compliance, it also raises concerns about how transaction details will be interpreted, especially in cases where users engage in multiple exchanges and cross-platform trades.

Exchanges, particularly U.S.-based platforms, are now responsible for ensuring compliance with the IRS’s new requirements. This will likely lead to:

- Increased operational costs due to system upgrades and compliance infrastructure.

- Stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) measures.

- A potential exodus of users seeking offshore or decentralized alternatives to avoid IRS scrutiny.

Privacy and Regulatory Overreach Concerns

One of the most contentious aspects of the IRS’s new regulations is their impact on user privacy. Critics argue that these requirements could infringe on financial sovereignty by forcing exchanges to disclose sensitive transaction data. Unlike traditional banking systems, many crypto users value the pseudonymous nature of blockchain transactions. Mandating centralized and decentralized platforms to report user transactions could set a precedent for increased surveillance in the industry.

Furthermore, the requirement for decentralized platforms to comply by 2027 has sparked debate over the practicality of enforcing such rules. Unlike centralized exchanges, DEXs operate through smart contracts and often lack a formal entity that could comply with regulatory demands. This raises questions about whether such regulations could push DeFi innovation offshore or drive development further into decentralized autonomous organizations (DAOs) that resist compliance.

The Future of Crypto Regulation and Compliance

The IRS’s push for greater oversight aligns with broader global trends. Regulators worldwide seek to integrate digital assets into existing financial frameworks. While some view this as a step toward legitimizing cryptocurrencies within mainstream finance, others see it as a move that could stifle innovation and deter participation in the U.S. crypto market.

Investors and exchanges alike must prepare for these regulatory shifts by:

- Keeping detailed records of transactions to ensure compliance with tax requirements.

- Exploring tax reporting software and professional accounting services for accurate filings.

- Monitoring ongoing regulatory developments that may affect their trading strategies.

>>> Read more: What is CARF 2027

As the crypto landscape evolves balancing regulatory oversight and financial privacy will remain a key debate. Whether these new IRS rules foster broader crypto adoption or drive users toward alternative solutions remains to be seen.

Readers’ frequently asked questions

How does Form 1099-DA impact individual crypto investors, and do I need to take any action?

Centralized exchanges (CEXs) like Coinbase or Gemini will issue Form 1099-DA to users and the IRS, detailing taxable crypto transactions. So, if you trade on a CEX, the IRS will have direct access to your transaction records, and it will be harder to underreport or overlook taxable events. As an investor, you should ensure that all your cryptocurrency transactions are accurately recorded, including cost basis information, to avoid discrepancies in your tax filings. While the form is meant to simplify tax reporting, you may still need to track transactions across multiple platforms, including decentralized exchanges (DEXs), to ensure accurate filings. Consulting a tax professional or using crypto tax software can help you stay compliant.

If I trade only on decentralized exchanges (DEXs) or use self-custody wallets, will these new IRS regulations affect me?

For now, the new reporting requirements mainly target centralized exchanges. However, that changes in 2027 when the IRS will require decentralized platforms to report transaction proceeds. While DEXs function without intermediaries, the IRS aims to close tax loopholes by enforcing compliance on platforms facilitating peer-to-peer transactions. This raises enforcement challenges since many DEXs operate as smart contracts without a central authority. If you frequently interact with centralized services (e.g., off-ramping funds from a CEX), they may still flag your transactions. It’s crucial to keep personal records of trades and consult tax guidance. Expect compliance measures for DEX users to evolve.

Will the new IRS reporting rules lead to increased scrutiny or penalties for past unreported crypto gains?

The IRS’s primary goal is to improve tax compliance going forward. Nevertheless, introducing Form 1099-DA could lead to a higher detection rate for prior underreported transactions. While these regulations do not explicitly target past gains, the increased visibility into crypto holdings may prompt audits or retroactive enforcement. Investors who have not reported previous cryptocurrency gains should consider voluntary compliance through amended tax returns before stricter enforcement measures take effect. The IRS has historically provided guidance on correcting past noncompliance, and taking proactive steps may help mitigate penalties.

What Is In It For You? Action Items You Might Want to Consider

Keep Your Transaction Records Organized Now

Don’t wait until tax season to scramble for transaction details. Start maintaining a clear record of your trades, including purchase prices, transfers between wallets, and any staking or yield farming rewards. With Form 1099-DA coming into play, ensuring that your reported gains match IRS records will save you from unnecessary audits or tax complications. Consider using crypto tax software that automatically tracks your transactions across multiple platforms.

Review Your Trading Strategy with Compliance in Mind

If you rely heavily on centralized exchanges, expect tighter reporting requirements. This might be the time to reassess how and where you trade. For those using decentralized platforms, keep in mind that reporting obligations for DEXs will kick in by 2027. Evaluate whether holding assets in self-custody or using off-shore exchanges aligns with your risk tolerance and compliance responsibilities. The regulatory landscape is shifting fast—adapting your strategy now can help you stay ahead.

Consult a Tax Professional Before It’s Too Late

Crypto tax regulations are becoming more complex, and the IRS is making it harder to stay off the radar. If you’ve been trading actively, it’s worth consulting a tax expert who understands digital assets. A professional can help you navigate the new reporting requirements, ensure accurate filings, and even advise on how to minimize your taxable gains through strategic trading or tax-loss harvesting. Acting now can help you avoid penalties later.

[…] >>> Read more: IRS Cryptocurrency Tax Reporting 2025: What You Need to Know […]